The latest data from the just-food international basket, published today, covers the third quarter of 2012. The basket is a group of 17 items from tuna to milk that highlights the difference in price between national brands and own label in seven international markets. Amid the worst economic conditions for a generation, shoppers are becoming more promiscuous in their behaviour and the data will prove valuable to brand manufacturers, own-label suppliers and retailers alike.

| CATEGORY | TYPICAL PACK SIZE | PACK TYPE |

|---|---|---|

| Cereals | 500g | Single Medium Box |

| Rice | 500g | Single Packet |

| Canned tuna fish | 185g | Single Can |

| Ambient wet soup | 400g | Single Can |

| Ambient Mayonnaise | 400g | Single Jar |

| Frozen Pizza | 400g | Single Average Size Pizza |

| Frozen Burger | 224g | 4 Pack |

| Yoghurts | 500g | 4 Pack |

| Margarine | 250g | Single Tub |

| Butter | 250g | Single Packet |

| Wet cat food | 400g | Single Can |

| Milk – Ambient | 568ml | One Pint |

| Beer | 440ml | Single Can |

| Fruit juices – Ambient | 1000ml | Single Carton |

| Energy drinks | 250ml | Single Can |

| Tea bags | 500ml | 160ct Packet |

| Colas | 1320ml | 4 cans |

|

In the third quarter, the cost of the just-food basket increased across most of the monitored markets year-on-year, except for the recession-hit southern European markets of Spain and Greece.  Discover B2B Marketing That PerformsCombine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms. |

|

The third quarter saw an indication of downward pressure on own-label prices in the US, which, aside from discounter-driven Germany, was the only market to see the price of a private-label basket fall.

|

|

The gap between the prices of brands and own label has squeezed in five of the eight countries, most noticeably in southern Europe. However it is not universal and countries like Germany, where the low cost discount channel is a major feature, continue to maintain private-label prices that are about half that of brands.

|

|

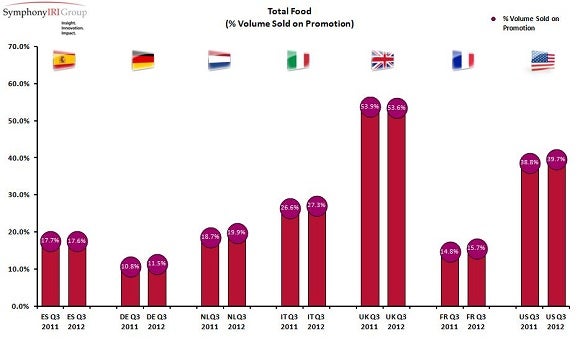

The volume of food sold on promotion increased in all countries in the third quarter, except for Spain and the promo-laden UK.

|