Australia’s Freedom Foods Group, which has had a troubled 18 months amid an accounting scandal, executive departures and asset sales, has said its turnaround plan is “beginning to gain traction” after seeing sales rise and losses decline in the first half of its financial year.

The company behind Australia’s Own milk and Vital Strength protein powders booked a 10% increase in revenue to AUD317.3m (US$248.3m) for the six months to the end of December, or a 15% rise based on continuing operations. In December, Freedom Foods agreed to sell its cereal and snacks business to Australian snacks maker The Arnott’s Group.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Freedom Foods reported a net loss after tax of AUD23.9m but that was lower than the AUD63.5m booked in the first half of its previous financial year.

The results from Freedom Foods’ prior fiscal year have been restated after a Deloitte investigation into accounting at the company. The review, which also led to Freedom Foods’ 2018 and 2019 financial accounts being restated, followed news last June the company was probing the possibility of fraudulent activity in the wake of write-downs, charges which followed the departure of senior executives.

Trading in the listed company’s shares has been on hold since last June and remain suspended. Interim CEO Michael Perich, who took on the job last August, said Freedom Foods’ first-half results “demonstrate the potential of the businesses” within the company.

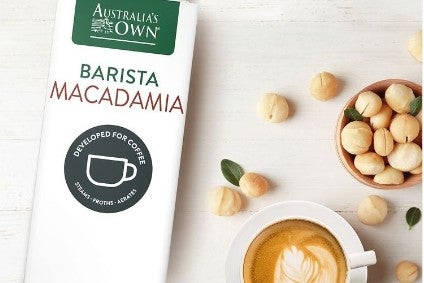

After the sale of its cereal and snacks assets to Arnott’s, Freedom Foods is focusing on two divisions: dairy and nutritionals, which includes long-life milk and performance powders; and plant-based beverages. The company still has a presence in seafood but it is reviewing its options, including a possible sale of that asset.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPerich added: "The results show the financial and operational turnaround strategy underway across the company is beginning to gain traction. By working hard to remove complexity across the business – as well as improving our culture, governance and accountability – we are able to focus our attention on the brands and products with the greatest potential."

In January, Freedom Foods said it had reached an "in-principle agreement" with its majority shareholder Arrovest – a New South Wales investor owned by the Perich family – for a cash injection under a recapitalisation project. Arrovest agreed to inject AUD200m into Freedom Foods through the issuance of secured convertible notes, capital the business will use to "enable it to continue its financial and operational turnaround", as well as to pay down debt and for working capital.

Upon announcing Freedom Foods' half-year results on Friday (28 February), Perich added: "While there remains a lot of work to be done to ensure Freedom Foods Group can meet its full potential, these results validate our decision to focus on building a world-class business around our market-leading dairy and nutritionals and plant-based beverages brands. Once the recapitalisation is complete, we will have a capital structure that allows us to continue to focus on delivering on our turnaround strategy and restore the group to sustainable and long-term profitable growth."