Weetabix could be set for a new private-equity investor, with claims Baring Private Equity Asia is to buy 40% of the UK-based cereal group.

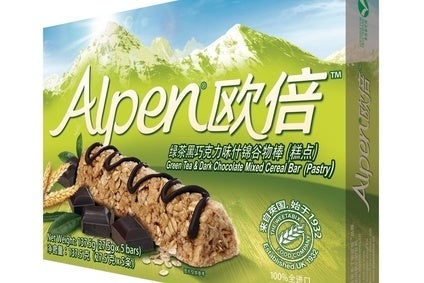

According to Bloomberg, the Hong Kong-based buyout house and Chinese food giant Bright Food are nearing a deal over the Alpen manufacturer.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Bright Food, which owns 60% of Weetabix, is set to buy the other 40% of the business from UK-based private-equity firm Lion Capital. Baring would buy that stake from Bright Food, Bloomberg reported today (20 April), citing an unnamed source.

The make-up of Weetabix's ownership has periodically hit the headlines in recent months. In October, reports in the UK said Bright was set to buy Lion's stake in the company. There has been repeated speculation Bright has also been considering listing Weetabix, as well as other overseas assets, including Australian food group Manassen Foods.

Neither Baring nor Bright Food could be reached out of local office hours.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData