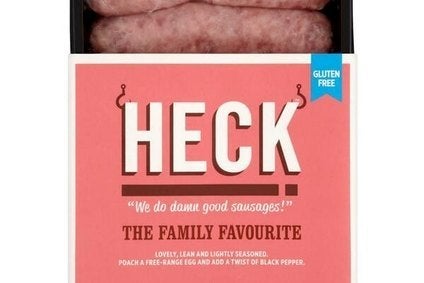

UK sausage maker Heck Foods wants to become the leading producer of upmarket bangers in the country, the private-equity firm that has become a minority investor in the company has said.

Panoramic Growth Equity has invested GBP1m (US$1.6m) in Heck, securing a 25% stake in the business.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Andrew and Debbie Keeble, who set up the Debbie and Andrew’s sausage brand in 1999 before selling it six years later, formed Heck in 2012, winning listings at retailers including Tesco, Asda and Morrisons.

In the year to the end of July, Heck generated sales of GBP3m. It has a target of doubling its revenues in the current financial year.

Stephen Campbell, a partner at Panoramic, told just-food the fund’s investment would help the business with its target of becoming the “leading premium sausage business” in the sector.

“The managment have proved themsleves once before and they have a clear plan to be the leading sausage business in the premium part of the market,” Campbell, who will take a seat on the Heck board, said.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAt its peak the Debbie & Andrew’s sausage business accounted for over a quarter of premium sausage sales in the UK. It was sold to JJ Tranfield in 2005, until that company was acquired by Vion two years later. Last year, Vion, as part of its exit from the UK, sold Debbie & Andrew’s to Ireland-based company ABP Food Group.

Heck’s brands include its namesake sausage and The Harrogate Sausage Company. The Debbie & Andrew’s brand and The Black Farmer, produced under licence by Cranswick, are the two “major” brands in the category, Campbell said.

The investment in Heck is Panoramic’s first in the food sector; the fund’s portfolio includes companies in sectors like renewable energy, technology and media.

Despite Panoramic’s lack of experience in the food industry, Campbell said the investor’s other assets could help Heck in areas including marketing.

“We can bring contacts, people who can help the business with their growth,” Campbell said. “We have two companies in our portfolio, including at a digital advertising company, that can help with brand-building. Both have certain skills that Heck can tap into.”

Campbell will also work with an unnamed food industry executive already assisting Heck to help further grow the business, he said, declining to name the individual.

Mr Keeble insisted Panoramic would “allow us the freedom to run our business our way”. He said: “They vowed never to alter our production facilities and this was really important to us. Panoramic brings a great deal of business experience, connections and financial firepower to the table but we remain in total control of our production process.”

Campbell said Panoramic was on the look-out for more acquisitions in the UK food industry, “particularly where there’s a strong brand involved”.

He revealed the company had held talks with one company but said discussions were at “an early stage”.