Australian confectioner Yowie Group has launched an off-market takeover bid for all the issued fully paid ordinary shares of its largest shareholder Keybridge Capital.

In a filing with the Australian Securities Exchange (ASX), Yowie said the proposal is structured as an all-scrip bid, offering one Yowie share for each Keybridge share on issue.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The proposed transaction is subject to a minimum acceptance of 50.1% of Keybridge shares, Yowie shareholder approval, and other regulatory clearances, according to an ASX filing today (9 May).

The latest announcement comes shortly after a significant legal development involving Melbourne-based Keybridge. On 8 May, the New South Wales Supreme Court of Appeal dismissed an appeal by its executive Nicholas Bolton, affirming the legitimacy of the board installed at the company’s general meeting on 10 February.

The court’s decision, announced in a separate ASX filing, marked the end of Keybridge’s period of external administration.

Keybridge entered administration on 9 February, following Yowie’s demand for repayment of an outstanding A$4.6m ($2.9m) loan by 7 February.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe investment firm also cited opposition to new fundraising efforts from its own investor, publicly-listed WAM Active, as a reason for entering administration.

WAM had repeatedly gone through Australia’s courts to prevent Keybridge from securing new finance.

In its administration notice on 10 February, Keybridge said it had been attempting to raise new funds since October last year. WAM’s latest attempt to block new financing arrangements was suspended by the Supreme Court of New South Wales on Monday.

Keybridge owns circa 78% of the Australia-based chocolate maker after increasing its holding in December 2023.

The investor held 23% of the novelty chocolate business’s stock back in 2020 before it launched a takeover approach in December 2023, when Keybridge was already the largest shareholder.

A deal was finalised in December, whereby Keybridge took its holding to 78.359%.

In May 2024, Bolton, a managing director at the investment firm, was appointed as CEO of Yowie.

Recent developments have also brought structural changes at Keybridge.

Bolton’s executive roles have been suspended pending an internal investigation.

Additionally, Jesse Hamilton has been appointed as company secretary, replacing John Patton.

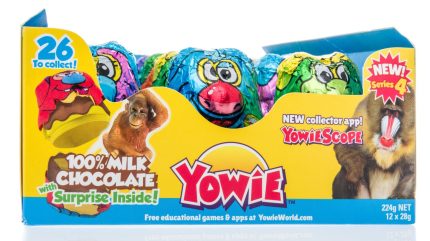

Yowie, headquartered in Perth in Western Australia, markets its namesake products in Australia and the US to “promote learning, understanding and engagement with the natural world”, featuring Yowie characters such as Rumble and Squish. It outsources production and distribution.