Nosh Foods, a US-based organic baby-food producer, has been bought by private-equity firm Grays Peak Capital, an investor focused on emerging trends.

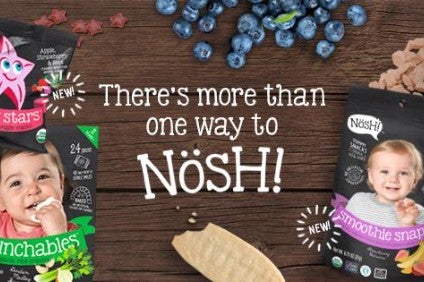

Founded in 2016, Nosh Foods manufacturers baby and toddler foods, including snacks such as Peanut Butter Puffs and Whole Grain with Chickpea Puffs, and is based in Los Angeles, California. Its products are stocked in retailers Target, Kroger, Walmart, Meijer and HEB, although the company is in the process of setting up a direct-to-consumer (D2C) service.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Financial terms behind the transaction were not disclosed.

Jason Becker, the chief executive of Nosh Foods, said: “We expect this transaction to accelerate our expansion of Nosh Foods in North America and our initiatives internationally. Grays Peak will provide resources and expertise to build out a direct-to-consumer and omni-channel digital approach across the multiple brands.”

Grays Peak Capital said its deal for Nosh Foods marks a further expansion into organic foods to add to the Healthy Mama and NurturMe brands.

Launched in 2011, NurturMe produces baby foods and “solutions specifically formulated for ingredient-sensitive consumers”, according to Grays.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe investor’s founder Scott Stevens said: “The Nosh acquisition brings a unique product line and trusted brand with an experienced management team. The merged entity will combine operational resources to innovate in the marketplace and expand the company and product offering.”