Post Holdings has booked higher third-quarter sales, pushing its top line higher over the first nine months of its financial year, in a set of broadly positive quarterly results for the US food group.

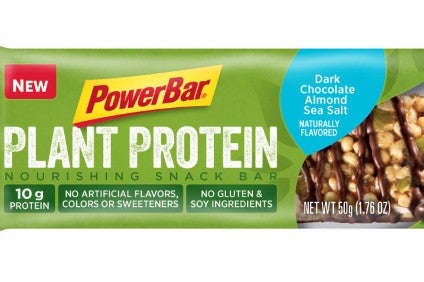

The owner of brands including PowerBar nutrition bars and now Weetabix breakfast cereal booked a 2.1% increase in net sales to US$1.27bn for the quarter to the end of June.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

On a pro-forma basis, which accounted for Post Holdings’ acquisition of US egg supplier National Pasteurized Eggs last summer, the group’s third-quarter net sales were flat.

In May, the Grape-Nuts cereal owner reported a 1.2% fall in second-quarter net sales to $1.26bn. On a pro-forma basis, second-quarter net sales declined 3.3%.

The rise in Post Holdings’ third-quarter net sales came on the back of growth from its Michael Foods egg-to-potatoes arm and its Active Nutrition divisions. The company’s Post Consumer Brands and private-label units saw sales decline.

The growth meant Post Holdings could book a 0.3% rise in its nine-month net sales to $3.78bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPost Holdings’ third-quarter operating profit jumped 34.2% to $190.5m, boosted by lower SG&A expenses and exchange rates. Over the first nine months of the year, Post Holdings’ operating profit was $404.2m, down 7.6%, hit by a provision for a legal settlement.

The business regularly provides a figure for adjusted EBITDA, which rose 5.7% in the third quarter to $13.1m but fell 1.6% over the nine-month period to $702.7m.

Post Holdings made a third-quarter net loss of $62.9m, compared to break-even. A $160.4m loss from the early extinguishment of debt and a further $45.2m charge primarily related to non-cash mark-to-market adjustments on interest rate and cross-currency swaps weighed on Post Holdings’ bottom line.

Over the first nine months of Post Holdings’ financial year, the company run up net earnings of $23.9m, versus $12m last year.

The company completed its acquisition of Weetabix on 3 July.