In Europe, healthy food – or products marketed as healthier than their existing counterparts – are most popular, and showing the strongest growth potential, among millennials, IRI writes in its monthly column for just-food.

While the definition of millennials differs among researchers, what is clear is they behave rather differently than other cohorts in a number of ways.

Having grown-up in a digital world, the way they shop and the choices they make are important for manufacturers and retailers alike to understand.

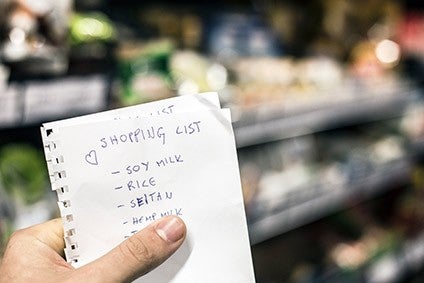

IRI has undertaken a study in seven European countries (France, Greece, Germany, Italy, Netherlands, Spain and the UK) looking across four different areas of wellness: healthy foods (wholegrain, low salt/sugar); vegetarian; free-from; and organic.

What is clear from the results of the study is the millennial audience is a key one for food manufacturers to target if they want to grow the sales of their healthy (or healthier) products in the future. The cohort purchases more across all four of those product groups.

The first of the the four product segments has millennials as its highest audience, with 78% of millennials purchasing them – eight percentage points more than the total market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHowever, the biggest difference in the purchasing habits of the cohort compared to others can be seen in vegetarian foods, which is bought by over half of the millennials surveyed (54%), which is 15 percentage points higher than the total.

It is not just the fact millennials purchase significant quantities of wellness foods that manufacturers should heed; it is that their spend in this area of the market is in growth.

When asked about how much they spend compared to two to three years ago, the millennials’ spend has increased considerably – 55% of millennial consumers spoke of a rise on the ‘healthy foods’ category and 42% on free-from – on each of the different types of wellness foods.

Their increase in spend is in line with the rest of the market – but is particularly important because they purchase more in the first place. And the growth is not showing any signs of stopping, nearly a third (29%) of those asked said they intended to spend more across the four categories over the next six months.

The reasons for purchasing these types of food is pretty consistent among millennials compared to the rest of the population. General wellness is the biggest reason millennials seek out the four types of food with more than half, 51%, identifying this as a reason to buy.

Other reasons include wanting something more natural/additive free, which is a motivation for nearly a third of consumers, as is believing the products will assist with weight loss. A concern for the environment is a motivator for 22% of millennials.

What is interesting in this research is that although 47% of millennials are buying free-from foods, only 14% cite having a food intolerance in their household as a reason for purchase. It is clear free-from foods are often a lifestyle choice rather than a health need.

Brand choice is not the most important thing when assessing what factors millennials weigh up when buying healthy foods. Almost half of millennials (49%) believe it is important to eat more fruit and vegetables, compared to 11% who think buying the right brands is key. However, this suggests there is potential for brands to position themselves more clearly as the healthy choice.

Meanwhile, the study shows millennial consumers think that they need to dedicate more time and effort to being healthier. Spending time on reading the ingredients is the next most important thing for a healthier diet (25%) along with paying attention to calories and fat (23%). In terms of effort, 23% believe changing the way that they cook will make them healthier and 18% believe they need to dedicate more time on shopping.

Across the four product groupings, the items are still predominantly purchased in hyper and supermarkets, although millennials do this a little less than the other demographic groups. For example, 72% of the healthier foods millennials buy come from them, compared to 79% for the market overall. In general, millennials buy more, around three percentage points, of their wellness foods on the Internet, than the other groups, while they also go to the pharmacy and health food store more often than the other cohorts.

Wellness attributes in food are a strong driver for growth now and for the future and the research shows some clear opportunities food manufacturers can capitalise to capture their share of the valuable millennial audience. Online is a significant, although not huge, channel for millennials to buy wellness brands so brands that want to continue to grow should include that among their target stockists.

Manufacturers should make sure it is easy to be chosen, by, for example, clearly calling out the ingredients and product benefits on the packaging in a way that time-poor millennials can easily understand.

Helping to provide meal choices that make it easier for people to feel that they are shopping healthily, either by working with the retailers on bundling products as meal solutions, or developing products that can easily be prepared in a healthy way is another way manufacturers can make their products attractive.