Magic Spoon, a US breakfast cereal maker, has attracted US$85m in investment in a Series B funding round.

The New York business said the money, which takes total funding to date to $100m, will be used to accelerate its growth, which involves developing the company from being selling solely directly to consumers to one also supplying bricks-and-mortar retail.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The funding round was led by HighPost Capital, which was joined by fellow investors including Siddhi Capital, Coefficient Capital and Constellation Capital.

Celebrities – including pop star Shakira, rapper Nas, electronic duo The Chainsmokers and American footballer Odell Beckham Jr. – also took part.

Magic Spoon is making its retail debut in Target stores nationwide and will launch in additional retailers throughout this year.

Co-founder Greg Sewitz said: “Our focus on a direct-to-consumer model when we launched was key as we were growing and establishing a presence in a tired category, but we are beyond ready and excited to be able to reach even more consumers across the country through our brick-and-mortar retail launch.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDavid Moross, CEO of HighPost Capital – co-founded by Mark Bezos, younger brother of Amazon founder Jeff Bezos – said: “We are excited to announce our investment in Magic Spoon, which immediately upended the old-school cereal industry when it launched in 2019

“In a short period of time, [co-founder] Gabi [Lewis] & Greg have built a tremendous brand with a fiercely loyal and engaged consumer base through their unwavering commitment to innovation and creativity.”

Magic Spoon is said to have reached one million customers in the three years since it was launched.

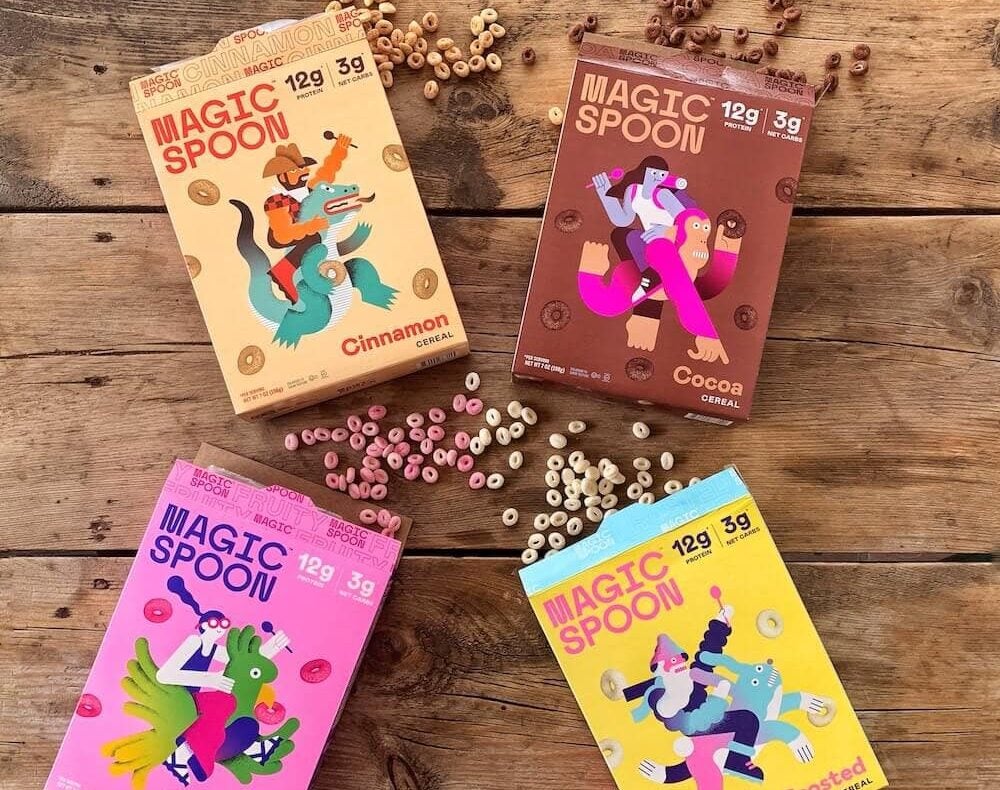

Its cereals – with flavours including Fruity and Peanut Butter – are high in protein, low in carbs, keto-friendly and free of gluten, grains, soy, and artificial ingredients.

Magic Spoon also makes cereal bars, sometimes in limited editions.

Just Food’s Stateside Strategy column: Digitally-native brands must become omnichannel to thrive