Lean Cuisine is a declining brand in a struggling category, placing the US business in a precarious position within the Nestle portfolio. Last week, Nestle announced a "reboot" that will see it attempt to reposition Lean Cuisine through new products, new packaging and a new marketing message. But will this be enough to breath fresh life into what was a dated and off-trend brand? Katy Askew investigates.

Lean Cuisine has become something of a problem brand for Nestle. It faces two major issues: the frozen meals category has fallen out of favour with US consumers and "diet" brands are increasingly being rejected in favour of brands that offer nutritional balance.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Frozen ready meals are the largest sub category within the US frozen food sector. Euromonitor data reveals frozen ready meals generated sales of US$8.22bn in the country in 2014. However, the figures also show that frozen ready meals are a category in decline, losing nearly $1bn in value over the last five years.

The reason for the decline can largely be attributed to shifting consumer preferences in the US, where fresh, less processed food has come to be viewed as healthier and of a higher quality. Frozen ready meals have taken on the mantle – accurately or not – of highly processed foods that are lacking in transparency and filled with artificial ingredients, flying in the face of the so-called "clean labelling" trend that has seen consumers switch to products made from simple, recognisable, natural, ingredients.

US consumers have also lost interest in "diet" brands, instead preferring to take a more holistic approach to diet and health. Nestle is all too aware of this fact. As Jeff Hamilton, president of Nestle's prepared foods business in the US, noted in an investor presentation last year, the decline in diet meals has been steeper than the overall frozen ready meals sector, dropping 7% between 2012 and 2014 to a value of $2.1bn.

Within the declining diet meals category, Lean Cuisine holds a leading market share, accounting for 40.9% of total sales in 2013. However, Lean Cuisine's market share is also in retreat: the brand accounted for 43.2% of total sales in 2011.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBelatedly, perhaps, Nestle signalled last year something needed to be done to address these issues. And last week, the company unveiled its "reboot" of the Lean Cuisine brand.

"We’ve committed ourselves to completely making over Lean Cuisine to align with the way people are selecting and enjoying their food," Hamilton noted as he unveiled the brand's new persona. "Giving shoppers choices within the frozen food aisle is a pillar of the Lean Cuisine brand, and we know that they want more than just new flavours – they want transparency around ingredients in their food and they are seeking new approaches. We’re motivated to do what’s right for our consumers, and from the Lean Cuisine brand, offering a greater ingredient choice is something we know they want."

Nestle has reorganised Lean Cuisine into four sub-lines designed to meet the different need states – or "food moods" as the company terms it – of its core female consumer. The lines are: Lean Cuisine Marketplace, for when consumers want "modern" "chef inspired" foods; Lean Cuisine Craveables, for when consumers want "casual" yet "indulgent" options such as pizza and sandwiches; Lean Cuisine Comfort, home-style foods that are familiar or nostalgic; and Lean Cuisine Favourites, a line made up of popular exiting recipes.

Through this re-organisation, Neslte is attempting something of a balancing act. Nestle does not want to alienate the existing consumer base supporting what market size/share figures would suggest is a brand worth around $840m in annual turnover. But to grow, Lean Cuisine also needs to extend its appeal to new customers looking for more exciting flavours, cleaner ingredients and, essentially, a more premium brand.

Announcing the relaunch, Nestle also spoke of the "individualised" food preferences that were highlighted by its market research – making it hard to appeal to a broad sweep of consumers based on one product attribute alone.

"We spoke with hundreds of women and found that their eating preferences vary significantly from one woman to the next. Whether the preference is organic, gluten-free or eating more protein, they expect the food must always taste great," said Julie Lehman, marketing director for the Lean Cuisine brand.

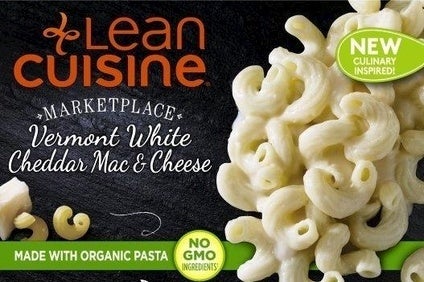

Nestle's new packaging and product launches support the drive to broaden Lean Cuisine's appeal. The group is rolling out on-trend products in packaging that features "modern" food photography to tap into trends like provenance, free-from, high-protein and made without artificial ingredients. These new products include: Vermont White Cheddar Mac & Cheese (made with organic pasta, GMO-free, preservative-free); Cheese & Bean Enchilada Verde (made with organic beans & tomatillos and no preservatives and GMOs); Sweet & Spicy Korean Style Beef and Pomegranate Chicken (both of which are high in protein , gluten-free and contain no preservatives).

Nestle is trying to shift Lean Cuisine into a bright spot in a gloomy category, while also maintaining control of the ground it already covers. It is worth noting that this new territory is not, however, a white space. Up-and-coming brands like Amy's Kitchen or Ian's already occupy this area. Coming from different segments – such as the natural and organic channel – these brands may have a greater 'authenticity' while Lean Cuisine is hampered by negative perceptions around 'big food'.

Marketing, too, is playing its role in Nestle's effort to revise Lean Cuisine's image. With the new "mission" to "feed your phenomenal", Nestle said it is using "real, everyday, phenomenal women" to convey the brand's new message. The company has launched a #weighthis social media campaign that talks about the achievements of women – of different shapes, sizes, ages and ethnicities. Rather than addressing weight loss or management, the group's YouTube video insists "if you are going to weigh something, weigh what really matters". And, of course, Lean Cuisine is there to support you through all these "everyday, phenomenal" achievements.

Nestle is working hard to change perceptions of Lean Cuisine and break the link between the brand and dieting. Will it work?

Datamonitor's Tom Vierhile is sceptical. "Given Lean Cuisine’s sales slippage, any attention at all on the brand is welcome at this point and the firm’s effort to recast the issue of weight control in a broader context via its "Weigh This" social media campaign may resonate," he says. "But the brand is really hamstrung by its branding, market positioning and heritage. As Nestle acknowledges, dieting is out. That’s why companies are using terms like "smart" or "fit" to communicate weight management benefits. Consumers may want to manage weight, but they don’t want to diet. The problem is that the brand name "Lean Cuisine" boxes the brand into the dieting realm and all of the negative connotations that come with it. I question whether a brand with "Lean" in the branding can engineer craveability, comfort and adventure into its product line when these trending food concepts seem to be at odds with a "Lean" branded food offering."

Nestle's new look for Lean Cuisine is a significant shift in positioning that has been well engineered. Marketing and packaging are being used to try and break the link between the brand's "diet" positioning. Through reorganising the brand architecture, the company has cast a wide net to appeal to new and old consumers. But, for all the on-trend NPD in the world, frozen ready meals remain fundamentally off-trend and the category continues to stagnate.

IBISWorld estimates overall frozen sales (including more promising areas such as frozen fruit and vegetables – which could potentially shed the reputation for being highly processed) are only expected to increase by 0.8% in the US to 2020, well below the food industry average. The research firm suggests the convenience factor will appeal to consumers, but warns that this will be offset by increased purchases of fresh products and a tendency for consumers to eat out more frequently.

Moreover, IBISWorld researchers note, profitability in the sector is also coming under greater pressure. "Coupled with stagnating demand, industry profitability has waned… Marketing costs reduced profit margins in the short term as leading producers aggressively introduced new products to gain market share. Furthermore, many producers were unable to pass on the rising cost of inputs, such as wheat, to downstream markets due to growing price-based competition across the industry."

In this context, much hangs on the outcome of Nestle's turnaround drive. The company is in a process of trimming under-performing parts of its portfolio – selling off assets like Jenny Craig – and a shape-up or ship-out ultimatum has effectively been issued.

The challenge that Lean Cuisine faces is about more than improving perceptions of a brand. It needs to contribute to the turnaround of an entire category. To achieve this is no mean feat. To achieve this without sacrificing too much margin is even more challenging.

As Datamonitor's Vierhile observes: "The frozen food sector clearly has issues and consumers see frozen food as overly processed and too far from the fresh foods they are gravitating to. According to Datamonitor Consumer’s 2014 consumer survey, just 14% of US consumers say they eat frozen food "almost every day" or "daily" – a reading which is just a hair above the 13.6% figure for canned food. That’s not the kind of company you want to keep."