India’s chocolate sector is set to continue to enjoy solid growth and, in part two of his deep dive into the market, Raghavendra Verma looks at which parts of the category could offer rich pickings.

Predicting what lies ahead for India’s growing chocolate market, the industry is expected to see more sales from healthier products and premium offerings over the next two to three years.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Recent new product activity is already starting to reflect these nascent trends. Among the high-profile chocolate launches in 2019 have been Mondelez International’s Cadbury Dairy Milk 30% Less Sugar and the company’s Cadbury Dark Milk, with both bars designed to cater to health-conscious customers.

Growing awareness among Indian consumers about the links between diet and health has, in the country’s chocolate market, also led to growing sales of wafer-based lines, such as Nestlé’s KitKat or Munch, Himanshu Manglik, president of Gurgaon-based consultancy Walnutcap, a former senior executive for Nestlé’s operations in India, points out. “They are growing this market rapidly with their unique wafer and chocolate innovations,” he says.

And the broad trend of premiumisation was behind the decision by Nestlé in 2018 to launch Les Recettes de l’Atelier in India, chocolates imported from Europe and sold through speciality channels, a spokesperson for Nestlé’s business in India says. A 100-gram pack of this brand is sold for INR250 (US$3.57).

Anil Viswanathan, director of marketing for chocolate brands at Mondelez’s India business, tells just-food the US snacks giant’s objective in the country is not just to deliver innovation in existing categories but to expand into newer segments. “There is a need to continuously adapt to evolving palates,” he says.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataL Nitin Chordia, a certified chocolate taster and consultant based in Chennai, argues the launches from Mondelez show how less sugar and higher cocoa content will be increasingly important in India, as tastes mature and consumers develop a taste for chocolate itself, rather than just its sweetness. “These two trends are very important,” Chordia asserts. “That is where we see the market going.”

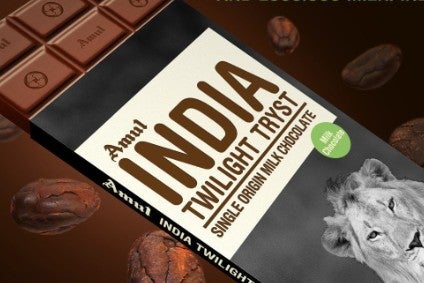

Darker chocolate, with cocoa content of between 55% and 90%, can be more costly but the segment is also a key focus of India-based major Gujarat Cooperative Milk Marketing Federation, which sells 20 varieties of such chocolates under its Amul brand, including Ivory Coast Grande Nuit and Bitter 90%. “Consumers like their taste and are willing to move away from the traditional milk or sugar-based chocolates,” Rupinder Singh Sodhi, managing director of the cooperative, says, adding the company is “the market leader in dark chocolates”, without disclosing the data on which that claim is based.

Amul’s chocolate portfolio does include milk chocolate and a part of its strategy in that segment has been to launch products designed to be more upmarket, such as the single-origin India Twilight Tryst.

Even though Chordia says the premium segment accounts for just 5% of India’s total chocolate market, he adds it is growing at an annual rate of 30%. UK-based data, research and analytics group GlobalData predicts India’s overall chocolate market will grow annually at an average of 8.6% between 2018 and 2023.

The Nestlé spokesperson business says the country’s consumers are prepared to pay a higher price for better chocolates, stressing the Indian chocolate industry is witnessing consumption-led growth. “Consumers demand unique flavours, different tastes and textures, as well as exotic ingredients, and are willing to pay for such experiences,” the spokesperson says.

In the upmarket segments of the category, companies use spices for exotic flavours, Manglik says. An example is Mason & Co., from the southern state of Tamil Nadu, with lines such as chilli and cinnamon dark chocolate. Manglik notes, however, how such specialist lines are still “limited to a few exclusive retail outlets”.

Chordia thinks experimentation with Indian flavours will remain a niche for the time being and western flavours will continue to dominate the mass chocolate market for the foreseeable future. “Milk chocolates account for the majority of sales, even in the rural markets where customers are equally aspirational but less experimental,” he says. Rural parts of India provide Mondelez’s Indian arm with 20% of its chocolate sales, according to company statements.

One important innovation in rural India is making smaller serving sizes available. Mondelez believes chocolate products that retail at INR1, INR2 or INR5 are the driver of the firm’s rural business in the country.

Making special efforts in rural India is smart, because these markets are still largely unexplored and unexploited, Harish Bijoor, a brand strategist and analyst who founded Bengaluru-based Harish Bijoor Consultants Inc, says. “The industry is slated for a frenetic pace of growth as really good chocolate gets discovered all across the rural hinterland of India,” he says.

One key tactic for brands is persuading consumers to switch to branded products such as chocolates from generic traditional Indian sweets and convincing them their chocolate products are “an upgrade”, Bijoor says.

For instance, marketers have successfully argued that Ferrero Rocher is like a ‘laddu’, a traditional Indian sweet with nuts, “and it has been a roaring success”, Bijoor asserts.

A good time for chocolate companies to make this case is during festivals, such as Diwali and Raksha Bandhan, when a lot of sweets are consumed. “Increasing market penetration continues to remain a large opportunity and festivals are important occasions to connect with consumers,” the Nestlé spokesperson says.

There has been a broader shift away from traditional Indian sweets towards chocolates, especially those bought as gifts, Amul’s Sodhi points out. “After seeing an encouraging response to our new brands, we will also be investing more in the chocolate market and double our sales every three years,” Sodhi says.

With larger scale, there will be more room for additional brands. Sodhi says Amul has already increased its share of India’s chocolate market from 2% to 5% over the last four years. He points to another trend from which the company is benefiting. Amul’s target consumers, especially younger shoppers, like to buy larger sized chocolates and share them with friends, he says. “Nowadays people are buying 125-gram to 150-gram bars.”

Suresh Bhandary, managing director of the Mangalore-based Central Arecanut and Cocoa Marketing and Processing Co-operative Ltd, also known as Campco Ltd, has been researching younger consumers, claiming the switch from child impulse purchases, buying on the spot from the retail display, to requesting a brand usually happens at the age of 16. “Those above 16 years of age ask for specific brands, mostly snack bars like Mars or Snickers, and they often change their preferences,” he says. Mars sells a number of its confectionery brands in India, including Mars, Snickers and M&M’s and covers some of its sales through local production.

For Bijoor, overseas chocolate brands can quickly attract a dedicated following in India. He cites Ferrero Rocher’s success and predicts if the Italy-based multinational launches its Pocket Coffee line in India the product “would be a big hit”.

Bijoor claims at least three overseas players are planning to enter the Indian market over the next five years, although he says he could not name them as they are his clients. “Every one of these will contribute to market excitement and expansion,” he says.

Perhaps in a sign consumer-facing chocolate companies are planning to enter or ramp up their activities in India, business-to-business supplier Barry Callebaut is setting up a new factory with an annual production capacity of 30,000 tonnes in Baramati, near Mumbai, in 2020. “We are excited about India’s great growth potential,” the company said in a statement issued in July.

Annual per capita consumption of chocolate in India is only 130 grams, compared with more than 10 kilograms a year in the UK, according to Mondelez’s Viswanathan points out and that, on paper, offers a lot of potential for growth.

For part one of this deep dive into India’s chocolate market, click here.