Australia’s Freedom Foods Group reported a 54% increase in full-year revenue but net profits slid, partly due to acquisition costs, foreign-exchange losses and restructuring expenses.

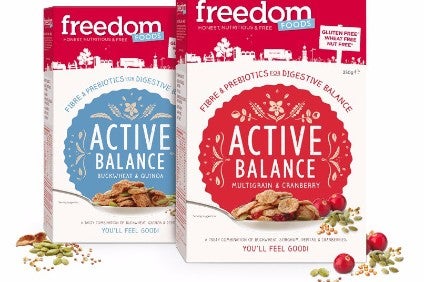

The maker of cereals, snacks, protein foods and milk products booked revenue of AUD262m (US$207m) in the 12 months through June, it said in a statement today (31 August). Revenue for fiscal 2018 are expected in a range of AUD340m to AUD360m.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Achievements during the reporting period included growth in the key brands of Freedom Foods and Australia’s Own, growth in oat-based cereals offered in China and Australia led by Arnolds Farm, and an acceleration in sales of dairy beverages such as `Own Kid’s Milk’ in China.

Still, the exchange-listed company said “once off non-recurring factors” impacted operating EBDITA, which rose 22% to AUD26.2m – principally, the increased cost of manufacture at its Taren Point site due to capacity limitations and downtime associated with major processing upgrades at its Shepparton facility.

Net profit on a statutory basis plunged 85% to AUD7.5m to reflect “costs not representing underlying performance”, including once-off acquisition costs of AUD1.3m, unrealised foreign-exchange losses of AUD444,000 and restructuring costs of AUD668,000.

Freedom Foods noted significant acquisitions as the completion of Australian Consolidated Milk’s 50% interest in Pactum Dairy Group at Shepparton, “providing for a more integrated dairy processing platform” and the acquisition of the Vitalstrength sports nutrition brand to expand its offerings in the performance and adult nutrition markets.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData