Kerry Group today (23 February) reported an increase in volume sales from its consumer foods business in 2015 in “deflationary” conditions in Ireland and the UK.

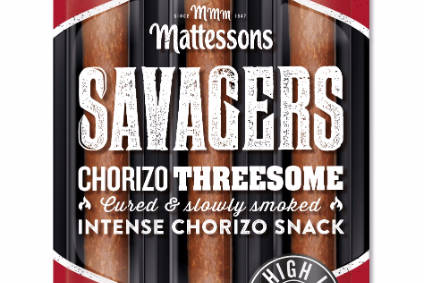

The Mattessons and Cheestrings owner saw volumes from its consumer-facing division rise 3% last year. With net pricing down 1.9%, revenue from the unit fell 2% to EUR1.48bn (US$1.63bn).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Trading margin from consumer foods, the smaller of Kerry’s two operating units, rose by 20 basis points to 8.5% due to efficiency gains, while the company felt a benefit from selling off assets, including the Pinnacle lifestyle bakery business in Australia.

Kerry said its consumer products benefited from a “continued growth in snacking”. It added it had “outperformed” growth rates in its categories online.

However, the company said its brands had put in a “mixed performance” in the UK. Mattessons’ sales grew at a “double-digit” rate, although sales of Richmond sausages were hit by what Kerry called “the changing promotional environment”. The company said the continued investment discount retailers are making in the UK had led to a growing focus across the industry on every day low prices, or EDLP.

Kerry’s UK own-label business saw “strong growth” across chilled, ready-to-cook and frozen ready meals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn Ireland, Kerry said its brands “performed well”, citing growth from Denny Gold Medal sausages, Fire and Smoke cooked meats and Chareville cheese.

Looking ahead, Kerry said the changes it had made to its consumer foods portfolio meant it was “well positioned to capitalise on today’s snacking, convenience and food-to-go trends”.

It added it was “now focused on expanding its footprint into new growth categories and channels, and into selected international markets”.

Speaking to just-food at the Anuga trade show in Cologne in October, Kerry said it was “hopeful” it can add this year to the nine European markets in which it sells cheese brand Cheestrings.

Kerry Group results breakdown (inc. ingredients division)

- Revenues: +6.1% to EUR6.1bn

- Adjusted EBIT (before one-off items): EUR612.1m v EUR569.9m

- Profit after tax: EUR525.4m v 479.9m