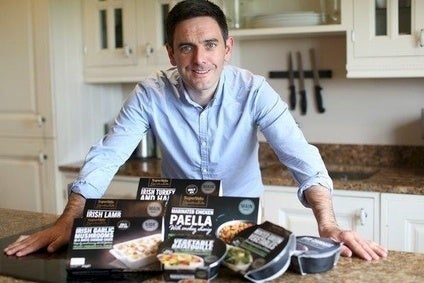

Irish private-label ready-meals maker Ballymaguire Foods has opened a new domestic plant it hopes will help expand its presence in the UK. The company says demand for ready meals continues to rise in Ireland and the UK and managing director Ed Spelman talks to Hannah Abdulla about the group's plans to tap into that growth.

just-food: Ballymaguire Foods is part of Irish agribusiness Country Crest and is a relatively new company but has grown to become the largest chilled ready meals producer in Ireland. Where did the idea for creating Ballymaguire come from?

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Edward Spelman: Ballymaguire Foods was formed in 2008. We found people are not eating potatoes as much as they used to; younger people years ago grew up on potatoes but nowadays it's not the central piece in their diet. There is pasta, rice, which are more flexible and quicker to cook and we are very used to them. Sales are dropping on potatoes so that would be one of the main reasons for our launch – the shift to value add.

j-f: You have your eye on growth in the UK and have opened a new plant in Lusk to serve the market? Are you already present in the country?

Spelman: We entered the UK around a year and a half ago and started supplying Budgens. The extension [into the UK] is based on sterling being positive for us now. Our experience with Budgens we hope is something we can build upon. We can deliver to the UK six to seven days a week, as quickly as we can to Cork from here [Lusk]. We deal with all the retailers in Ireland – Tesco to Lidl and Aldi. There's some products here that are uniquely Irish – stews for example – we'd be able to bring a bit of provenance to that in the UK. Also the retailers' requirements and standards expectations in the UK are the same in Ireland – our plants have the necessary accreditations.

j-f: The ready meals market in the UK is crowded with the likes of Bakkavor and Greencore present. How does Ballymaguire plan to compete?

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSpelman: The players you've mentioned do a great job; the quality is outstanding. The UK is a little bit ahead of Ireland. Own brand is very much our focus and we see it growing into the future. We're quite small in the context of those UK giants you've mentioned plus there are others that are larger, too. With Budgens, they are a small retailer and they don't get too much love from the larger players. They don't get the flexibility. But for someone like us it is big business. So we are very focused on developing that relationship. We certainly might be able to get some SKUs or ranges into some of the Tescos, Lidls and Aldis but that's very much based on the sterling and the way it is at this moment in time plus our relationship with those retailers here.

j-f: The grocery sectors in the UK and Ireland have seen significant change in recent years, with discounters grabbing sales from more mainstream grocers. How has that impacted your business in Ireland?

Spelman: Our experience of the discounters has been extremely good, we find them positive to our business. They are very clear on what they require and have a very limited SKU range and that certainly gives volume. We supply on time, good quality and the margin for us – given the volume they put through the plant – is extremely positive. With other retailers like Tesco or Supervalu – you might have 50 or 60 different SKUs but in Lidl or Aldi you've only got five or six. It's very focused and centred on volume or pallets and that's it. The discounters started out in Ireland 12 years ago; in the UK they're expected to double or triple in the next four to five years. So there is an awful lot of growth there.

j-f: How do you see demand in the UK for ready meals?

Spelman: The growth absolutely is there. Sixty per cent of the ready meals consumed in the UK is own brand so within the own-brand space there is a demand. Today's consumer is very conscious on waste. They don't want to pick up a full head of cabbage and throw half away. You've got the millennials that just want to buy the product, get it into them as quickly as possible and then move on because they lead a very busy lifestyle. That works for us because we don't just do full meal solutions. There are different layers of engagement with consumers when it comes to our ready meal offerings. They could buy mashed potato then buy in their local butcher a breast of chicken and cook that up and feel like they have engaged with the meal. We offer everything from sauces to meal accompaniments to full meal solutions.

j-f: Frozen ready meals have had a bit of a hard time in recent years, getting the negative perception of being unhealthy. Has the chilled ready meals category been challenged in the same way? What has been the impact of this?

Spelman: The negativity in terms of ready meals is disappointing. It is something we are working on and retailers are working on to reposition the value of ready meals. But that will take time. We're finding the "clean agenda" and using simple products is extremely important. People in the UK and Ireland need to know where their food is coming from, they want good quality and fresh foods. What people are putting into their bodies is becoming important. With the obesity crisis as well – having a clean declaration on the back of a pack is important and certainly has been part of our agenda for a long time and that has been driven by the retailers. We use fresh ingredients like you do at home and produce in small batches and that's what we have to do to get the customers' confidence.

j-f: The horsemeat scandal took its toll on the ready meals sector as a whole. How has Ballymaguire reacted to growing concern among consumers about the supply chain?

Spelman: We work out of a farm, a green site, 80% of our power comes from a windmill, that too is great comfort to people that we are giving back to nature. In terms of traceability, we have a 500 herd of cattle where we can bring our customers up to see the cattle, we hold pieces of their feedstuff and that's something that came out of the horsemeat crisis. We took the situation extremely seriously, so serious that we've invested quite substantially into a cattle feeding unit where we kill our own continental heifers for all heifer beef within our meals. The feed comes from our own land and we have great control and traceability around that, all the potatoes and onions come from our own land too. Traceability is key and is going to become more important as food scarcity, droughts, climate change, a whole lot of things, will make food very expensive. Trying to have supply and control in your own destiny, I think that's where the future is.

j-f: Back home, the Irish catering and foodservice channel is another area of interest for Ballymaguire. Why?

Spelman: Three in every meals eaten in Ireland is eaten outside the home so there is a great potential there for catering. We do a small bit in catering in Ireland at present and are looking to grow that. What we have learnt with the retailer is portion control [and] nutrition information – so we have that for all our recipes – and that's something we can bring to the catering side of things where people want to know the calorie count of what they eat and what's within it. We believe we can give that in a large-form catering unit, which will give consistency and repeatability within a kitchen and will give a central control and a cost control and portion control. In terms of challenges, probably finding a partner that's like minded – its about partnership. Days are gone of buy, buy, buy and getting the best price. There are a lot of other factors involved like quality ingredients for example. Certainly in Ireland and the UK that's how the horsemeat crisis happened where prices had been pushed and pushed. So we want to team up with someone that is like minded and we are very close to doing.

j-f: What are the wider ambitions for the business?

Spelman: We are going to move into new factory in the next nine months, extend production within Ireland first, and continue to supply the UK via Budgens. We think in the next month or two we will be starting to supply UK retailers as well, on a small scale but we have a three-to-five year plan rolling that we hope to go into and achieve because these things don't happen overnight. We deal with all the retailers in Ireland, Tesco to Lidl and Aldi to the Musgrave Group. We are very focused on following our customers. A lot of the customers that we deal with here in Ireland, we'd certainly look to deal with in the UK.