The gluten-free sector is enjoying robust growth in a number of markets. It’s no longer a specialist category targeting coeliac sufferers. It’s become almost fashionable for health advocates, and fans in the West visiting and working in the Middle East are demanding the trend shifts to the region, forcing manufacturers to respond. Hannah Abdulla explores.

Gluten-free is fast becoming the buzzword of our time. The market is enjoying double-digit growth and, by 2018, the global gluten-free market is predicted to reach a value of US$6.2bn – phenomenal growth for an industry that was relatively unheard of ten years ago. While the category was initially deigned to support the needs of coeliac sufferers, more consumers are buying gluten-free products for their purported health benefits. Chris Brockman, EMEA analyst at Mintel, calls it “one of the most dynamic categories in the global food market”. But in a region where the food sector itself is young and developing, is it a bit ambitious to expect a big return on gluten-free in the Middle East?

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

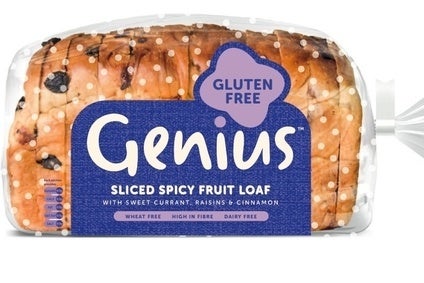

At the beginning of the year, UK gluten-free specialist Genius Foods secured listings for products in the United Arab Emirates with seven products going on sale at nine Spinneys outlets and four Waitrose stores.

David Shaw, commercial director at Genius, says there has been big demand coming out of the region for free-from ranges.

“Within the Middle East, there’s real international diversity and there’s lots of transient traffic that goes through there – so many Americans, Europeans etc that are very well educated on gluten-free and living a gluten-free lifestyle. But they didn’t really have the availability of what I would class great product. So it seemed like a reasonably obvious place to go for us,” Shaw tells just-food.

“We undertook a reasonable amount of on-the-ground market research from our team there. We responded to social media, which is phenomenal in this category, and responded directly to consumer requests for the products out there, and through all of these things we ended up having some incredibly positive conversations with Spinneys, who are passionate about bringing great gluten-free foods to their customers.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt is this transience in traffic that is leading to the gluten-free boom. According to Fatemah Sherif, a senior research analyst at Euromonitor, “Western influence” is what has encouraged the emergence of gluten-free and, more generally, free-from products in the region. Rate of growth of the gluten-free category stood at 3% last year says Sherif.

However, most of this growth comes from international companies. A quick Internet search will reveal that manufacturer-wise, there are not yet many in the region catering to a gluten-free option for retail yet. Most local gluten-free manufacturers will serve the foodservice sector, or goods are produced in specialist gluten-free dedicated stores such as Sweet Connection, rather than the major multiples, supporting Sherif’s views that as of yet, the gluten-free sector in the region is still “a niche category”.

Areej Joma, founder of the UAE’s first 100% gluten-free bakery Sweet Connection, explains that one of the reasons gluten-free is sold mainly through specialist channels rather than the major multiples, is the lack of education surrounding the manufacture and handling of the products.

“Integrity is not really viewed as important. There is a lack of understanding when it comes to baking gluten-free products as an independent process. Cross-contamination is a huge problem here. This comes down to no training or not enough training surrounding ingredients and use of tools such as a separate knife for regular cakes and a gluten-free range – even the oven has to be different,” says Jomaa.

Shaw agrees there is a lack of understanding surrounding the handling of gluten-free but adds the opportunity therefore is “huge”.

“It is always an educational process when you are trying to do things that people aren’t used to seeing or doing before. Essentially we’re going through process of explaining the benefits of gluten-free and free-from, but there’s also an underlying detailed educational process on how to display the products and handle the products to ensure we keep that gluten free integrity throughout the supply chain. Retailers have not been used to handling gluten-free foods.

“The wonderful challenge is the educational piece surrounding free-from, especially as this area develops and we keep bringing out great foods.”

With the lack of locally manufactured gluten-free products, there are export opportunities in the Middle East. In 2013, Nestle was the category giant, occupying just above half of market share for the Middle East and Africa. Cerelac Rice with Milk, Cerelac Rice & Maize, Quality Street and the soon-to-launch Aero range of chocolates are just a selection of the gluten-free products it offers the market. There was a significant gap between Nestle, and LD Bar-El which was second in size of market share at 9.5% in 2013.

It seems clear competition will continue to grow as the potential of the sector is recognised. Only this week, Israeli confectionery manufacturer Carmit Candy launched a pea-protein fortified gluten-free wafer snack; gluten-free it said “to serve multiple niches in the market”.

Genius’s Shaw is sanguine about the prospect of growing competition.

“Competition in gluten-free is a great thing. It raises awareness, especially if it is great foods out there”.

According to Euromonitor, by 2018, the gluten free products sector overall in the Middle East and Africa will be worth US$22m compared with just US$1.8m. Naturally, gluten-free bakery products will be the largest segment at US$9.7m, closely followed by baby food at US$8.7m. But will the gluten-free category ever be as big in the Middle East as it is in the West?

“It’s difficult to say,” asserts Shaw, adding products where consumption habits are similar between the Middle East and the West will continue to experience “big” growth.

“It depends on local diets. So in the West, we have a high consumption of bread in our diet. I may not expect the Middle East to have as high a consumption of bread relatively speaking, but they may have as high a consumption of other gluten free products that are more akin to their diet,” he adds.

Within the Middle East itself, consumption habits differ. Sherif believes that at present there is particular prevalence in demand for these products in the UAE specifically but Shaw says demand is region-wide.

“The demand is across the region. The other point I would make is that as the knowledge of this increases, it also increases within the medical profession and in terms of how they treat and diagnose people globally and test for gluten sensitivity. The local population will become more aware of it and there will likely be more demand for the products as this continues.”