US-based branded food business Hormel Foods has increased its sales guidance for fiscal 2021 after record third-quarter revenues.

The Austin, Minnesota, business, which owns brands such as Spam canned meat, Jennie-O Turkey Store and Skippy peanut butter, expects annual sales to total US$11.0bn to $11.2bn. Its previous estimate, announced in May with its second-quarter results, was for sales of $10.20bn to $10.80bn.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

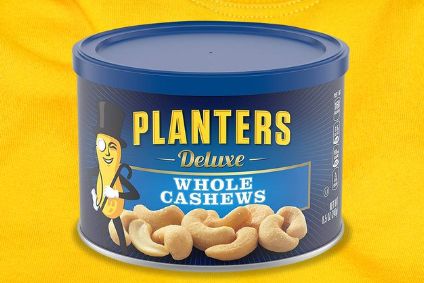

Hormel said the increase in guidance reflects the full impact of the acquisition of the Planters snack-nuts business. It was announced in February that Hormel was to pay just over $3.3bn to acquire the brand from Kraft Heinz.

Announcing its results today (2 September), Hormel revealed sales for the quarter of $2.9bn, up 20% year-on-year and up 25% on the total for the corresponding period in the pre-pandemic year of 2019.

Earnings before income tax were down 5.7%, compared to the Q3 2020 print of $204.2m as a result, the company said, of acquisition costs and inflationary pressures.

The company’s guidance for diluted earnings per share for fiscal year 2021 is $1.65 to $1.69 against the previous estimate of $1.70 to $1.82.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHormel CEO Jim Snee said: “Our team delivered the highest quarterly net sales result in the company’s history, with growth from every segment and all four channels. This record performance demonstrates the power of our brands and our team’s ability to successfully integrate the Planters business, which is quite an accomplishment, given the difficult operating conditions again this quarter.

“Our ability to deliver consistent quarter-after-quarter top-line growth during this very dynamic time along with 25% sales growth over pre-pandemic levels, is directly linked to the tremendous progress we have made in expanding our portfolio to reach consumers when and where they want to eat.”

Snee suggested the company’s investments in retail, deli and e-commerce helped carry Hormel through the initial phases of the pandemic last year as consumers shifted to more at-home eating occasions.

“Today, our leadership positions in foodservice and snacking have fuelled an acceleration in growth as consumers pivot to spending more time in restaurants, travelling, and hosting gatherings with family and friends,” he added.

Snee said the company has seen “significant inflationary pressure” in almost all areas of its business, including raw materials, packaging, freight and labour.

“We have implemented pricing actions across virtually every brand, which has been our main lever to offset these inflationary pressures. In addition, our experienced management team is taking numerous other strategic actions to offset cost increases, including optimising promotional activity, improving product mix and rationalising less efficient products in our portfolio,” he said.