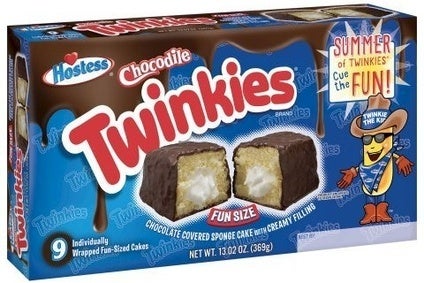

US snack cake maker Hostess Brands LLC has reportedly decided against a sale and is instead looking at an IPO after turning down offers for the business.

According to Reuters, which cited unnamed sources, the Twinkies maker has rejected bids of US$2.4-2.5bn, including debt.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

There has been continued speculation Hostess's private-equity owners, Apollo Global Management and C. Dean Metropoulos, have been looking to sell the business, although the investors have not commented on the rumours since they hit headlines at the end of last year.

However, Reuters reported today (7 July) Hostess will borrow money to pay a dividend to its owners. The company will also start preparations in the coming months for a listing it believes will value the business more than the offers it attracted, the people added.

In May, The New York Post reported US food group Post Holdings, bakery group Flowers Foods, Mexican bakery giant Grupo Bimbo and Switzerland-based bakery company Aryzta were among the suitors that had made non-binding bids for Hostess.

Apollo and Metropoulos bought the snack cake assets of the former Hostess Brands in 2013, months after the company filed for bankruptcy.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataApollo Global Management declined to comment. At the time of writing, Hostess and C. Dean Metropoulos had not returned requests for comment.