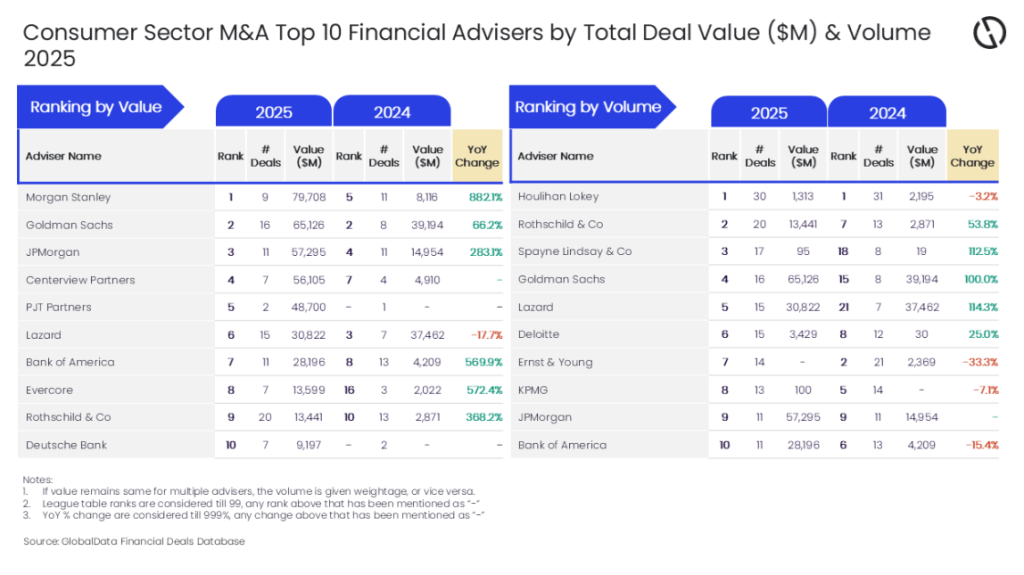

Morgan Stanley and Houlihan Lokey topped the charts of financial advisors working on consumer M&A in 2025, according to newly released deals data.

According to GlobalData, Just Drinks’ parent, Morgan Stanley led the chart for deal value while Houlihan Lokey worked on the most consumer-sector transactions by volume.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Morgan Stanley advised on deals worth a cumulative $79.71bn. The data showed Houlihan Lokey was appointed an adviser on 30 transactions.

Aurojyoti Bose, lead analyst at GlobalData, said: “Houlihan Lokey was the top adviser by volume in 2024 and retained its leadership position by this metric in 2025.

“Meanwhile, Morgan Stanley advised on a smaller number of deals but still managed not only to lead by value but also to outpace peers by a significant margin. Of the nine deals advised by Morgan Stanley during 2025, four were billion-dollar deals that also included two mega deals valued more than $10bn. Involvement in these high-value transactions helped it top the chart by value.”

In August, Morgan Stanley was contracted on Keurig Dr Pepper’s move to acquire Dutch coffee company JDE Peet’s for €15.7bn ($18.36bn) and then split the combined business into two.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe thrust of Houlihan Lokey’s work came in food, including the move by a European holding company for Ferrara Candy Company to buy French sweets maker CPK Group from investment firm Eurazeo. The transaction gives Ferrara brands including Carambar, Poulain, Lutti and Terry’s.

When measuring the value of deals, Goldman Sachs ranked second, advising on $65.13bn worth of transactions.

JPMorgan followed, working on 11 deals worth a combined $57.3bn, then came Centerview Partners on $56.11bn and PJT Partners on a pair of transactions worth a combined $48.7bn.

In terms of deal volume, Rothschild & Co. were second after working on 20 deals, followed by Spayne Lindsay on 17, Goldman Sachs on 16 and then a pair –Lazard and Deloitte – on 15.

GlobalData’s league tables are based on the real-time tracking of thousands of sources including company websites and advisory firm websites. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.