UK grocery prices rose at the fastest pace in February in more than four decades as the headline rate of inflation surprised on the upside.

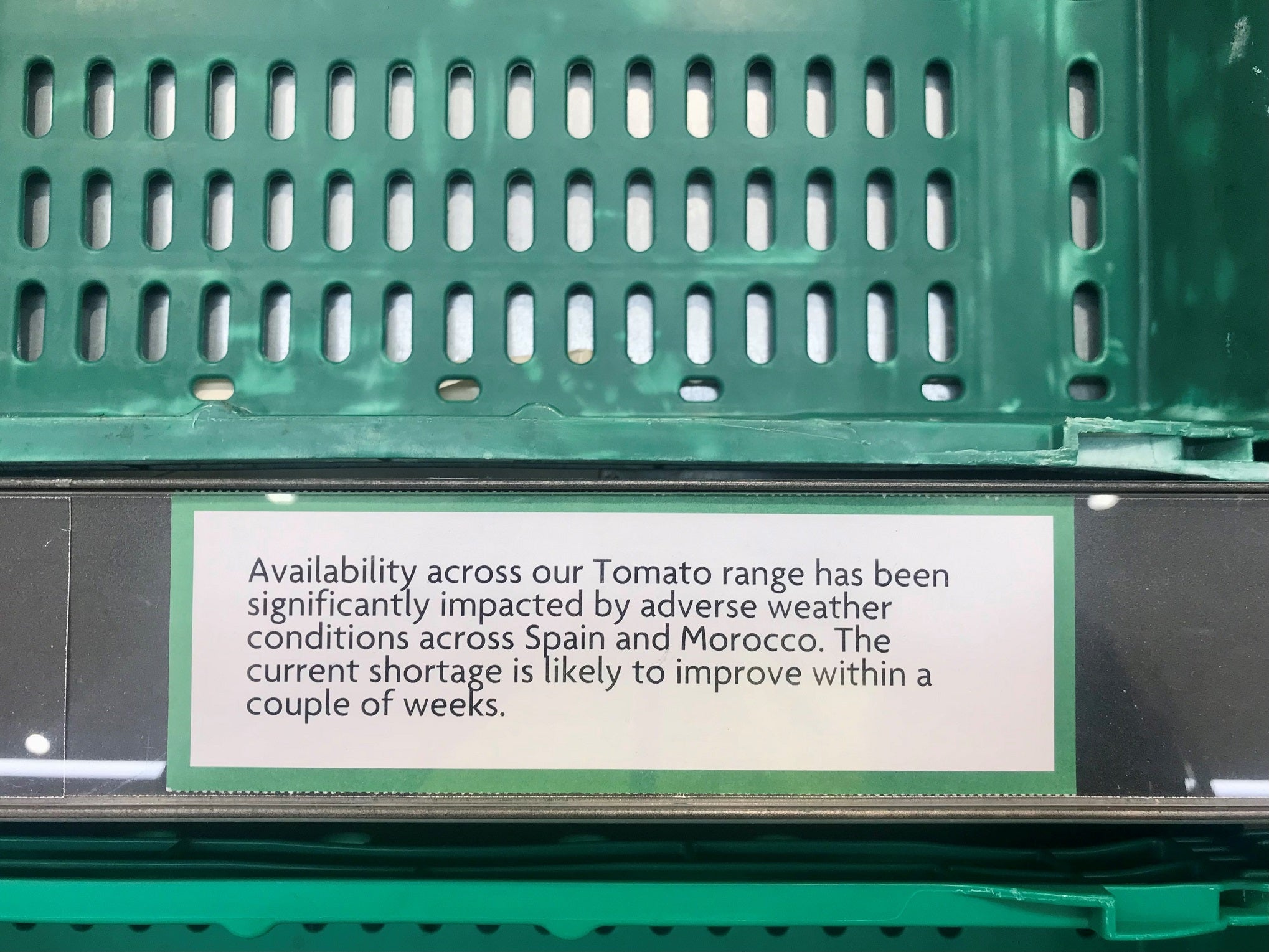

The shortage of fresh vegetables such as peppers and cucumbers in UK supermarkets pushed inflation for food and non-alcoholic beverages to 18.2% in the 12 months through February, the highest level since 1977, the Office for National Statistics (ONS) reported. The ONS estimated the corresponding figure for that year was 21.9%.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

February’s annual rate for groceries was more than triple the 5.5% in the same month last year. The ONS pointed to an 18% rise in vegetables prices, the most since February 2009, as the culprit.

“There have been media reports of shortages of salad produce and other vegetables, reportedly because of bad weather in southern Europe and Africa, and the impact of higher electricity prices on produce grown out of season in greenhouses in the UK and northern Europe,” the ONS noted in its statement today (22 March).

Karen Betts, the CEO of UK industry body the Food and Drink Federation, responded this morning: “Today’s acceleration in food and drink inflation to 18.2% will come as disappointing news for households. It reflects the continued, significant pressure the food and drink sector is under as businesses grapple with persistent cost rises.”

An easing in the UK’s headline rate of inflation and for the prices of groceries in January had spurred optimism that a peak had been reached. The cost of food and soft drinks cooled that month for the first time since May 2021, down from December’s 16.8% rate, which was also the highest since 1977 before last month’s print reported today surpassed that.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe ONS said prices for all goods measured by the consumer price index rose 10.4% in the 12 months through February, up from 10.1% in January. However, that is still off the October peak of 11.1%, a level not seen since 1981.

Prices were up 1.1% compared to a 0.8% increase in February 2022.

Announcing the spring budget last week, Chancellor Jeremy Hunt said inflation would cool to 2.9% by the end of the year, based on an estimate by the Office for Budget Responsibility (OSR).

The OSR’s outlook led to speculation the Bank of England may ease off on its interest rate tightening cycle but UK-based investment firm the Wealth Club said the latest numbers will likely put policy makers in a “squeeze”.

Nicholas Hyett, an investment analyst at Wealth Club, said: “The hope was that a steady drift down in inflation would let central bankers ease back on rate rises. Instead, a spike in food prices, up 18.2% and the highest it’s been since 1977, and higher prices in restaurants and hotels, up 12.1%, means the fight against inflation is not yet over.

“Food inflation is already back in the disco era, the challenge for central bankers is to limit other reminders of the late 70s to flared jeans and shoulder pads.

"Unfortunately, that leaves the Bank of England with unappealing choices - ease back on rate rises but risk leaving inflation running higher when households are already struggling, or stay in the inflationary fight and risk further economic crunches.”

Just Food's analysis on vegetable shortages: The multiple issues putting the UK’s salad days at risk