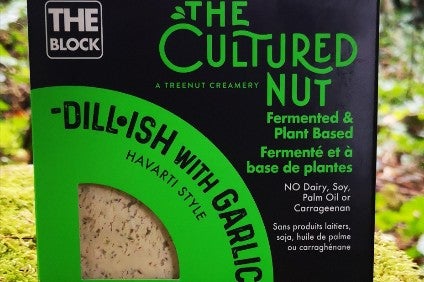

The Very Good Food Co., a Canada-based meat-alternative start-up, plans to expand into the dairy-free category after signing a non-binding letter of intent to acquire The Cultured Nut company.

Founded in 2016 by chief executive Mitchell Scott and James Davidson, its head of R&D, Very Good Food manufactures meat-free burgers, sausages, hot dogs and pepperoni under The Very Good Butchers brand for the retail and foodservice channels from two facilities in Canada. The company is also setting up an operation in the US.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Its deal for Cultured Nut, a dairy-free cheese business based in Victoria, British Columbia, will be subject to regulatory approvals once due diligence and a “definitive agreement” have been completed under an exclusivity period running to 15 February. “However, the company can give no assurance that the acquisition will be completed as proposed or at all”, Very Good Food said in a statement today (11 January).

The transaction price has been set at CAD3m (US$2.3m) and will consist of a mixture of cash payments and common shares. “Key” employees at Cultured Nut will transfer to Very Good Food, which went public last year via an IPO.

Very Good Food’s CEO Scott said: “The proposed acquisition of The Cultured Nut marks Very’s first move into the dairy-alternatives space and is the next natural step towards achieving our near-term objective of being a leader in the plant-based food technology industry. We have been selling their plant-based cheeses in our e-commerce and retail stores since September 2017, and have seen increased demand from consumers and highly positive reviews.

“We feel that by quickly integrating The Cultured Nut into our existing processes and distribution network, these synergies will allow us to scale their operations significantly and create a key, and entirely new revenue stream for our company.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCultured Nut’s products are sold through select stores of Whole Foods Market and online, and include block-style cheeses, cream cheese and plant-based butters that are soy- and gluten-free.