PepsiCo has swooped to buy South Africa-based food and drinks manufacturer Pioneer Foods Group with a bid worth around US$1.7bn, the US giant has announced.

The Frito-Lay and Quaker owner said today (19 July) it had struck an agreement to buy Pioneer for ZAR110 a share. PepsiCo said the offer represented a 56% premium to the 30-day volume-weighted average share price before Pioneer’s statement on Monday of talks that could have affected its share price.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In South Africa, Pioneer’s portfolio of food brands includes Weet-Bix cereal, Sasko flour and Safari snacks. The company also has a stable of drinks brands including Ceres and Liqui Fruit juices.

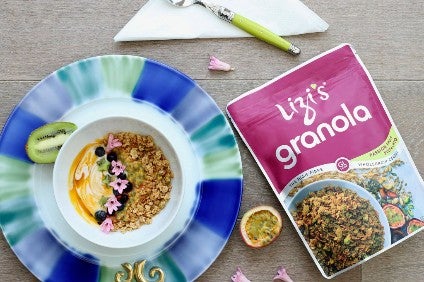

Pioneer mainly operates in South Africa but it has international operations, including in the UK, where its range of products includes granola brand Lizi’s and children’s snack brand Fruit Bowl.

Announcing the deal, PepsiCo said the acquisition would help it “gain a solid beachhead for expansion into sub-Saharan Africa by boosting the company’s manufacturing and go-to-market capabilities, enabling scale and distribution”.

Tertius Carstens, Pioneer’s CEO, described the sale to PepsiCo as “a very exciting milestone” for the company, adding the deal “highlights the strength of what we have created”.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHe added: “As part of PepsiCo, we will have greater scale to expand our leading brands, greater capital to invest in local agriculture and people, greater access to leading global capabilities and a partner committed to taking our company to even greater heights.”

The takeover of Pioneer, which remains subject to shareholder approval, would be the first major acquisition struck by PepsiCo chairman and CEO Ramon Laguarta since he took the helm at the US food and drinks behemoth last year.

He said: “Pioneer Foods represents a differentiated opportunity for PepsiCo and allows us to immediately scale our business in Africa. Pioneer Foods forms an important part of our strategy to not only expand in South Africa, but further into sub-Saharan Africa as well. Our businesses are highly complementary, and we look forward to working with the Pioneer Foods team to successfully build and implement a shared vision in the region.”

In May, Pioneer reported its latest half-year figures, covering a period that ran until the end of March. Revenue was up 12% at ZAR11.04bn (US$798.2m). Excluding M&A, revenue rose 7.9%, with volumes growing 1.3%.

However, the company said “adjusted” operating profit – which took in operating profit “before items of a capital nature” – fell 23% to ZAR729m amid higher raw-material costs and a “material” increase in trade investment to support promotions. Pioneer’s headline earnings slid 14% to ZAR509m.

In Pioneer’s last full financial year, covering the 12 months to 30 September, revenue reached ZAR20.15bn, up from ZAR19.58bn a year earlier. Operating profit was ZAR1.65bn, compared to ZAR1.1bn in the previous 12 months. Profit for the year was ZAR1.07bn, versus ZAR726m the year before.

PepsiCo plans to create a new operating unit within its business for sub-Saharan Africa. The unit will remain part of PepsiCo’s wider Europe Sub-Saharan Africa division from a financial reporting perspective.