Reckitt Benckiser has reportedly kicked off plans to sell its remaining businesses in infant formula.

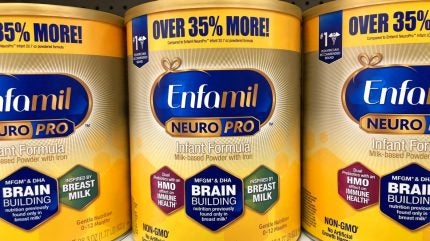

The UK group, home to brands including Dettol bleach and Nurofen painkillers, is working with advisers on moves to sell the assets, which include the Enfamil brand.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

A sale would mark Reckitt’s exit from infant formula five years after buying US manufacturer Mead Johnson. Last year, the company sold its infant-formula operations in China to local investment firm Primavera Capital Group. Reckitt kept an 8% stake in the business.

Bloomberg reported private-equity firms Blackstone, Carlyle and KKR are running the rule over the remaining Reckitt infant-formula assets.

Citing estimates from unnamed sources, the publication said the division could fetch US$7-10bn.

Just Food has approached Reckitt and the three private-equity firms for comment. Carlyle declined to comment.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn 2021, Reckitt’s infant-formula business grew its revenue by 3% on a like-for-like basis. The US accounts for around half the revenue.

Research from GlobalData suggests Reckitt was the third-largest player in the US market, behind Abbott Laboratories and Nestlé, when measuring sales in 2020. GlobalData’s figures gave Reckitt a market share of 25.9%, with Nestlé at 28% and Abbott Laboratories at 28.5%.

Bruno Monteyne, an analyst covering Reckitt at investment bank AllianceBernstein, said the mooted $10bn valuation “seems much too high”.

Based on Monteyne’s estimates of the division’s EBITDA in 2022, that would value the assets at an EV/EBITDA multiple of 21 times, he said.

“It would be well above Reckitt’s 14.8 times 2022 multiple, despite infant nutrition having materially lower growth and profitability. A valuation of $6.8bn seems more reasonable, reducing share price impact,” Monteyne added.