GLP-1 weight-loss drugs might be providing a quick fix to a growing number of users but there are many unknowns as to the real or potential hit on packaged foods manufacturers in both the short and longer term.

What is clear, however, is the speed in uptake of these drugs originally designed to treat type-2 diabetes and the introduction of pill variants to the wider market in the new year will only serve as a challenge for global food producers to swallow.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

GLP-1s are undoubtedly a hot topic in boardrooms, on earnings calls with analysts and throughout the broader food industry but why now when the Glucagon-like peptide-1 receptor drugs targeted at weight loss have been around for a decade?

The answer may rest with cost, affordability and increasing distribution with the entrance of new players and the next generation of brands. But, at the heart of it all, are addiction and cravings for what are often deemed as the wrong types of foods – salty snacks, sweets, sugary drinks, processed and refined foods, products high in carbs or anything high in fat, salt or sugar (HFSS).

There lie two sides of the coin: overweight people seeking to lose weight with the prick of a needle or a pill to swallow and the types of food manufacturers that might be at risk.

The protein, fibre debate

Then conversely, those likely to benefit: fresh-produce suppliers and those offering protein- or fibre-rich foods, which GLP-1 users reportedly need when they are on these drugs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“GLP-1s and their widespread availability have accelerated the conversation around appetite, nutrition and food choices,” Anna Del Mar, a managing director at consultancy AlixPartners, says.

“Food manufacturers are apprehensive because even modest GLP-1 adoption drives measurable, category-specific demand drops that hit high-margin products first, creating outsized revenue risk without needing large user numbers.”

Lisa Sanders, the owner of Cornerstone Nutrition and a scientific consultant to the Institute of Food Technologists in the US, holds a similar view but with an injection of alternative spin.

“It is less about worry over revenue and more about preparing and positioning for a change in the food landscape. For many people, it will be a drug they continue with for the rest of their lives, so it will inevitably change the food landscape and manufacturers are preparing for that,” Sanders suggests.

“Some people may also want to stop using the drug when they reach a desirable body weight and will be looking for foods to help them maintain their weight loss. Protein and fibre will play a key role here.”

In denial

Despite the upsurge in GLP-1 usage, many food manufacturers appear to be in denial or have shrugged off the potential impact on their business, be it on revenues and profits or, more importantly, sustained appetite for their products. Or perhaps they are secretly hiding their concerns.

Bernstein CPG analyst Alexia Howard has a balanced perspective as she predicts the “headwinds” posed to the food industry are likely to dissipate beyond 2026 in the aftermath of the GLP-1 pill introduction.

“Most are positioning it as an opportunity to get closer to specific consumer needs – portion control, higher protein and fibre in particular,” she says. “Few are really owning the idea that this is part of the volume pressure we have seen over the past three years, although that could change as we start to see a slowdown in the rate of adoption in the US.”

John Baumgartner at Mizuho Securities is more forthright in his assumptions as the topic of GLP-1s increasingly crops up in executive discussions.

“If you listen to any of the earnings calls, you’ll hear all the management team say ‘oh, we don’t really see an impact on our business’. But it’s very clear at the category level, you have very clear differences in consumption by category,” the Mizuho analyst and managing director says.

“Anything with protein – Greek yogurt, cottage cheese, you’re seeing volumes growing high, single digit, double digit, even things like canned tuna, baked beans, categories that haven’t really grown in volume in years.

“On the other end, categories like juices that are high in sugar and sweet snacks, you’re seeing volumes down.”

You’re not relying on willpower. That’s how GLP-1s could really change the game

John Baumgartner, Mizuho Securities

Without getting too bogged down in the science, GLP-1s are said to work on the brain to reduce hunger pains, while also causing food to stay in the stomach longer, leading to the feeling of fullness or satiety.

“If you can pop a pill and curb your appetite, lose weight without having to conquer your cravings, which a lot of people don’t want to do, or have to work out and run multiple days a week, it’s hard to see why the GLP-1 enthusiasm would fade over time, unless you had a negative side effect,” Baumgartner aptly puts it.

“Now you have something powerful enough to change eating behaviours, you’re not relying on willpower. That’s how GLP-1s could really change the game.”

Proportionate response

Nevertheless, the impact is likely to be proportionate to the number of overweight people in a given country and those taking these drugs, the time spent on the medication and eating habits adopted once off the weight-loss regime. Add to the equation the influence on other household members’ dietary habits or family members feeling encouraged to go on these drugs.

One would suspect the number of overweight or obese people would be small relative to the overall population but some estimates are shocking, albeit caution over the accuracy and tolerance measures must surely be factored.

Hank Cardello, an executive for health and prosperity at the Business for Impact Centre, Georgetown University, suggests that compared to ten years ago, obesity and overweight rates in the US have surged – 40% for obesity and 70% when combined, while new GLP-1 formulations can reduce weight by 20%.

“People just don’t want to eat much on these particular drugs and that’s a big issue for the industry but I do think there’s a lot of opportunities for the industry, too,” Cardello says.

“I think once a pill comes out, that really accelerates the move towards these drugs, and I think the industry will really get a wake-up call, a serious wake-up call.”

GLP-1 and wider landscape

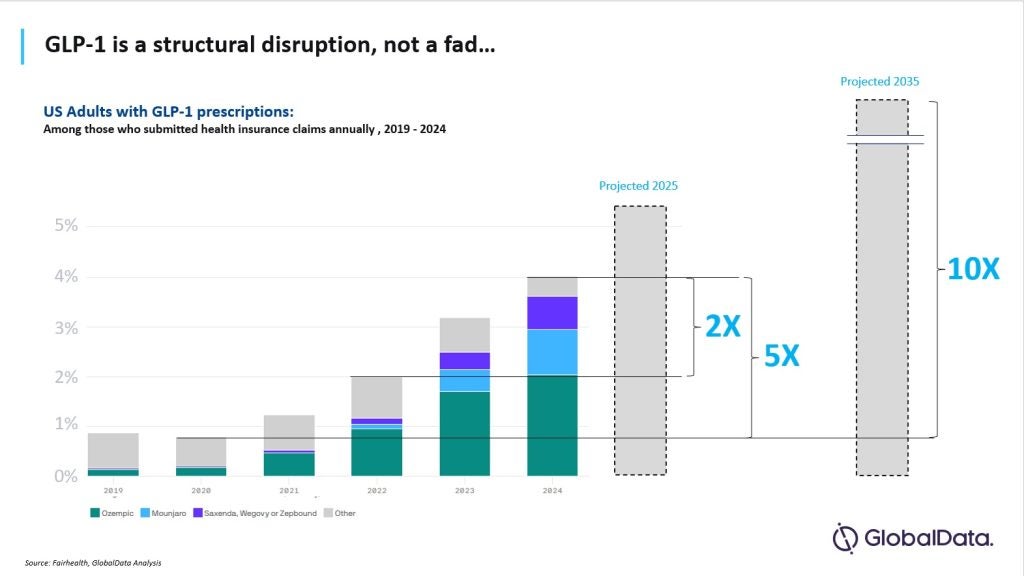

Speed is perhaps the main concern in the food industry, laced with an element of caution given it’s still early days in the GLP-1 evolution. And longer term, could the use of the drugs fade just like other weight-loss regimes of the past as the fad stage wears off? Or are they a game changer for food manufacturers?

“The potential difference here is the rate at which things might move. There’s always been different eating patterns, different diets but nothing is this effective and being adopted this quickly,” Justin Shimek, the CEO of Mattson & Co., a US-based innovation and advisory agency for the F&B sector, says.

“Everybody’s trying to get their crystal ball shined up to try to understand where this might end up, knowing we’re still in the early days. The interesting question is: what happens in the long-term maintenance piece? The base medications are going to be evolving and changing and getting better.”

GLP-1s, however, might just be a blip on the evolving landscape of food, a crumb of a bigger pie around health and – for manufacturers – reformulation, with science and government regulation dumped on top.

Health has become a big issue since the Covid-19 pandemic, with some people adjusting dietary habits accordingly and scrutinising ingredients more than they perhaps did before. And there is a push by authorities and regulators to cut obesity and the treatment of related diseases, which are costly to government budgets.

Remember, too, the Make America Healthy Again campaign and the debate around ultra-processed foods, efforts to stem media advertising targeted at kids and HFSS directives.

I view it as a perfect storm right now for the industry

Hank Cardello, Georgetown University

So are GLP-1 weight-loss drugs just part of the bigger and perhaps pandemic-induced theme?

“The drugs arrived at a time of growing awareness about the quality of food we eat and holistic dieting approaches, creating a multiplicative effect on healthy eating trends,” AlixPartners’ Del Mar says.

“Younger UK consumers (Gen Z and Millennials) already prioritise protein, functional foods and clean labels, independent of weight-loss drugs. Manufacturers are already feeling volumes under pressure as consumer demand shifts.”

Cardello at Georgetown University says it’s in the consumer “psyche”. He adds: “You have all those things going on and then, just for good luck, throw in rising prices that are cramping consumers. I view it as a perfect storm right now for the industry. All of this is going to force them to innovate because the industry as a whole has never really spent much money on R&D.”

Bernstein’s Howard suggests food manufacturers could do themselves a favour in one big shot and get ahead, or at least on a level playing field, with emerging brands.

“If companies were able to deliver packaged foods made with simpler ingredients that growing numbers of consumers trust, in categories that deliver solid nutritional benefits, I believe the sector really could get back on its feet in a more sustainable way and stop losing market share to smaller challenger brands,” Howard contends.

Reformulation challenges

Reformulation, nevertheless, isn’t always a quick and easy fix for food manufacturers, especially those in categories likely to be shunned by GLP-1 users or by consumers dialling up their health agenda.

On the other hand, there are people who are not overweight or obese, and demand is always likely to remain for the odd treat or indulgence.

“It’s actually a broader spectrum,” Shimek says in terms of where Mattson is seeing enquiries on GLP-1s.

“It’s not necessarily people taking a deep defensive posture. When you’re in the business of innovation, you’re always in the business of creating something new and recognising there’s always a change in consumer behaviour.”

Shimek adds: “The one opportunity that presents itself to everyone in the industry is thinking about portions – you don’t even have to reformulate a product at that point. Every company, every brand, every product, even if you’re designed to be indulgent, it’s thinking about what’s the right portion.

“You can start to build in some positives in terms of micronutrients, macronutrients. You can start to address some of the specific needs. It’s an opportunity for all to think about.”

Reformulation costs can also be “significant” in terms of factory retuning and R&D, presenting a “real strategic challenge” for food manufacturers, according to Del Mar. But, she argues, they don’t really have many options in the face of rising GLP-1 usage, especially amid the “broader wellness trend”.

Baumgartner at Mizuho suggests some companies face a quandary as there’s certain categories where “you’re not going to be able to appeal to consumers with a protein fortification”, and so there’s no quick fix.

“Food manufacturers are probably a lot more vulnerable to GLP-1s than the retailers are because the food manufacturers have got fixed assets. If they sell certain products, that’s it, you’re at the mercy of the market. You’re going to have to acquire something or sell a business,” he says.

Dedicated brands, M&A

Might dedicated GLP-1 brands be the answer? That question raises a number of thoughts – a limited audience perhaps governed by the endurance of weight-loss drugs and costly outlays with no guarantee of success.

Sanders at Cornerstone Nutrition suggests GLP-1 specific brands might emerge – some already have – but argues the broader theme is more likely an increased focus on protein and dietary fibre with new or existing better-for-you foods.

Bernstein’s Howard proposes the “jury is still out”, advocating whether a “GLP-1 friendly label might alienate non-GLP-1 patients”.

In perspective, she adds: “Perhaps launching new brands that are specifically GLP-1 focused could work, although the hit rate on new brands is fairly low and I imagine there are any number of new entrants going after this opportunity today as barriers to entry have fallen across the industry over the past 15 years.”

Perhaps then, the door is open to M&A as a longer-term remedy to address the GLP-1 opportunity, or not as the case may be.

Del Mar says: “M&A activity in healthy, functional foods is accelerating, while major CPGs are divesting or repositioning less healthy brands as GLP-1 drugs and wellness trends reshape portfolios.

“At the same time, smaller, health-focused brands are commanding investment premiums, driving category growth and becoming prime acquisition targets.”