The Protein Ball Co. set up in 2015, markets protein snacks from its base in southern England – and has managed to build a customer base across more than a dozen countries.

Founded by husband-and-wife team Matt and Hayley Hunt (who remain majority shareholders), the company counts the US and Germany among its major markets. It is eyeing turnover of £5m ($6.6m) this year and is forecasting at least £8m in sales for 2026.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The business has recently relaunched its flagship product, which it markets as a more natural alternative to protein bars, with “no junk” – no added sugar, sweeteners or emulsifiers and “made with simple natural ingredients”.

Just Food sat down with Matt Hunt to discuss the rebranding of its Protein Balls, his plans to grow exports and how consumers’ understanding of protein claims may be changing.

Eszter Racz (ER): How do you stand out in this very competitive segment of healthier snacks? Is the recent rebranding a part of that effort?

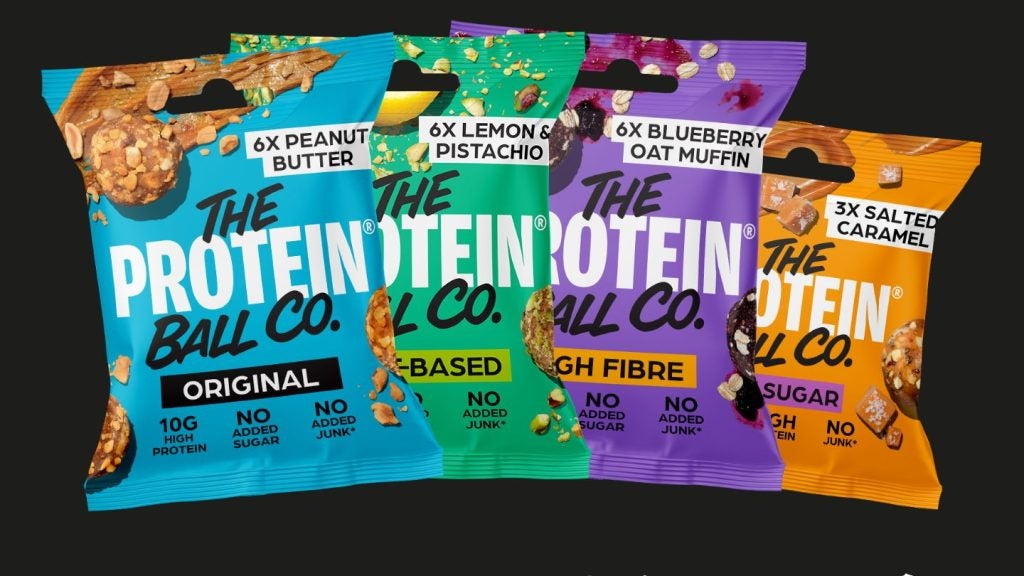

Matt Hunt (MH): Standing out is very difficult. Our tenth anniversary present to ourselves was to rebrand our whole product line. Our branding looked a little bit neutral and didn’t really stand out. We made the logo dynamic. We looked at the tone of voice and the wording.

We wanted to put our names on the back of the packaging with Hayley, my wife and business partner, so that people realise that Protein Ball isn’t run by a big, multinational organisation. We’re a husband-and-wife team with two children who employ friends and friends of friends in our local area, so we thought that it’s really important people start to understand who we are.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWe worked on the tone of the voice, worked on the colours and I think that’s how you stand out but that’s only half the job. Now we have to go and make a lot of noise and disrupt the market, which is full of the bigger bars and the bigger players. We really need to get people to understand it’s not all about how much protein is in the product. It’s about a natural product with protein that your body can digest.

ER: Which channels do you mainly use for advertising?

MH: We are just about to start on TikTok. I feel like we are not attracting the younger generation because we’re not on TikTok. We have budgets for Facebook and Instagram. We do quite a lot with LinkedIn. We still look at newspapers and magazines and editorials and send out samples in the post because it’s really nice when you get a write-up by one of the big magazines, like Runners Weekly or something like that.

LinkedIn has been pretty good for us because we have buyers that we engage with and, when we post about a new flavour or a new concept or a new win, it gets a lot of engagement. The next few months for us are going to be about learning TikTok and TikTok live and trying to get our message to the younger generation. We also have advertisements going through Amazon but Amazon is its own kind of beast. At the end of the day, it doesn’t matter how much you grow on Amazon; you still have quite a limited, small percentage of profit at the end.

ER: Do you see differences in consumer behaviour from younger generations compared to older customers?

MH: I think now the younger generation is really reading the back of the packs, looking at ‘what goes in my body’? I know this generation, I’ve got a niece and a nephew and a lot of people in the company don’t drink so much alcohol, don’t eat so much bad food. They vape. I think that seems to be a commonality across this age group but they are reading the back of the pack and are not falling for the marketing bullshit that says this has 20 or 30 grams of protein and this is super healthy.

They’re reading the packaging and saying: ‘What are some of these ingredients? What is this emulsifier? What’s this sweetener? What’s this glycerol that they’re putting in it? Is this good for your body?’ I think it will all turn the food industry around and the companies that are using natural ingredients will start to rise again and have their day. It won’t be all about mass marketing, big budgets and 100-million-dollar or billion-dollar companies. It will be about healthy food, picking the right brands that resonate with you and picking the right companies that have the right ingredients that are good for your body.

Credit: The Protein Ball Co.

ER: The Protein Ball Co. has recently expanded its footprint in the US. What has driven your growth so far there?

MH: We’ve been in the US for five years because we’ve been supplying Whole Foods Market stores for that long. Now we have two or three more of the top ten supermarkets and now we’re talking with more customers over there. There’s definitely a big demand in the US, I think, because a lot of their products have GMOs and ingredients which aren’t clean. They really like UK companies, because we can supply them a clean product that has real natural ingredients, and I think they go down really well in the US.

It’s mainly private label in the US but we’re speaking to a supermarket chain about the Protein Ball brand

It’s mainly private label in the US but we’re speaking to a supermarket chain about the Protein Ball brand, which will be really big if it happens. So far, we’ve gone through all the sampling and the pricing, and we’re just speaking to them now about the commercials, how that will work with the final price. But we usually work with private label.

As a business, we would prefer to just have our own brand but sometimes private label will bring opportunities in different countries, especially in Germany and the US, where you have some strong supermarket brands or health-and-wellness brands and they want to pivot and use their own brands because they are really trusted by their consumers. It opens up a whole new market, whilst we continue to grow our brand in different places.

The US market is really interesting because there are 350-400 million consumers, and they have money – and Americans really snack. Once you have a product and you get a loyal following, it’s easy to expand. You could go into somewhere like Texas mand you could be into 300 supermarkets just in Texas. It’s that big. Once you have a product that’s starting to gain momentum and there’s a national rollout across all the states, then you can really see volume increase dramatically.

ER: Was there a conscious decision at the start to focus on exports?

MH: Our first-year turnover was £500,000 and £250,000 of that was export. From day one, during almost the first three months, we were selling into Denmark, Switzerland and Germany. There is a real appetite for these healthy snacks there in my opinion. What normally happens is that these health trends will come from California. Then about one or two years later, they will make their way to the UK, and then after the UK, they will head over to Europe, usually starting in Scandinavia or Germany or the Netherlands and working down to southern Europe, so we were very early.

We went directly into northern Europe within the first few months and we’ve maintained it but we still see that the new trends, like the collagen mushrooms, or the gut healthy fibres, or the high fibre that’s coming in from the US would take a little bit of time before it hits the UK, and a little bit more time before it hits Europe. We were just quite early to the market with Protein Ball.

ER: What challenges are you facing in your different geographical markets?

MH: Whilst we have [strong business in] the US, we also have to be slightly cautious, because with the Trump regime and with tariffs, and now with a fall in dollar, we get paid less than when we first set up the contract, we’re also starting to hedge and we’re really pushing Europe again. We are talking to a ‘number one’ supermarket chain across Holland. We are in talks with a supermarket chain across Scandinavia and we’re very close to closing both. We already have supermarket chains in Germany and Switzerland and we’re starting to hedge our bets and try and push Europe because the US does have some uncertainties at the moment, until things stabilise a bit more.

We’re starting to hedge our bets and push Europe because the US does have some uncertainties at the moment

ER: Are you planning to enter new markets?

MH: Yes, the Middle East. I think the Middle East is a very powerful market for the protein segment and for natural ingredients, especially if it’s British-made. My next focus, which will start in January, will be trying to find some wonderful importers in countries Kuwait, Dubai and Qatar. We are trying to get the Protein Ball Company to have some contacts out there to start expanding the business. If you have a natural product, it can almost go around the world.

ER: How do you see your presence in the UK currently?

MH: We are a UK company and we are starting to concentrate more on our domestic market because there are a lot of businesses, a lot of points in the UK, that we are still not servicing and we could service better.

There are more gym chains that we can go after. There are more supermarkets in the UK that offer natural products now but there seems to have been a really big shake-up the last few months. I think [fitness coach and TV personality] Joe Wicks was part of this; he had a TV programme that spoke about using unnatural fillers, emulsifiers and ingredients in protein bars that weren’t as healthy as they should be. People are looking at what’s in their protein bar and if it is healthy for their body, and it is good for them.