The economic downturn has led consumers to turn to private label for greater value. Own label has been a significant sector in Europe for decades but US consumers are now looking to store brands more regularly – and emerging markets are starting to catch on, too.

Private-label is a crucial tool for food retailers. Not only does it give retailers more control over costs and quality, it allows them to market their own brand whilst making sales.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The practice has been long established in Europe and it is becoming increasingly popular in the US. “Today [in the US], approximately one out of every four food and beverage products in a supermarket is a private-label/store brand,” New Jersey, US-based food marketing customer service expert Dr Richard George tells just-food.

According to data from US trade body the Private Label Manufacturers Association (PLMA), private-label units were up by 6.4% for the year (2009) compared to a decline of 1.7% for national brands.”

The statistics clearly show that private-label is having no trouble gaining traction in the US food market. And although, the recession has helped drive private-label sales because they are considered good value, it is not the sole factor in their growth.

The PLMA cites a February 2010 Booz & Company survey that stated: “The shift to private label started before the recession but has accelerated and shows no immediate signs of slowing down. Many consumers are having a good experience with private label and would need a reason to switch back.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAnother recent study conducted by market researchers GfK for the PLMA showed that nearly 50% of primary US household shoppers chose a store brand over the ‘national’ or producer brand, despite prior loyalty to the national label. After they had made the switch-over they were pleasantly surprised. “Nine out of ten people said the store brand products compared favourably or very favourably to their previous national brand choice,” the study councluded.

George believes that many well-established national brands have made it easy for store brands to grab market share. “National brands that have not been the recipient of investment spending on product improvements give the consumer little reason to pay the national brand premium.”

None of this will be a surprise to observers of the European food retail scene. The development of own-label food marketing in Europe has soared since it first began on any scale 25 to 30 years ago and is now “mainstream practice” in all EU countries, says Francine Cunningham, director of government affairs for EuroCommerce, which represents the retail, wholesale and international trade sectors in Europe.

Brussels is looking at the private-label sector. The European Commission has been asked to study the effect of own labels on the competitiveness of the agro-food industry, in particular on small and medium-sized businesses (SMEs), “and examine ways to reduce if appropriate, the imbalances of power in the food supply chain”. Results and recommendations will be released later this year.

Own-label success in Europe and, latterly, the US has inspired retailers in emerging markets such as India and China. Private labels in the Indian food industry are increasingly prevalent, as increased profit margins, more brands to display and wider presence in the market make them an attractive proposition for the big retail companies. However, they still have a long way to go.

“This is an early introduction state for private labels in India,” said Kumar Rajagopalan, CEO of the Retailers Association of India. According to Rajagopalan, Indian retailers have not grown big enough to achieve the economies of scale vis-à-vis private labels.

Still, private-label brands such as Bharti Walmart’s ‘Great Value’, Future Group’s ‘Fresh n Pure’ and ‘Tasty Treat’, Reliance Retail’s ‘Dairy Pure’ and Spencer’s ‘Smart Choice’ are being promoted with prominent shelf displays and prices that are 15-20% lower than the established brands, according to Rajagopalan. “As the competition increases every retailer has to give differentiated assortment to consumers to create affinity towards their stores,” he says.

Market surveys have revealed that the quality of private labels is already perceived by Indian consumers as being equal to those of national brands and this has increased the bargaining power of the retail chains with the manufacturers.

At the same time, however, some traditional national brands such as Top Ramen noodles, Mrs Bector Foods, Dynamix Dairies and Bonn Foods have linked up with modern retailers, offering their facilities for manufacturing private labels. On the other hand, Reliance Retail has turned the whole concept on its head by selling ‘Dairy Pure’ products through unorganised traditional retailers.

Meanwhile, in China, private-label food offerings, often with a similar look to brand-name foods but at a lower price, have also started to take off.

For example, at Centurymart, a domestic hypermarket run by Shanghai-based Bailian Group, a pack of peanut-flavoured waffles carrying its own label – Better Living – is priced at CNY2.8 (US$0.41) for 200g, compared with CNY5.9 (US$0.86) for a similar-looking waffle manufactured by Hong Kong-based Garden Co.

Centurymart so far has 116 stores in mainland China, offering a wide range of private-label products from food materials and frozen foods to confectionery.

Its rivals, including Lotus, which belongs to the Bangkok-based CP Group, and Rt-Mart, a subsidiary of Taipei-based Ruentex Group, are all racing to develop private-label foods – and all of them are competing with more experienced foreign retailers such as Carrefour and Metro Group.

But not all retailers are impressed by the booming business. Nong Gong Shang (NGS), another hypermarket in China, is one of them. “Currently we don’t want to be heavily involved in the business,” a spokesman for NGS says.

Indeed, dealing in private-label foods is not necessarily a lucrative business for all retailers, insists Li Wei, a retail expert at Shanghai Zhan Guo Ce Consulting.

“Consumers want to buy foods from highly professional food manufacturers that can be trusted, so in this case, retailers are not that competitive,” he says. Only giant retailers with a good reputation could have some leverage to gain consumers because “they can be somewhat trusted”, Li says.

Research conducted last year by London-based research firm Euromonitor International shows that Chinese consumers, especially in urban areas, are still reluctant to buy private-label products, including foods, due to concerns over quality.

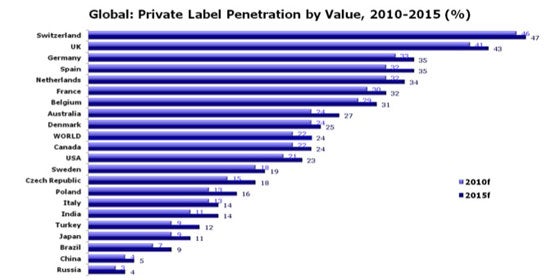

Private label growth is anticipated for nearly all markets worldwide, with particular growth in emerging markets.

Credit: Planet Retail Ltd. The Brands of the Future