US-based private-equity firm Kratos Capital has sold Albie’s Foods, a supplier to foodservice outlets and retailers, to fellow investment house Union Capital.

Founded in 1987 as a pasty manufacturer, Albie’s Foods now also produces pies, filled bread sticks, calzones and its EZ Jammer sandwiches under its namesake brand and also for private-label clients. It also supplies school lunch programmes.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

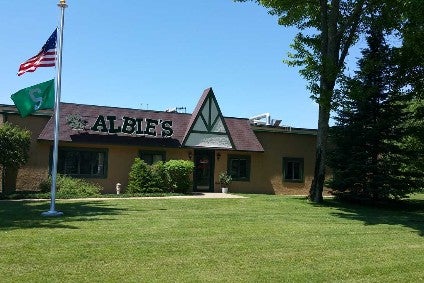

The company operates out of a 25,000 square-foot plant in Gaylord, Michigan, which has undergone a number of expansions as business increased.

In a statement announcing the deal, Kratos Capital’s principal Josh Bammel said: “Our clients were looking for a partner to provide a liquidity event, while also building future value for this growing business. Union Capital, given their reputation in the food sector, proved to be the best partner.”

No financial terms for the deal were disclosed.

Neither Albie’s nor Union Capital responded to requests from just-food for comments on how the new private-equity owner plans to take the business forward.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataKratos’ statement described Union capital as a “lower middle-market” private-equity firm operating in North America and targeting companies with annual revenues of US$20m to $200m.