Consumers are increasingly making grocery choices based on wellness and nutrition claims as awareness grows about the impact of diet on disease prevention and healthy aging. GlobalData analysis shows that food and drink ingredients dominated worldwide consumer goods M&A by deal size in 2023 and health and wellness are noted by GlobalData consumer analysts as a top theme driving deal activity in this space. The market intelligence firm projects the consumer health industry to grow to US $375 billion by 2026, up from US $337 billion in 2023 even as macroeconomic concerns put pressure on household budgets.

Demand for sports and active nutrition, vitamins and dietary supplements and over-the-counter (OTC) healthcare is growing as studies increasingly show how proactive consumers are taking steps to improve their immunity, focus and general wellbeing.

“The post-pandemic era increased focus on health and this is prompting consumers globally to seek added functionalities in everyday goods, says Magda Dziuba, a GlobalData analyst focusing on consumer trends. “The main focus areas of these products are features that support gut health, increase one’s focus, provide added benefits for visual appearance and overall beauty, or enhance relaxation.”

‘Added functionality’ on the rise

Almost all of the 20,000 + participants of GlobalData’s flagship consumer survey in Q1 of 2023 (91%) said they paid at least medium attention to the ingredients used in the food and drink they consume.

Dziuba adds: “Global buyers want to learn about the origin of ingredients, the authenticity of the product claims, and about the added features of the goods they consume. This tendency is expected to grow even further in 2024 as consumers not only increasingly seek more product details but also have a wider selection of sources to verify these claims themselves.”

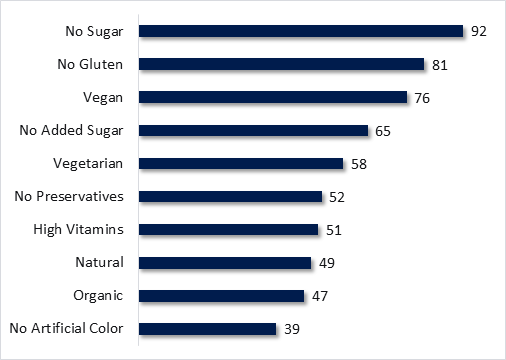

In response, brands are seeking formulations with highly specific, personalised and functional features and this is borne out by the top claims made by food brands in 2023. While ‘free from’ gluten, meat and additives claims dominated, high protein and high fibre, a plant-based nutrient that reduces the risk of metabolic diseases, ranked fifth and sixth, out of all the product launches tracked by GlobalData.

GlobalData: top claims in product launches among food, 2023

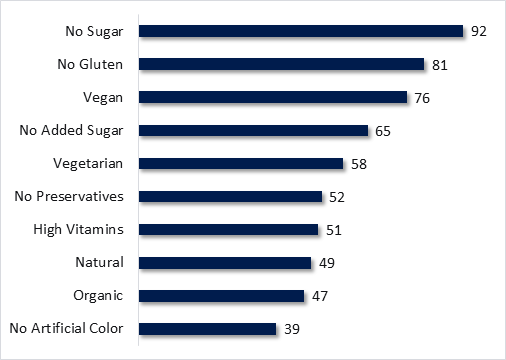

GlobalData: top claims in product launches among non-alcoholic beverages, 2023

“Gut health support is an increasingly popular claim as awareness of the link between the human gut – our digestive system – and overall mental and physical health grows. Most often, these products contain added fibre or pre and probiotics, some of the best-known gut-boosting functional food ingredients,” says Dziuba.

Now, a new biotic, is beginning to emerge as a hot topic.

Biotics and the next macro health trend

Chyn Boon Wong PhD, Manager, Science Communication and Marketing, Morinaga Milk explains the difference between prebiotics and probiotics.

“Probiotics introduce beneficial live microorganisms into the body to support good gut health and overall wellbeing,” says Dr Wong. “Prebiotics are compounds that help healthy bacteria grow in the gut.” Awareness of the immunity-boosting and digestive benefits of probiotics, in particular, has grown as a result of big budget marketing campaigns by some of the major food brands like Danone, which makes the Activia and Actimel yoghurt drinks. Certainly, probiotics were believed to have a positive impact on health by the majority of millennials (55%), generation X (60%) and boomers (55%) in GlobalData’s 2023 Q1 survey, which covers 42 countries.

The majority of buyers (more than 75%) said they associate prebiotics and probiotics with improved digestive health and better immunity. Over the past few years many products have come to market advertising prebiotic and probiotic culture formulations, with dairy and non-alcoholic drinks accounting for most of the growth in the category as a result of the fragile properties of these biotics. Morinaga Milk, a functional food ingredient innovator based in Tokyo, believes that increasing health consciousness in Europe and the US will support growth in this exciting space but the company, which has been researching bifidobacterial strains since the 1960s, is also excited about what it sees as a new wave of innovations in biotics: postbiotics.

Can ‘The afterlife’ boost a long life?

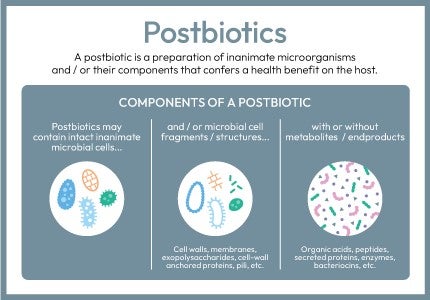

Literally meaning “the afterlife”, postbiotics are defined by the International Scientific Association of Probiotics and Prebiotics (ISAPP) as a preparation of inanimate microorganisms and/or their components that confer a health benefit on the host. In other words, postbiotics are non-viable, or dead microbes (whole cell or cell components with or without their metabolites).

Dr Wong says: “Postbiotics have great potential for use in various innovative applications because they are inactivated. They can achieve certain delivery formats and manufacturing conditions that might be more challenging for live probiotics to thrive.”

Presenting on a webinar Postbiotics: Navigating the Path to Commercialisation, she explains: “Probiotics have a stability issue and so they have limitations with regard to formats that require high moisture. They cannot tolerate high temperature conditions either, whereas postbiotics, which are heat-killed, retain their functionality in the harsh food processing conditions and are easy to store. This makes them ideal for use in a much wider range of applications than probiotics, including long-life food and drink shelf stables, which are becoming more of a focus.”

Yet its early days for postbiotics and the road ahead is not straightforward.

Postbiotics: the path to commercialisation

Countries in APAC, including Japan, South Korea, China and Thailand have embraced the potential of this new bioactive agent and Europe and the US are catching up with the trends. Postbiotics have gained traction over the past few years, even though standards and quantification methods are still being debated. The ISAPP definition is still not universally accepted as some others think that the postbiotics concept should also include metabolites (purified or semi-purified). Another challenge for most postbiotics available in the market is the limitations to achieve standardisation and quality control, especially if the postbiotics contain bacterial lysates and metabolites.

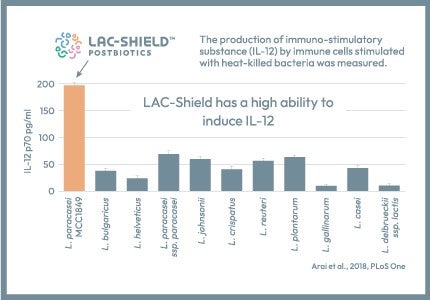

Morinaga Milk is keen to support the development of this market, leveraging its expertise from years of studying the effects of heat-killed Lacticaseibacillus paracasei MCC1849, which it has named LAC-Shield™. This bacterial strain was selected from several thousand strains for its capacity to induce production of interleukin-12 (IL-12), a potent activator of innate and adaptive immunity. LAC-Shield™ has demonstrated its outsized impact on the immune system in several of the company’s clinical studies.

Commercially available in Japan since 2014, LAC-Shield™ is used by more than 500 companies and added to more than 1,000 products in the country, including baked goods and cereal bars, confectionary, dairy and powdered drinks such as cocoa and supplement gummies.

“The resilience and proven efficacy of LAC-Shield™ has supported its strong uptake in Japan and there is every sign that LAC-Shield™ will lead growth in different categories and in markets worldwide,” Dr Wong maintains.

Read more about the science-backed efficacy of LAC-Shield™ and the potential for consumer brands to take advantage of the versatility of postbiotics in this free whitepaper from Morinaga Milk.