The US accounts for the bulk of General Mills’ business and, with its operations at home under pressure, the food giant has got out the chequebook to snap up local natural and organic food maker Annie’s. But is it the right move? Dean Best investigates.

General Mills has some international brands (Yoplait, Old El Paso) and has made some moves overseas (think of its 2012 acquisition of Brazilian firm Yoki) but, fundamentally, it remains a US-heavy business.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

And, in recent quarters, General Mills – in fairness like a number of US food companies – has seen its domestic operations struggle as it battles fragile consumer confidence, weak sales volumes and changing consumer habits.

In June, after reporting a year of flat US retail sales and falling operating profit, the Cheerios maker said it would turn to innovation, moves in areas like gluten free and margin management to improve its showing at home.

However, yesterday late afternoon US time, General Mills turned once more to M&A to try to revitalise its flagging US performance.

In its first deal since the takeover of Yoki two years ago, General Mills has struck a deal to buy Annie’s, a US manufacturer of natural and organic products.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAnnie’s, which listed in 2012, is a business enjoying rapid top-line growth. Sales in the year to 31 March jumped 19% to US$204.5m. It is a company that has been able to capitalise on increasing interest among US consumers for natural and organic products, areas of the industry that are outpacing the more mainstream categories in which the likes of General Mills does business.

General Mills has agreed to pay $46 a share, an eyebrow-raising 51% premium to the 30-day average of the Annie’s stock. The deal values Annie’s at $820m, which Sanford Bernstein analyst Alexia Howard said today (9 September) was a “whopping 27.9x expected EBITDA”, the kind of multiple rarely seen in acquisitions in the food industry.

There has been a flurry of deals in US food in recent quarters as companies look to re-boot their growth, with the battle for Hillshire Brands, Hormel Foods buying protein group CytoSport and Post Holdings acquiring brands and businesses from PowerBar to Michael Foods.

However, Annie’s, with its position in fast-growing categories, had been touted as an attractive takeover target. General Mills, trying to eke out growth from its core business, has pounced, with a move some on Wall Street viewed as pricey. “The purchase price strikes us as quite rich at first blush,” Morningstar analyst Erin Lash wrote in a note to clients today.

General Mills said the deal, expected to close by the end of the year, would “significantly expand our presence in the US branded organic and natural food industry”. Annie’s, with its annual sales of north of $200m, will join a General Mills natural and organic portfolio that generated sales of $330m in the company’s last financial year.

Jeff Harmening, General Mills’ COO, said: “Annie’s competes in a number of attractive food categories, with particular strength in convenient meals and snacks – two of General Mills’ priority platforms. Consumers know and trust Annie’s purpose-driven culture and authentic brand. We believe that combining the Annie’s product portfolio and go-to-market capabilities with General Mills’ supply chain, sales and marketing resources will accelerate the growth of our organic and natural foods business.”

Chris Growe, an analyst at Stifel Nicolaus, said the multiples involved in the Annie’s deal were “very high” but said General Mills could achieve synergies when bedding the company into the business.

“We believe the ultimate multiple is more palatable when considering General Mills’ ability to drive synergies from this business. The typical rate of 7% of acquired sales – a level we would regard as a good average level of synergies from most acquisitions – would likely prove conservative here, and that figure by itself pushes the EV/EBITA multiple into the high teens,” Growe said. The analyst pointed to synergies from overheads, procurement and possible manufacturing, although he said the latter is an area where General Mills may have to make some investment.

Growe also suggests the price paid by General Mills will likely deter rival bids for a deal yet to be finalised. “We believe this was a necessary evil to prevent – or minimise – competitive bidders for Annie’s,” Growe said.

However, at Sanford Bernstein, Howard expresses doubt whether General Mills will face competition for Annie’s. “We would not completely rule out such an eventuality since Annie’s is clearly in the sweet spot of consumer demand for authentic and health and wellness-focused products and is also at an early enough stage in its development not to be too disruptive to earnings for the acquirer. However, unlike in the situation with Hillshire Brands, Annie’s is not a unique portfolio – there are several other health and wellness-based publicly traded companies that could sate the appetite for other potential acquirers. And the high multiples could deter other potential bidders from entering a price war.”

Shares in General Mills were off a touch in New York today, falling 0.56% to $53.21 at 12:59 ET.

Nevertheless, despite some reservations about the price paid, there was a general feeling among analysts that the move for Annie’s was right strategically. “Annie’s is a great means for General Mills to increase its exposure to health and wellness focused foods,” Howard said.

However, Jonathan Feeney, principal at Athlos Research, expressed concern about Annie’s recent moves into new categories and the loyalty of consumers attracted to the business.

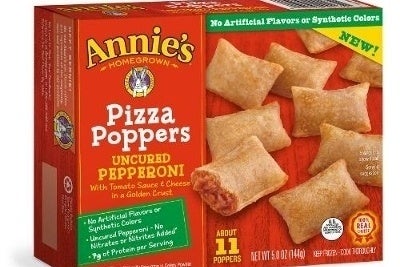

“We believe Annie’s is one of the premier natural/organic food brands, as demonstrated not only by its sales, but more importantly by the successful recent defence of its dominant position in natural/organic mac and cheese against [WhiteWave Foods’] Horizon and [Campbell Soup Co.’s] Goldfish,” Feeney said. “Yet … Annie’s has failed to extend its brand to new categories [like] cereal [and] frozen pizza and outside of mac & cheese, its mainstream success is rather limited.”

He added: “On the surface, General Mills is paying a significant premium on a lower-margin business that has benefitted from peak natural/organic demand driven by non-recurring financial tailwinds that have enhanced its scarcity value. Having just converted core Cheerios to non-GMO, General Mills seems to be betting that the recent natural/organic preference of younger cohorts is a long-term trend despite apparently significant economic and demographic headwinds. Put simply, we think Annie’s new customers are likely to be less loyal and profitable than its early adopters.”

Amid struggles with a US retail business that accounts for 60% of annual sales and three-quarters of EBIT – and struggles that have lasted a sustained period – General Mills has acted, swooping for a company that has enjoyed rapid top-line growth.

Annie’s generates lower margins but General Mills believes the business has attributes that will serve it well. “Annie’s has built a strong, profitable product portfolio, established deep and valuable brand equity with consumers, and has developed enviable go-to-market capabilities in the US natural and organic channel. Combine that with General Mills innovation capabilities and our ability to help invest in Annie’s growth, and we think Annie’s could help us accelerate our growth in the important natural and organic segment. This is a great business in an attractive segment of the US food and beverage industry,” a spokesperson told just-food.

The spokesperson, incidentally, also said General Mills had examined the recent accounting issues at Annie’s “thoroughly” and is satisfied about the company’s financial controls. In June, Annie’s said it had “identified a material weakness in our internal control over financial reporting”. It has since appointed a new auditor. At Stifel Nicolaus, Growe described the issues as “minor”.

In the main, General Mills’ move for Annie’s has been welcomed by Wall Street analysts, despite the outlay for the business. General Mills will hope the attempt to boost its US business through M&A will be a price worth paying.