Alongside our daily news coverage, features and interviews, the Just Food team sifts through the week’s most intriguing data sets to bring you a round-up of the week in numbers.

Synlait Milk caught the eye as the New Zealand dairy company won a reprieve with creditors after a missed debt repayment.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

However, Synlait slumped to a hefty first-half loss and effectively put two of its plants on the market among a raft of financial fixes revealed this week.

Another loss-making business, Stryve Foods in the US, emitted confidence in reaching profitability in its 2025 fiscal year under new CEO Christopher Boever.

Although the biltong maker cut low-hanging fruit from its portfolio in 2023, causing a slump in sales, the forecast is for an improvement in 2024.

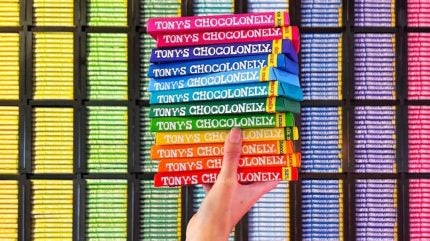

Elsewhere, Tony’s Chocolonely attracted investment interest from former Starbucks boss Howard Schultz as the chocolate maker drums down on the US market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCanada’s Cooke Seafood announced it plans to shut a facility in the US by the end of May. While the company was coy on the reasons for the closure, seafood volumes are under pressure in the US.

Finally, Dutch cheese producer St. Paul struck an M&A deal in the Netherlands.

Synlait finance woes

A bailout was the name of the game with Synlait as it secured NZ$30m ($18m) in short-term funding and won more time to pay NZ$130m in debt.

After suspending trading from the New Zealand Stock Exchange last week due to the missed payment, the dairy company is now weighing up an equity raise and the sale of two facilities in North Island – its infant formula blending and canning plant in Pokeno and the manufacturing site in Auckland.

The “deleveraging” outlined by CEO Grant Watson is geared toward reducing Synlait’s NZ$559m debt bundle, efforts made the more harder by a first-half bottom-line loss and a forecast for a “significantly” lower-than-expected full-year EBITDA result.

China’s Bright Dairy, however, has pledged support for Synlait as its largest shareholder, committing to take part in the equity raise and provide funding if needed.

Watson said: “It has been a challenging half-year for Synlait as we continue to reset the company to better achieve our strategic objectives, while working to significantly reduce our elevated levels of debt.

Stryve Foods narrows losses

The Texas-based biltong snacks business has turned a loss since a Nasdaq listing in 2021 but Stryve Foods suggested it is moving toward profitability.

Net losses almost halved to $19m in the 2023 fiscal year, from $33.1m in the previous 12 months and it was a similar picture for adjusted EBITDA.

CEO Christopher Boever and his finance counterpart Alex Hawkins set out a target this week to reach sales of $24-30m this year and if that threshold is met or exceeded they expect adjusted EBITDA to “breakeven”.

Under Boever’s strategy since he replaced Joe Oblass as CEO in May 2022 he has sought to make manufacturing more efficient, lower costs through changes to the product portfolio and expand distribution.

Sales, for instance, fell 41% in 2023 as a result of the elimination of “low-quality revenue” through an SKU rationalisation programme.

“This year has been pivotal for our long-term strategy, designed to position and prepare us for our next phase, which is delivering profitable growth,” Boever said.

“We have navigated through a transformation that now has our company on a solid foundation, one that has been right-sized with structural improvements across the enterprise.”

Hawkins said the 2024 sales guidance is based on volumes accelerating each quarter as the year progresses, replete with a “significant advancement” in the gross margin from 13.7%.

“The operating leverage derived from increasing volumes each quarter, coupled with advancing gross margins, positions us to approach an adjusted EBITDA breakeven point in the fourth quarter of this year should we reach the higher end or exceed our net sales guidance range, absent any externalities or unforeseen fluctuations in beef prices,” Hawkins added.

Tony's US chocolate endeavours

Tony’s Chocolonely is eyeing US expansion with more investment funds in its pocket as former Starbucks boss Howard Schultz took a minority interest.

The Netherlands-headquartered chocolate producer plans to use the new funds to increase output at its factory in Chicago as the facility approaches its one-year anniversary in June.

Some of the undisclosed capital from Schultz’s investment will be channelled into the Tony's Chocolonely B2B bean-sourcing operation in the US.

CEO Douglas Lamont said: “We are incredibly proud of the strides we've made in the US market…Our expanded retail presence, coupled with strategic investments in production and our exciting new investment partnerships, are all part of our larger ambition to end exploitation in the cocoa industry."

Tony's Chocolonely also plans to increase distribution through its partnership with Walmart. The company’s bars are now being sold in over 4,000 stores of the US retail giant.

Commenting on Schultz’s investment, Lamont added: “We are proud to welcome Howard Schultz as an investor in the company and we are looking forward to drawing on his extensive experience of building a global consumer brand and company.

Cooke Seafood consolidates

Cooke’s US subsidiary, True North Seafood, plans to permanently shut a facility this year in New Bedford, Massachusetts, without specifying a reason.

Production will be switched to another site in the city of Suffolk, Virginia, operated by True North Seafood’s Wanchese Fish Company.

“This decision will optimise the company’s capacity at the modern Wanchese Fish Company processing plant and cold storage facility, which will better serve its customers,” according to a statement announcing the closure, which is planned for May.

Wanchese Fish Company processes scallops, shrimp, oysters, crab and various fish species. The Suffolk plant supplies customers in North America and Europe.

While Cooke or True North Seafood did not provide a reason for the New Bedford closure, GlobalData, Just Food’s parent company, forecasts seafood volumes in the US will decline each year from 2023 through to 2028.

Cooke attained the New Bedford site when, through True North, it acquired Mariner Seafood in 2020. A year ago, Cooke snapped up another US seafood business, Slade Gorton.

St. Paul cheese ambitions

St. Paul struck a deal to acquire Dutch peer Koninklijke ERU as cheese market volumes in the Netherlands are poised to grow.

Last year, the two companies teamed up to buy cheese business Kasi Food from Lekkerkerker Food Group.

In a statement, St. Paul, which will take on Koninklijke ERU’s 200 employees, described the latest deal as “a significant milestone” that helps its “growth ambitions by strengthening its position as a market leader in the melted cheese market”.

The company said it moved for Koninklijke ERU to “produce a powerful alliance that will produce a wide range of melted cheese preparations for the consumer market, out-of-home market. and food industry”.

Dieter Kuijl, the CEO of St. Paul, said: "We are determined to further develop and expand our diverse range of high-quality melted cheese products, meeting the diverse needs of consumers, out-of-home, and the food industry.”

Maurits Sandberg, who heads up Koninklijke ERU, said the transaction would give the business the opportunity “to further grow our brands and explore new markets”.