Mexico’s Grupo Lala is nearing a deal to buy Brazilian dairy peer Vigor.

Lala said yesterday (1 August) it had completed discussions with Vigor’s investors, the largest of which is J&F Investimentos, the Batista family vehicle that controls JBS, Brazil’s biggest meat processor.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The financial terms of the deal discussed have yet to be disclosed and the transaction remains subject to conditions, including the approval of Lala’s board, which is to meet tomorrow to discuss the acquisition.

A meeting of Lala shareholders also needs to give the green light. The deal also needs governmental approval.

Lala said it would “timely inform” whether the transaction is completed.

For its part, J&F had yesterday issued a statement, through JBS, in which it said it was in “advanced negotiations” with Lala on the sale of Vigor.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataJBS, which itself holds a 19% stake in Vigor, said its board would also meet tomorrow to discuss the transaction.

In March, Brazilian business daily Valor Econômico claimed PepsiCo had made two bids for Vigor but no deal had been reached.

Vigor is one of Brazil’s largest dairy processors. It owns a 50% stake in another dairy company in Brazil, the co-operative Itambe.

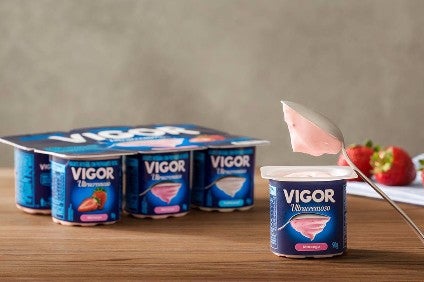

Vigor has 14 production plants and 31 distribution centers in Brazil. It employs more than 7,600 staff. The company markets dairy products including yogurt and cheese under brands such as Vigor, Danubio and Faixa Azul.

In 2007, a majority stake in Vigor was sold to Brazilian meat processor Grupo Bertin. Two years later, Bertin sold a majority stake in itself to Brazilian meat giant JBS, another company controlled by J&F.

In 2012, JBS spun off Vigor, retaining a minority stake in the company.

In 2015, J&F announced plans to buy control of Vigor. Last year, Vigor was delisted. European dairy giant Arla remains a minority investor in Vigor.

Should the deal go through, it will be another move by JBS to offload assets to bolster its finances.

On Monday, JBS announced it had finalised the sale of its beef operations in Argentina, Paraguay and Uruguay – a deal first announced in June – to fellow Brazilian processor Minerva.

Last month, JBS struck a deal to sell Canadian feed unit Lakeside Feeders for CAD50m.

The meat giant is also looking to offload its UK-based arm Moy Park, as well as its Five Rivers Cattle Feeding assets and farms in the US.

On Monday, Reuters reported JBS had hired BNP Paribas to help it sell Moy Park. The newswire said companies that have expressed interest in acquiring Moy Park include China’s WH Group, French beef processor Groupe Bigard and UK business 2 Sisters Food Group.

Last week, JBS announced it had struck a deal with banks over a portion of its debts. The company said the agreement ensured “the financial liquidity and regularity of JBS’ operations as they allow for the stabilization of short-term indebtedness and the preservation of the bank’s agreements in their original conditions”.