Alongside our daily news coverage, features and interviews, the Just Food team sifts through the week’s most intriguing data sets to bring you a round-up of the week in numbers.

Mondelez remains in pricing mode as cocoa inflation persists

After Mondelez International’s double-digit pricing last year, the branded chocolate and biscuits maker has signalled there is still more to come.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Volumes have so far remained relatively resistant as consumers prioritised snacking around favoured brands, despite two to three years of price increases by Mondelez, chairman and CEO Dirk Van de Put said this week as he announced the Cadbury maker’s 2023 financial results.

In Mondelez’s two-largest markets – North America and Europe – pricing has already been agreed for the new year in the former and the “majority” has been agreed in Europe, the CEO explained during a Q&A session with analysts.

Nevertheless, Van de Put suggested there might be some backlash in Europe to further pricing, as there was in 2023, as he indicated talks with some retailers are still ongoing.

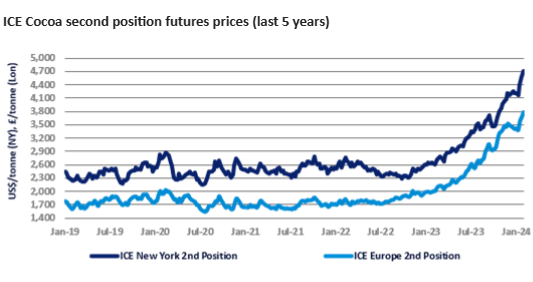

And Mondelez pointed to the particular pressure it is seeing from the cost of two commodities – sugar and cocoa.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

“For inflation, we expect a high single-digit increase for ’24…driven by significant increases in both cocoa and sugar, as well as another update in labour costs,” CFO Luca Zaramella said.

Zaramella said the pricing contribution to revenue will be “a little bit less” than last year and will mostly be chocolate-centric due to cocoa costs.

In 2023, Mondelez’s gross margin increased 2.3 percentage points on a reported basis to 38.2% and was up 0.3 points in adjusted terms at 37.5%. The operating profit margin rose 4.1 points to 15.3% and 0.1 point adjusted to 15.9%.

Eyeing margin target, Utz sells brands, factories

This week, Utz Brands announced another set of asset disposals as the US snacks major undertakes a restructuring of its supply chain and looks to boost its profitability.

The company has agreed to sell two brands and a pair of factories to Our Home, the company behind Popchips snacks.

In September, Utz set out plans to overhaul its manufacturing network to “support long-term volume growth and reduce costs”.

The Boulder Canyon maker sold a plant in Indiana and put two others – one in Louisiana and one in Alabama – on the block.

Utz has also set a target for its annual adjusted EBITDA margin to reach “circa” 16% by 2026.

Since the company went public in 2020, its annual adjusted EBITDA margin has not exceeded 14.3%, a level it reached in the third quarter of 2021.

Utz CEO Howard Friedman said this week: “With this important step in the optimisation of our supply chain and brand portfolio, together with immediate benefits to free cash flow from lower interest expense, we are well-positioned to execute against our expansion plans across the US and deliver on our margin target.”

China, North America sours outlook for honey maker Comvita

New Zealand-based honey business Comvita cut its full-year revenue and profit guidance once more this week due to “subdued consumption in China and North America”.

In a trading update, the company revised its full-year revenue range to between NZ$225m and $235m ($137.1m and $143.2m), compared to November guidance of NZ$245m and NZ$255m.

Reported EBITDA is now forecast to be between NZ$30m and NZ$35m, down from previous guidance of NZ$33m and NZ$38m, for the year ending 30 June 2024.

The group’s revenue for the first-half of its fiscal year reached NZ$103m, down NZ$8.3m year-on-year. This included the contribution from the Singapore retailer HoneyWorld it acquired in July.

CEO David Banfield said “We remain confident that our business model, premiumisation of the Mānuka honey category and long-term investment in our brand, puts us in a strong position once macro-economic conditions stabilise. We continue to maintain or grow share in our core markets, and we see premium retailers in the US and Middle East turn to Comvita as the only brand committed to growing the category with two new high-quality partnerships confirmed for H2.

“We remain committed to deliver cost reductions in H2 to protect our earnings and are forecasting a further reduction of debt and inventory in H2 supported by positive operating cash flow.”

Change at top of UK alt-meat company This

The joint founders and CEOs of plant-based business This are to give up the roles to former Ella’s Kitchen executive Mark Cuddigan.

Andy Shovel and Pete Sharman, who set up the London-based company in 2019, will step down as co-CEOs on 19 February. They will both remain involved with This in support of the incoming chief and the board.

Commenting on Cuddigan’s appointment, Shovel said: “Pete and I have been semi-decent early-stage CEOs (mostly!), but we wanted to invite a seasoned pro to lead our baby from here.

In a statement, This claimed to be the “largest independent brand” in the UK plant-based meat category. The B-Corp-certified company produces alternatives to pork, beef and chicken supplied into major supermarkets such as Tesco, Sainsbury’s, Morrisons and Asda.

This won its first overseas listing last year by getting on the shelves of the Netherlands’ largest supermarket chain Albert Heijn. It also received backing from UK TV broadcaster ITV in return for marketing investment.

Cuddigan joins the business at a challenging time for the plant-based meat category, which has seen growth in sales and volumes tail-off in Europe and North America since the peaks of 2020-21.

A number of UK companies failed last year, including The Meatless Farm Company and Plant & Bean. Another meat-alternative business, VBites, went into administration in December before the brand and assets were rescued by founder Heather Mills in January.

Meanwhile, This said its managing director Mark Turner left the company in January having helped steer revenue growth last year of 47% to around £19.3m ($24.3m), according to the statement.