Part two of just-food’s management briefing on private label focuses on two key players in a market at the forefront of development in the sector. UK retailers Tesco and Sainsbury’s have created sophisticated own-label ranges, creating a number of tiers and using their ranges to meet consumer concerns over sustainability.

The UK has always been a trailblazer in the development of private-label. Two of its dominant supermarket chains, Tesco and Sainsbury’s, have been particularly innovative.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Tesco’s private-label range holds the largest share of the UK’s private-label market, with Sainsbury’s coming in at second place. Both chains tout strong multi-layered ranges that continue to grow despite a tougher economic climate.

This consistent private-label growth may not be beneficial for branded food manufacturers, but others in the food industry view it as positive.

“Both branded and private-label products have an important role to play in providing supermarket shoppers with a greater array of products at different price ranges to suit different budgets. This diversity makes for an exciting and highly competitive food and drink industry,” says Angela Coleshill, director of competitiveness at the UK Food and Drink Federation.

In recent years, both Tesco and Sainsbury’s have sought to broaden their customer base, particularly during the downturn. Sainsbury’s, which traditionally appealed to mid- and high-income earners, reached down-market through promotions and new lines.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Sainsbury’s based its marketing campaigns around three themes: ‘Shop and Save’, ‘Switch and Save’, and ‘Cook and Save’,” reports global research firm Euromonitor International.

“Shop and Save highlights the fact that Sainsbury’s offers competitive pricing and a range of promotions. Switch and Save highlights the quality and value offered by Sainsbury’s private-label products at lower prices than the equivalent leading brands.

Cook and Save, meanwhile, aims to help households make the most of their food budgets, with promotions such as ‘Feed your Family for a Fiver’ and ‘Love your Leftovers’.”

Both promotions were focused around own-label goods. Sainsbury’s Feed your Family for a Fiver recipes featured a number of staples, such as bread and chicken products, from the company’s ‘basics’ own label range.

Tesco has also run similar own-brand meal deals. This Valentine’s Day the supermarket chain offered a GBP9 special where customers could select from main and side prepared meals for two paired with a bottle of wine.

Both retailers have also tailored their own-brand strategies to their customers’ growing interest in sustainability.

Sainsbury’s has placed high importance on sourcing local products and promotes this within its own-brand strategy. In 2009, the company changed a number of its private-label brands to 100% British ingredients. The company promotes its 100% British pork sausages including 100% British back fat – stating they are the only UK supermarket to do this.

Sainsbury’s runs its own-brand Partnership in Livestock and Partnership in Produce schemes, and has done so for a number of years. Sainsbury believes that this three-way partnership (supplier, farmer/grower and Sainsbury) has the following benefits: “members benefit from being able to plan better long term, to share information, to support joint research and development, and to reduce costs.”

Tesco, meanwhile, personalises its localisation by profiling all of its own-brand (and commercially independent brand) suppliers by region on the company website. Suppliers who want to join the Tesco team, whether to sell food marketed as own brand or under their own name, can apply directly through the site using an online form.

Buying local can also play a part in reducing each company’s carbon footprint. Tesco actively promotes its private label’s reduced carbon footprint with a labelling scheme.

“We have now footprinted over 500 [own-brand] products and will continue to footprint and label our products over the coming year,” says Tesco corporate affairs manager James Wiggam. Each label gives a figure of the amount of carbon dioxide generated over a product’s life cycle (from growth to storage).

That said, Tesco is yet to make a 100% switch: this May, the retailer received bad press for importing asparagus from Peru, when the green vegetable was abundant locally.

Sainsbury’s, meanwhile, has undertaken a number of initiatives to limit the environmental impact of its goods.

The company’s environmental initiatives have been “mostly on own-brand goods”, says a spokesman. “But of course we work with major suppliers to reduce packaging whenever possible.”

This year the chain relaunched its Basics own-label tinned chopped tomatoes in cartons rather than cans. The company stated that the switch would reduce packaging by half a million kilograms a year and cut back production carbon emissions by 156 tonnes per year. Other packaging reduction efforts include removing the outer sleeve on the retailer’s Basics chilled ready meals (lowering the amount of packaging used by 34%). Elsewhere, Sainsbury’s Basics family biscuits selection uses 70% less packaging than in its alternative ‘core’ own-brand family selection.

The chain has seen solid growth in its entry-level own-label Basics range, reporting sales were up 60% year-on-year in the final quarter of 2009.

While Sainsbury’s efforts have remained focused locally, Tesco continues to expand globally.

Tesco is now the world’s fourth-largest retailer and has expanded through aligning with established companies in foreign markets. For instance, Tesco now has 1,230 stores in Asia and has developed own-brand products across the continent.

Europe, another key market for Tesco, has felt the strains of the recession and the company has rolled out local equivalents to its Discount brands at Tesco own-label brand in markets like Poland.

In the US, Tesco has moved away from its name and operates an eco-friendly neighbourhood supermarket chain called Fresh & Easy.

Although the company is yet to reap large monetary benefits from its endeavour it has successfully expanded and has over 150 stores throughout California, Nevada, and Arizona, all sporting own-brand products.

Tesco and Sainsbury’s private-label innovation and expansion during the recession has served them well and has the potential to keep doing so after the economy recovers.

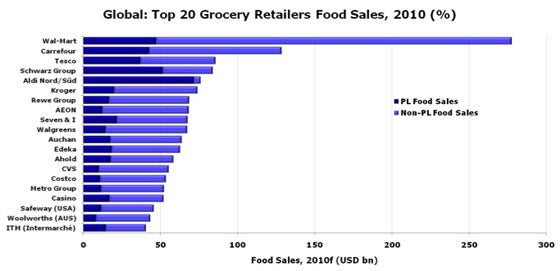

Private label shares of food sales are poised for further growth for virtually all of the global Top 20 grocers in 2010, while discount operators are the true PL champions. All 20 retailers are forecast for an upward trend for 2010, with the exception of Tesco and Schwarz Group, which will remain the same.

Credit: Planet Retail Ltd. The Brands of the Future