As 2023 draws to a close, we set out some of the biggest stories in food through data – from persistent inflation and problems in plant-based meat to the industry’s efforts on ESG.

Inflation remained stubborn

The price of food and non-alcoholic drinks hit a 45-year high in the UK in March and remained above double-digits throughout the year, sparking a debate around whether the industry was fuelling “greedflation”.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

There was, however, some festive cheer just before Christmas with news today (20 December) that UK grocery inflation had moved below 10% for the first time since June 2022.

The persistent levels of inflation were seen across markets worldwide and prompted scrutiny of food industry supply chains and pricing strategies. In France, the country’s government was critical of some of the largest manufacturers doing business in the country. Some suppliers also found themselves literally labelled with the charge of ‘shrinkflation’ by retail giant Carrefour.

Meanwhile, in Canada, as the debate over greedflation raged, the country’s official statistics office issued data on food sector margins – and showed manufacturers grew margins at the start of the pandemic, but since 2021, they’ve been on a steady decline.

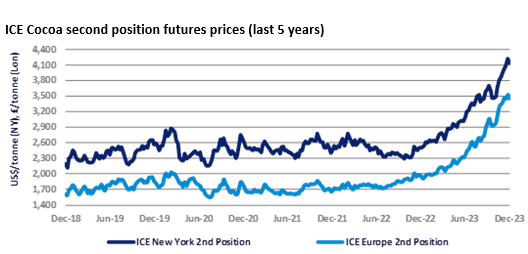

Even as rates of inflation slow in many markets worldwide, there remain concerns among some manufacturers about certain inputs. One commodity that has often been highlighted in recent weeks is cocoa. The agribusiness practice at GlobalData, Just Food's parent, this week issued an update of its analysis on cocoa futures.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Over the last twelve months to the beginning of December, cocoa bean prices have increased by 65% and 77%, respectively, in the New York and London cocoa bean futures markets. Over the last eighteen months, the increases were 78% and 99%, respectively,” GlobalData's Gerard Stapleton says.

Plant-based meat’s slowdown

There remains optimism about the longer-term prospects for plant-based meat, with the sector’s advocates pointing to rising consumer interest in the links between diet and health – and between diet and the environment.

However, 2023 has been a year in which some of the wind has come out of the category’s sails, with some well-known specialists seeing demand come under pressure, some businesses going to the wall and some corporate players reassessing their positions in the market.

It’s important to note that not all plant-based meat businesses have seen sales fall and some continue to attract investment. However, the travails of the likes of Beyond Meat and Quorn Foods in 2023 have shone a light on the prospects for the category in the near term.

The ongoing spotlight on ESG

Food majors worldwide have set out polices and targets in areas such as emissions, waste and packaging. There remain, though, some concerns about the progress being made in reducing emissions (not least methane), tackling waste and revamping the packaging used on food products.

PepsiCo’s most recent update on its efforts to reduce carbon emissions shows its footprint increasing by 4% to 61MtCO2e, against a 2015 baseline. Others are in a similar position. An analysis of the 20 largest meat and dairy producers in the world, conducted by the $70trn-backed FAIRR investor network, shows an increase of 3.28% between 2022 and 2023. The group includes firms like Hormel Foods and New Hope Liuhe, suppliers to household names such as Walmart and McDonald’s respectively.

In one small glimmer of hope for investors, 40% of the 20 companies (eight firms) are now publicly reporting Scope 3 emissions, with WH Group and Tyson Foods disclosing all scopes for the first time this year.

Tyson Foods, WH Group and Danone, among others, also disclosed a fall in annual emissions. However, their progress was negated by rises from other meat and dairy giants.

Jeremy Coller, chair and founder of the FAIRR Network, said: “The failure of leading meat and dairy companies to reduce emissions underlines the urgent need for more policy focus on the food and agriculture sector. Food system emissions deserve a place at the top of the table, alongside energy and transport, as they represent an estimated third of greenhouse gas emissions and 40% of methane.”

Meanwhile, The Ellen MacArthur Foundation’s (EMF) Global Commitment progress report once again revealed several FMCG giants are woefully behind on their 2025 sustainable plastic use targets.

While the report showed good headway on some metrics such as an increasing share of post-consumer recycled content (PCR) across all plastic packaging used, overall progress has been held back by a “few large organisations”.

Notable laggards included Mars, which increased its use of virgin plastic by 14% in 2022 compared to 2019, and PepsiCo, which used 10% more in 2022 compared to 2020. Beverage giant The Coca-Cola Company used 8% more virgin plastic packaging in 2022 compared to 2019.

Some progress was made by Nestlé, which achieved a 10% reduction in virgin plastic use in 2022 compared to 2018, but the share of its plastic packaging that was reusable, recyclable and compostable decreased from 55% to 51% over the same four-year period.

Almost universal progress was made in the realm of post-consumer recycled (PCR) content. Nestlé increased the share of PCR content across total plastic packaging by 7.5%, while PepsiCo increased its share by 4.3%.

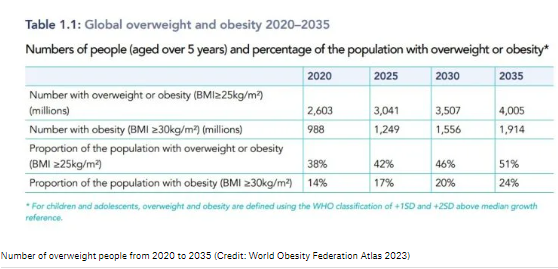

Meanwhile, it was forecast in March that more than half of the global population could be overweight by 2035, with childhood obesity levels doubling compared to 2020, research shows.

The economic impact could reach 3% of global GDP by 2035, or $4.32tn a year, if the curve does not flatten, a study by membership organisation World Obesity Federation found. This is measured by estimating healthcare costs, economic productivity loss and premature retirement or death.

The fifth annual World Obesity Atlas, published today (3 March), suggests 51% of the population will be overweight by 2035, while one in four – around 1.9bn people – will be obese “if current trends prevail”. Those with a BMI of 25 are considered overweight, while 30 and above is seen as obese.

The rate of childhood obesity could double among boys to 208m and see a 125% increase in girls to 175m.