Dill pickle, hot honey and matcha are among a clutch of ingredients touted to drive NPD in the global snacks industry.

The ingredients have been tipped by Ai Palette, GlobalData’s innovation and consumer insights platform, which seeks to help CPG brands predict market trends. It has identified a group of six ingredients it believes offer opportunities for snack brands to attract consumers.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The trend of ‘snackification’ – where more consumers are using snacks as a replacement for meals – means the sector presents opportunities for manufacturers – but demand continues to evolve.

With more consumers paying increasing attention to the links between what they eat and drink and their health, there is greater interest in ingredients and in healthier snacks.

But it’s not only health trends that come into play when consumers choose snacks. Flavour is another important factor and there are signs of growing interest in, for example, spicy snacks or those that offer ‘heat’ to a product’s taste profile.

Against that backdrop, brand owners face challenges in developing new snacks that will land with consumers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

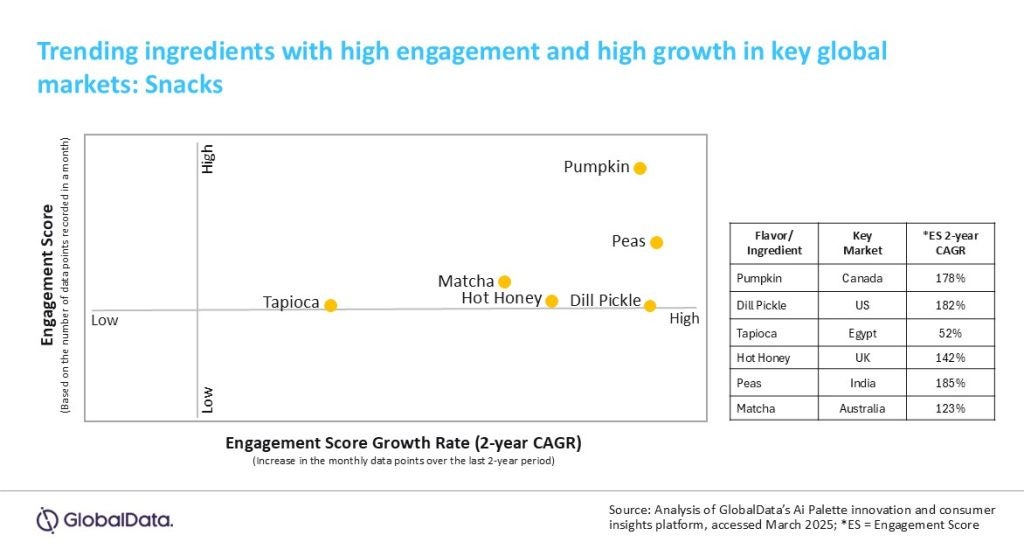

By GlobalDataAi Palette, like Just Food, is owned by GlobalData. The UK-based research and analytics group analysed Ai Palette’s database to identify one “stand-out ingredient” across six geographic markets – the US, Canada, the UK, Egypt, India and Australia.

Each ingredient is classified as having “high growth” and “high engagement” based upon consumers interactions with them across social media, retail and restaurant industry sites over recent years.

In a new research report, GlobalData argues why the six ingredients – a group that also includes pumpkin, tapioca and peas – should be of interest to manufacturers in the snacks industry, provided suggestions on ingredient pairings and reviewed how brands can use the ingredients in their products.

GlobalData says the key market for dill pickle is the US, with hot honey the principal ingredient of interest for manufacturers operating in the UK and matcha for those doing business in Australia.

Alongside those ingredients, the analysts selected pumpkin as of interest to product developers selling snacks in Canada, tapioca for NPD teams in Egypt and peas for research execs in Australia.

The engagement score GlobalData gives to an ingredient is based on the number of data points in the month. Growth is then calculated based on the increase of the monthly data points over the last two-year period to provide a two-year CAGR.

Picking dill pickle

GlobalData argues dill pickle is emerging as a notable flavour in the US snack market, driven by the ingredient’s “bold taste and perceived health benefits”.

GlobalData consumer survey data highlights how snack makers might pique the interest of Gen Z consumers, with 45% of respondents in that cohort preferring ““unusual flavours” in savoury snacks.

The use of dill pickle can be seen across different types of snack products, with Kettle offering dill-pickle chips in its product range through to the ingredient being used a flavouring in protein pork crisps sold under the Shaw Strength brand developed by professional strongman Brian Shaw.

And the GlobalData report points to how health and lifestyle publications are highlighting the purported benefits of dill pickle, with benefits said to be in the areas of gut health and reducing muscle cramps.

Celebrity engagement is also fuelling interest, the analysts suggest, pointing to tennis ace Carlos Alverez revealing he drinks pickle juice to prevent cramp during his tennis camps and matches and Dua Lipa’s viral TikTok video showcasing the singer’s concoction of Diet Coke mixed with pickle juice and jalapeños.

Could hot honey be a sweet spot?

Foreign travel is a central reason why products offering heat have grown in popularity in North America and Europe. As consumers’ curiosity has piqued and tastes developed from trips to distant climes, supermarkets and their suppliers have strived to broaden their appeal to shoppers by offering a product range based on global cuisines.

There has also been a generational shift. Younger consumers are leading the way when it comes to heat/flavour choices.

Originating in Brazil, hot honey is a mix of honey and chili peppers, combining sweetness with heat.

According to GlobalData’s analysis, hot honey is also emerging in the UK snack market and the researchers have touted this ingredient as one for more product developers to bear in mind.

The report puts forward habanero, blue cheese and nduja as possible ingredient pairings, pointing to UK grocer Sainsbury’s selling a Habanero Chilli & Honey Nut Mix under its private-label Taste the Difference.

With rival retailer Asda also offering a habanero and hot-honey crisps under its Extra Special own label, it underlines the inroads the ingredient has started to make in snacks ranges. And big brands have taken similar action; Kellanova has a hot-honey SKU in its Pringles range in the UK.

Away from snacks, upmarket UK grocer Marks and Spencer has used the ingredient in a range of dishes.

GlobalData says hot honey can appeal to all age demographics, particularly to consumers looking for products with fewer ingredients. “Because hot honey delivers sweetness on its own, there is less need for additional sweeteners,” the report reads. “Consumers are drawn to natural, simple ingredients that align with health and wellness trends. Hot honey fits this demand perfectly, offering a naturally derived sweetness without artificial additives.”

Matcha’s momentum

Demand for matcha is simmering away, fuelled by health-conscious younger consumers looking for alternatives to tea and coffee – and the snacks industry is responding.

Matcha-flavoured snacks range from nutty nibbles through to biscuits and onto bite-sized mochi as product developers look to tap into the health halo of the green tea powder.

“You see a lot of matcha flavours appearing in the snacking category,” Maria Dawson, the MD of Clearspring, a UK-based supplier of Japanese foods, told our sister site Just Drinks last month.

In a GlobalData consumer survey conducted in the first quarter of 2024, a clear majority of each of the Boomers, Gen X, Millennial and Gen Z cohorts said matcha had a “positive” impact on health.

And it’s Australia that GlobalData, crunching the data from its Ai Palette platform, holds up as a key potential market for snack makers looking to use the ingredient.

“In Australia, the demand for matcha has surged, leading to its incorporation into a variety of snack offerings,” the GlobalData report reads. “From matcha-flavoured chips to baked goods and confections, brands are exploring creative ways to integrate the ingredient into their product lines.”

The report suggests chocolate and cream cheese as possible ingredient pairings. And the ingredient is being seen in more indulgent snacking items in Australia; one example is the Matcha Green Tea with White Chocolate Ice Cream developed by local business Peters Ice Cream, which is on sale at major grocers Woolworths and Coles.

Plump for pumpkin

The report puts forward pumpkin as an ingredient to watch in Canada.

The GlobalData consumer survey from the first quarter of 2024 shows salty is the most-preferred flavour among shoppers for salty snacks in the country, which makes the “pairing of pumpkin and salt especially promising,” the report reads.

According to the researchers, pumpkin pairs well with salt, “enhancing its

earthy and slightly sweet notes”. They add: “This combination has led to successful

innovations such as pumpkin and sea salt granola bars, salted pumpkin chips, and

roasted pumpkin seeds.

“As demand for plant-based, wholesome snacks rises, pumpkin offers a naturally gluten-free, high fibre ingredient that appeals to health-conscious consumers. Its versatility and compatibility with savoury formats position it as a strong contender in the evolving snack landscape.”

The report points to products on sale south of the border in the US including rice cakes marketed by Drizzilicious and spiced pretzels on sale at retail chain Trader Joe’s.

The ingredient, GlobalData says, can offer health and sustainability benefits. “Pumpkins can be grown domestically in Canada, helping reduce transport costs and avoid potential tariff barriers linked to imports. This makes local production both economically and strategically beneficial.”

Tapioca touted

Globally, Tapioca is known for its role in desserts like tapioca pudding and as the chewy pearls in bubble tea.

However, its neutral flavour and smooth texture make it suitable for a wide range of sweet and savoury recipes, GlobalData suggests.

Tapioca is a starch extracted from the cassava root, native to Brazil but it is Egypt’s local production of the ingredient that could make it a viable option for domestic manufacturers, the analysts argue.

“The availability of high-quality, locally produced Tapioca starch supports the development of innovative, gluten-free snacks, aligning with global health trends and reducing reliance on imports,” the report says.

The ingredient is seen as a useful option for product developers looking to tap into demand for clean-label and allergen-friendly ingredients.

And the report puts forward another reason why the ingredient could become more increasingly used in the wider Middle East and Africa region.

“With 36% of consumers in the Middle East and Africa viewing sustainable and environmentally friendly products as essential to their purchases, the highest rate globally Tapioca’s reputation as a low impact, renewable crop supports its position as a valuable ingredient in this expanding market.”

The potential of peas

Peas are among the oldest cultivated crops but the GlobalData AiPalette report puts forward an emerging opportunity for snack makers in India – the world’s most populous market.

Snack makers in western makers have launched products containing peas but India, the analysts argue, has a strong domestic production of peas and the ingredient is emerging as an option for the country’s snacks industry.

In the fiscal year 2021–22, India produced approximately 5.36 million tonnes of peas, with the largest outputs coming from the states of Uttar Pradesh Madhya Pradesh and Punjab.

India’s overall snacks industry is expected to grow by almost 8% in 2025 and the analysts argue there are opportunities for snacks manufacturers to use peas as a base in products like baked snacks – and not simply as a cost-effective solution.

“With an increasing number of Indian consumers seeking clean-label and plant-based foods, pea protein fits perfectly into this evolving demand,” the report says.

For any questions or further enquiries about GlobalData’s report ‘Emerging Flavors & Ingredients in Snacks’, or GlobalData’s Ai Palette innovation and consumer insights platform, please contact the company here.