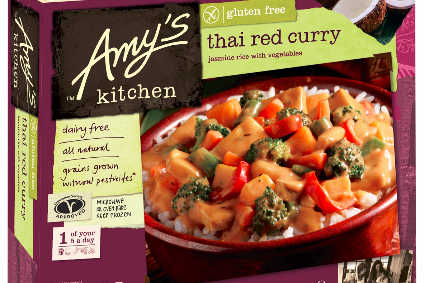

US organic vegetarian food group Amy’s Kitchen believes it has significant opportunities to ramp up sales. However, the company must balance its growth aspirations against the need to maintain the quality and values it says have been key to its success. Katy Askew spoke to VP of marketing at Amy’s Kitchen, Bridget Dwyer, to find out more.

Founded in 1988 with a single product – an organic vegetable pot pie – Amy’s Kitchen has grown to become one of the largest players in the organic packaged food space. The firm, which is still owned by the founding Berliner family, now offers an international array of products from frozen entrees, burritos, wraps and bowls, to soups, beans, salsa and pasta sauce. The company also produces a range of sweet treat products including cakes, cookies, candy bars and non-dairy frozen desserts.

As the company’s business has grown, it has sought to maintain the core values that define it, Amy’s Kitchen VP of marketing Bridget Dwyer tells just-food. “Amy’s Kitchen really is like a small business under a big umbrella,” she explains.

Dwyer suggests that is reflected in the group’s relationships with suppliers, she suggests. “We know all of our farmers by name, our suppliers, what they are growing, what their crop rotations are. Developing supplier relationships is something we do well. We have a large sourcing team and they travel… Our sourcing team is 26 strong and that is pretty big for a company that makes frozen food.”

It is also reflected in the way that Amy’s Kitchen manufactures its products. The company remains committed to manufacturing everything “by hand”, Dwyer notes.

See Also:

While this commitment to sourcing and production quality has proven a cornerstone to the successful growth of the Amy’s Kitchen brand in the US and overseas markets in Europe and Australia, in some respects it also puts a curb on the company’s growth rate.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“The thing for Amy’s is, because everything is made by hand and it really is all about the ingredients, you have to be careful about how fast you do something. There is only so much organic spinach or so many organic tomatoes that you can access. That is something we are really cautious about. Meeting demand is an issue,” Dwyer suggests.

Until early this year, the company had been operating from one production facility in California, is ramping up its production base. It is in “the process” of establishing a plant in New York, in the Hudson Valley. The group has also purchased a facility in Idaho, where production is already underway. “We were in the process building the plant in New York, which we had already purchased land for in the Hudson Valley. Then when we found out that Heinz was closing down a plant in Idaho. We looked at it September 1st, we purchased it November 17th, it was making food [for Amy’s] in February. It was just, like, bam.”

Amy’s Kitchen is also investing in capacity overseas. The company is developing a plant in Portugal to meet the needs of its European markets. “We are right now in the process of building a plant in Portugal to serve our EU market so we are not shipping food. That is something that we don’t want to be doing, we want to be able to produce in areas around the world,” Dwyer reveals.

The facility is scheduled to be operational in 2019 and will produce Amy’s Kitchen products for the UK and other European markets. “The site will serve the whole of Europe. We are in the UK. The UK is our biggest international market. Our biggest [overseas] markets outside of the UK as far as the EU goes are France and Germany, those are probably our biggest ones. We just launched in the Nordic countries in Sweden.”

Amy’s Kitchen is also exploring other growth markets and the company is set to dip its toe into India. “The test launch is going to happen this month. It will only be in 50 stores that are not the big hypermarkets. We are going to start slowly to get a flavour of the market and see how people react to our products.”

Dwyer says the test launch will be staged in New Delhi. Amy’s Kitchen is offering its products in high-end chain and independent retail outlets throughout the city, she adds. “We are targeting [Godrej’s] Nature’s Basket, those kind of outlets. There are some smaller family run businesses that we will also be in to. We are going to do it with our own branded freezer.”

Amy’s Kitchen is initially launching a number of SKUs. “In India we are doing a burrito, pizza, pizza bites – which is our snack. We are doing our swirls in India as well. And we are doing four soups.”

While the company is taking a tentative first step in the market, Dwyer says it is more a matter of judging what works before an accelerated roll-out. “We are going to go [for a wider Indian roll-out], it just depends what kind of product mix we put in there,” she suggests.

Although no products have been specifically developed to suit the Indian palate, Dwyer insists Amy’s Kitchen is confident that its products are a good fit for the Indian market and will resonate with consumers, particularly urban millennials. “Outside of Mumbai and in Delhi, all these kids – the millennials that are moving out for the first time – they are eating convenience food. They like convenience food and they are 79% vegetarian. It’s a blend that would work,” she says.

As to expansion beyond its current markets, Amy’s is not plotting to enter any new markets, Dwyer suggests. Nevertheless, while the company isn’t “actively looking to move into China at the moment”, Dwyer notes “people are asking us to come there”. As ever for Amy’s, it is a case of prioritising resources to manage growth opportunities.

In the US, the company’s extensive distribution sees it stocked in grocery and natural channels by the likes of national retailers such as Wal-Mart, Kroger, Publix and Whole Foods Market as well as regional retailers including Tops, Harmons and Winn-Dixie.

Amy’s Kitchen continues to attract additional consumers through a focus on innovation as well as benefiting from broader consumer trends that have resulted in a jump in demand for organic and vegetarian products. The organic food maker is also growing its footprint as a foodservice operator in the US, Dwyer reveals. “We are expanding our drive through side of it as well, we are growing the restaurant side of the business at the same time [as expanding internationally],” she says.