B&G Foods has entered into an agreement to buy the spices and seasonings business of ACH Food Companies, a US arm of Associated British Foods.

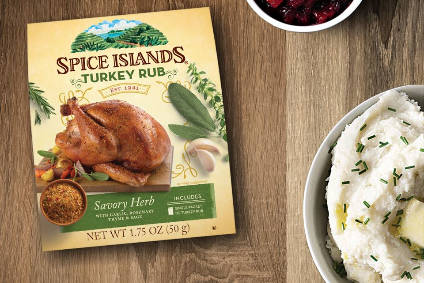

The deal values the business at approximately US$365m. It includes a number of US spice brands, such as Spice Islands, Tone’s and Durkee. It also includes the Weber brand sauces and seasonings, which are produced under licence. B&G will also take ownership of a manufacturing facility in Ankeny, Iowa.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

However, the transaction only covers part of the ACH business. ACH makes other products including vegetable oils and, when reports of talks between ABF and B&G first emerged earlier this month, it was suggested B&G was likely to acquire the ACH in its entirety.

“Following completion of the transaction, ACH will continue to sell vegetable oils, bakery ingredients and specialty ethnic products in the US, Canada and Mexico,” ABF said in a statement.

B&G said the deal is expected to close in the fourth quarter of 2016.

“This acquisition will significantly broaden our position in the large and growing spices and seasonings category, which we believe is very relevant to today’s consumer, who is looking for healthier options, simple ingredients and enhanced flavour,” stated Robert Cantwell, B&G’s president and CEO.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataB&G said the deal will be immediately accretive to earnings. The US company projects that, from 2017, it will generate annualised net sales of US220-225m, adjusted EBITDA of $38-40m and adjusted EPS of $0.26-0.28. The transaction value stands at 9.4 times projected adjusted EBITDA.

ABF declined to comment further.