After Mondelez International’s double-digit pricing last year, the branded chocolate and biscuits maker has signalled there is still more to come.

Volumes have so far remained relatively resistant as consumers prioritised snacking around favoured brands, despite two to three years of price increases by Mondelez, chairman and CEO Dirk Van de Put said yesterday (30 January).

Pricing supported revenues in the 2023 fiscal year as organic net sales rose 14.7% to a tad over $36bn, representing “record profit dollar growth and a strong total shareholder return”, he said.

In Mondelez’s two-largest markets – North America and Europe – pricing has already been agreed for the new year in the former and the “majority” has been agreed in Europe, the CEO explained during a Q&A session with analysts.

Nevertheless, Van de Put suggested there might be some backlash in Europe to further pricing, as there was in 2023, as he indicated talks with some retailers are still ongoing.

“While the consumer is feeling better and more positive short term, we see that elasticity is still at or below historical norms, but there is some uptick in consumer elasticity in some spots around the world,” he added.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“It is to be expected that we will have customer disruption in the beginning of the year in Europe, [where] the annual negotiations are in progress.”

Underlying volume/mix was a positive 1.3% across the whole of last year, with 13.4 percentage points of pricing.

In the final quarter, volume/mix was a negative 0.4% as pricing rose 10.2 percentage points. Organic net revenue climbed 9.8% to $9.3bn.

In terms of chocolate in Europe, Van de Put said there was a “strong price increase of 12% to 15% in Europe” last year, with a “very limited” zero to 0.5% impact on volumes.

“I would say the elasticity in Europe has been very reasonable. We might maybe expect a little bit of an uptick as prices keep on going up for a third year in a row, particularly in chocolate,” the CEO explained, adding he does not anticipate seeing “huge differences between different brands and no shifting of consumers”.

Sales in Europe grew 14.5% last year and 11.6% in the fourth quarter. In North America, the prints were 9.5% and 1.9%, respectively, with the latter going against an “exceptionally strong compare of almost 20% in 2022”, Van de Put said.

On North America, he said: “Full-year growth was driven by higher pricing, broad-based strength across brands and channels and solid volume/ mix.”

Mondelez not looking to boost margins, CEO says

Van de Put insisted Mondelez was pricing away cost inflation rather than seeking to boost group margins.

The gross margin increased 2.3 percentage points last year on a reported basis to 38.2% and was up 0.3 points in adjusted terms at 37.5%. The operating profit margin rose 4.1 points to 15.3% and 0.1 point adjusted to 15.9%.

“We are trying to offset the dollar impact of the inflation that we’re seeing on our input costs, and we’re not pricing for percentage margin, but offsetting that dollar impact,” the CEO added.

Mondelez guided to net organic revenue growth for the current new year of 3-5%, which unlike yesterday’s reported numbers is based on a non-GAAP measure. Adjusted EPS is seen in the high single-digit area in constant currency.

Finance chief Luca Zaramella gave his take on the outlook.

“We expect to be at the upper end of our 3% to 5% algo range for organic net revenue growth as pricing in certain markets, with significant chocolate portfolios such as Europe, is expected to be higher than historical levels.

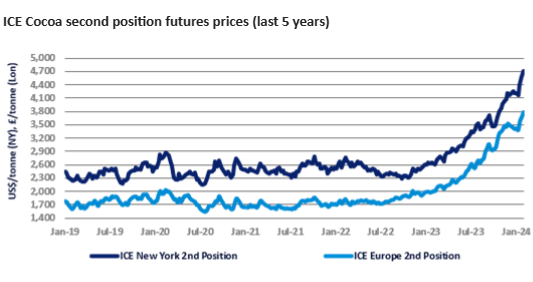

“For inflation, we expect a high single-digit increase for ’24…driven by significant increases in both cocoa and sugar, as well as another update in labour costs.

“As Europe faces more inflation than any other market, we expect customer disruption during Q1 and potentially into Q2, associated with our annual price negotiation process.”

However, Zaramella said the pricing contribution to revenue will be “a little bit less” than last year and will mostly be chocolate-centric due to the cocoa cost.

Volume/mix is likely to repeat last year’s “solid” performance, Van de Put said, although advertising and consumer promotions are unlikely to be in the same region as 2023’s 21% increase, probably around the high-single or double- digits range.

“We continued to navigate through a dynamic operating environment. We are closely tracking and planning around a number of near-term themes, including continuing inflation, shifting consumer habits, geopolitical challenges and rising cocoa prices,” he said.