Bringing together the opinion of food industry professionals from across the world, the annual just-food Confidence Survey acts as a barometer of the industry’s mood. As we moved into 2013, one of the messages that came through loud and clear is that FMCG companies are now acclimatised to the grim global economic outlook – and have adjusted their strategies to try to continue to grow. Katy Askew reports.

In many ways, the results of this year’s confidence survey confirm what we all recognise as the prevailing feelings about the industry and its prospects.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

After more than a decade of steady growth, the financial crisis plunged the world into a highly uncertain macro-economic environment. And, while the lows of previous years are seemingly behind us, today’s operating environment remains shaped by rising unemployment, declining real incomes, inflationary pressures, a slowdown in GDP and governmental austerity measures across a number of global markets.

These factors have combined to place consumer spending under mounting pressure.

|

It perhaps comes as little surprise, then, that food industry professionals are somewhat less optimistic today than they were at this time last year. Year on year, there was a nine-point drop in respondents who thought the operating environment would improve in 2013, compared to those who answered the survey 12 months earlier.

Interestingly, almost 39% of you thought that things would “stay the same” in 2013, up from 30% in 2012. Little change on a challenging year is not much to cheer about but it does suggest that respondents have become increasingly accustomed to operating in the challenging economic environment – and a growing number of people are confident that conditions will not deteriorate further this year. To use what has rapidly become a somewhat tired phrase: poor economic conditions have now become the “new normal”.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCommenting on Goldman Sachs’ outlook for 2013, chief economist Jan Hatzius concurred that the global economy would be in for “another relatively weak year” with global growth expected to stand at around 3%.

“In the major economies the annual average numbers are going to be quite similar [to 2012]: about 2% growth in the United States, similar to 2012, slight contraction in the euro area, just like 2012, and about 8% growth in China,” Hatzius predicts. “From a headline perspective there are quite a lot of similarities between the two years.”

|

The bulk of food industry professionals still see reason for optimism in the coming year, suggesting the operating environment will improve over the coming 12 months. However, significantly, it is important to note this majority has eroded somewhat – dropping to 37.3% from 46.4% in 2012.

Hatzius concurs there is reason to be more upbeat as we look to 2013. “Underneath the surface there are some important reasons why 2013 might be a little friendlier.”

Firstly, Goldman Sachs expects the global economy – driven by trends in the US – to see an upswing as the year progresses. The firm also believes the actions taken by the European Central Bank mean there is less “risk of spill over out of Europe and into the rest of the world”. Finally, Hatzius says there is “some evidence” that pressure on global oil markets – one of the key factors holding back economic expansion – has eased.

The outlook for global economic development is clearly a mixed bag and another theme that emerged in the survey is the increased level of concern food industry professionals have when they look to developed markets, notably those in the eurozone.

As this chart (below) shows, it is apparent the eurozone crisis – coupled with the mature, highly competitive and saturated nature of European market – presents the food industry with the greatest cause for concern in 2013. A massive 51.7% of respondents identified Europe as the market where conditions are least likely to improve over the next 12 months.

|

As if to confirm this prediction, in February, the European Commission revised its outlook that the 17-nation block will exit recession this year and conceded it is unlikely the eurozone will return to growth until 2014. The Commission blamed the bleak economic outlook on a lack of lending – for consumers and businesses alike – and high joblessness. These factors could potentially have a knock-on impact on household budgets and food spending.

But the food industry is not just concerned with conditions in continental Europe more than 16% of respondents flagged worries about the UK’s prospects, as fears that a triple-dip recession will hit the market persist.

Indeed, in the wake of Chancellor George Osborne’s latest Budget – which was unveiled last week – the Office for Budget Responsibility slashed its growth forecasts for the UK in 2013, cutting its outlook to 0.6% expansion from its previous forecast of 1.2% growth. The economists added the UK could narrowly avoid dropping into a triple-dip recession during the first quarter, if the economy is able to generate an expected 0.1% growth.

The OBR cited government spending cuts, slow growth in real incomes and productivity, the weak global outlook and ongoing issues in the financial sector.

While the Budget offered some good news for small UK businesses in an attempt to kick-start growth, the overriding consumer sentiment remains down in the country – and the knock-on impact on FMCG companies is clear.

The picture looks a little more mixed in the US. Consumer confidence continues to be tested by high fuel and gasoline prices but a break in wrangling over the federal government’s financial policy – after the House of Representative passed a bill to avert the fiscal cliff last week – looks set to offer some reprieve. The Congressional Budget Office has predicted the economy will pick up as the year progresses, resulting in declining unemployment, growing household budgets and improved consumer sentiment.

“After this year, economic growth will speed up, CBO projects, causing the unemployment rate to decline and inflation and interest rates to eventually rise from their current low levels,” the CBO forecast.

Nevertheless, unemployment levels are expected to remain above 7.5% through into 2014. If this prediction is borne out it would mark the sixth consecutive year unemployment has remained higher that 7.5% of the workforce – the longest squeeze on US employment for 70 years.

Interestingly, food industry professionals also highlighted concerns over Asia’s economic prospects – even though economies in the region have shown signs of resilience in the face of global economic weakness, with buoyant domestic demand driving growth. In China, in particular, many businesses were sounding warning bells as the country’s GDP growth dipped to 7-8%. However, compared to developed markets, this growth rate remains enviable – and looks set to remain steady in the coming year.

High unemployment, the rising cost of living, government austerity – all of these factors point to one thing: ongoing pressure on consumer spending power.

However, as the just-food confidence survey highlights, consumers are now accustomed to these pressures, having already lived through a protracted period of economic strife. While the food industry does not expect things to get much better in 2013, the good news is that things are not expected to get an awful lot worse either.

One obvious result of the gloomy economic outlook is a step-up in competition and a focus on price positioning and promotion. 2012 was a year of intense competition for the food industry. Weak consumer sentiment necessitated a strong focus on pricing and promotions. However, value also continued to mean more than “cheap” and the bottle neck effect – where companies at the premium and value ends of the market prosper at the expense of those occupying the middle ground – was evident in a number of geographies.This sentiment is evidenced in predictions for consumer confidence. Fewer respondents anticipate an improvement in consumer confidence in 2013 but fewer expect consumer sentiment to drop off further still. A growing majority of you expect the status quo to remain over the next 12 months.

In order to thrive, branded food manufacturers frequently looked to drive top line growth through brand building initiatives. Likewise, private label manufacturers competing in an increasingly crowded space viewed product development and an appropriate quality-price-value matrix as means to to drive growth. Across the board, the campaign to cut costs and build margins remained in full swing. In 2013, these trends are likely to heighten.

|

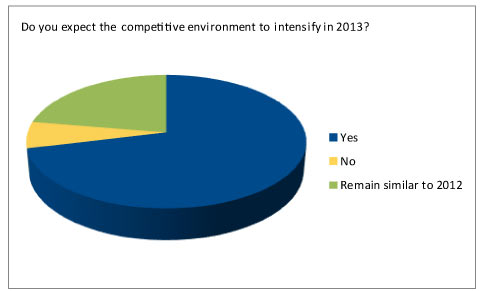

A significant majority – 71.2% of respondents – anticipate the competitive environment will intensify in the coming year. As competition heats up and the food industry battles over consumers’ constricting spending power, we can expect a renewed focus on price positioning. The food sector will look to deliver value through product development and marketing and will vie for position as it works to communicate the worth of its products to shoppers.

So what does all this boil down to?

|

Although the food industry has maintained a pragmatic approach to 2013, the vast majority of survey respondents expect to grow their businesses this year. With only 3.3% of respondents anticipating contraction, this bullish outlook suggests the food sector remains relatively upbeat in the face of some of the significant challenges.