Consumers are set to be more influenced by their personal health than the cost-effective options when buying food in 2023, analysts forecast.

Shopping is however still forecast to remain very price-centric for consumers due to stricter budgets and food inflation, according to research presented at a GlobalData webinar entitled ‘Top Trends in Food 2023’.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

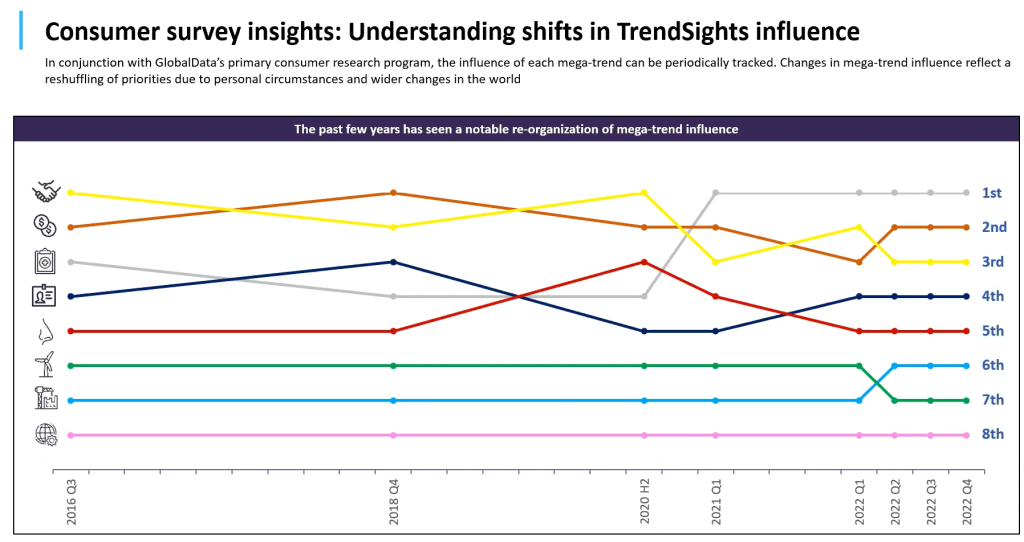

By GlobalDataSince the latter half of 2020, the GlobalData-dubbed ‘Health & Wellness mega-trend’ has remained the most influential trend shaping food shopping, ahead of ‘Easy & Affordable’ and ‘Comfort & Uncertainty’.

“In the second half of that year [2020], it went from being the third most important influence of consumer purchasing decisions, right up to first and it’s remained there, right up until the last quarter that we have data for. I think that’s really, really significant,” said Katie Page, content director for consumer, foodservice and packaging practices at GlobalData.

“That’s inevitably been driven partly by the pandemic, as you might expect, but even in the face of the financial crisis that we’re starting to be exposed to right now, it still retains that top spot against the mega-trends of ‘easy and affordable’ which as you’ll see with the brown line, comes in second.”

Page reiterated the significance of the health and wellness trend as it could be expected cost to be the priority.

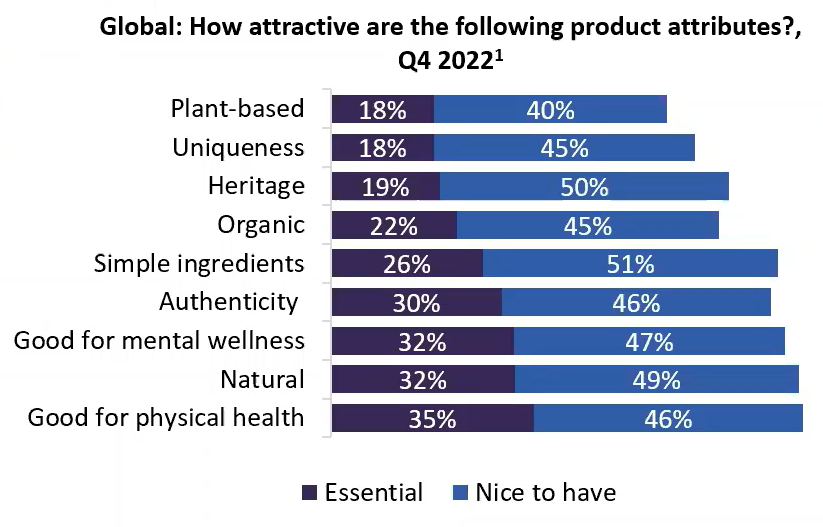

“Consumers are specifically willing to prioritise ingredients that benefit their health, even during the cost-of-living crisis, which indicates a consistent concern for health post-pandemic,” she asserted.

“The demand for these ingredients from consumers highlights a willingness to pay a higher price point, in return for health benefits.”

Post-pandemic period making people proactive in hunt for health

Analysts have spotted a trend of consumers opting for proactive health choices. In other words, since the pandemic, consumers are buying foods to benefit their health more generally rather than for vanity purposes or superficial benefits.

“At that time [pre-pandemic], the trends were very much aligned around things like weight management. They might have been aligned around fitness, or they might have been aligned around very specific health needs,” Page added.

“And I think the massive shifts that we’ve seen in the last few years have been much more to proactive health. So, this is much more about being healthy for yourself, just having a healthy body, being a healthy person so that you can fight against the risks of disease, for example. It’s much less about superficial benefits, much less about just targeting one or two individual health needs.”

Some 35% of global consumers are actively looking for products that impact their health when grocery shopping, according to a GlobalData Consumer Survey for Q4 2022.

Value for money still key – online grocery shopping continues to grow

Page made it clear that a focus on personal health does not preclude the financial concern which is at play when consumers are food shopping. In a time where people are very conscious of their spending, it is inevitable that price points and cost-effectiveness will matter.

She commented: “Consumers have got tighter budgets, and so they’re being even more ‘choosy’. They are definitely scrutinising product labels much more closely in terms of the projects that they are buying into, and it’s all about value for money.”

“It’s not necessarily a race to the cheapest. When consumers are looking at things in the round, it’s about how you [brands] could help them to choose or make more beneficial purchasing choices which could really align with their own particular needs and values.”

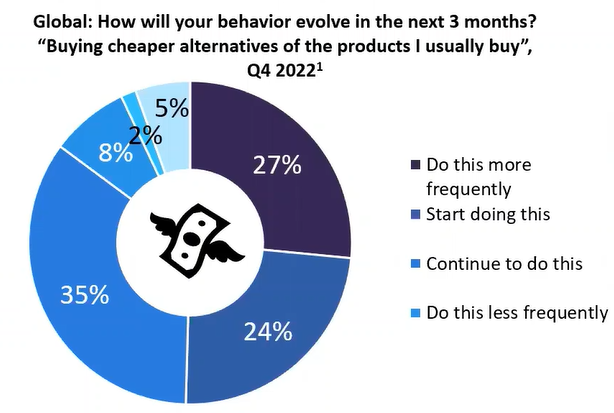

Due to stricter budgets and rising grocery prices, many consumers’ shopping habits remain impacted by price. Those shoppers are trying to find the most cost-effective option, which often involves purchasing cheaper alternatives to their usual products and not remaining brand loyal, as well as switching to cheaper retailers.

Some 58% of global consumers are buying grocery products online more frequently than they were previously, according to a GlobalData 2022 Q4 consumer survey.

“Through digitalisation, consumers can get ample access to the information they need to decide and establish a product’s position within their budget, as well as having convenient and immediate solutions to instantly gratify their purchases,” claimed Page.

“This is very important during the cost-of-living crisis as brands are experiencing a heightened competitive environment, making an online presence and digital shopping experience a significant resource for competitive advantage.”

Page also believes the pandemic taught brands supply chains require a refresh to be able to match the instantaneous nature of online shopping nowadays and in the future.

She said: “One big learning point that we should all have taken from the pandemic was that our supply chains have had some inherent weaknesses. Within that, we couldn’t move goods around the supply chain perhaps as agilely as we needed to.”

“Thinking about tactics, maybe such as dual suppliers. So, having the same goods made in more than one factory, in more than one location to hit more shopping locations. That might be you know, something that brands should be looking at.”

“Again, thinking about the whole online piece, so you know, how can you be agile, how can you make sure that consumers can somehow always get hold of your brand, always get hold of your product? You know, these are really big questions that I think the food industry needs to be reflecting on in 2023.”