Australia-based Yowie Group is re-evaluating its supply chain in response to the planned US tariffs on imports from Canada and Chinese imports.

The tariffs, effective from 4 February, include a 25% tariff on Canadian imports and a 10% tariff on Chinese shipments to the US.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Yowie sources chocolate and packaging from Canada and imports toys from China for its US production facility.

The company anticipates an additional $0.8m in annual costs from the tariffs if no changes are made to its supply chain.

To mitigate these costs, Yowie said it plans to source chocolate from the US, which will address around 65% of the potential tariff burden.

The company is also conducting a broader supply review to further minimise the impact of the tariffs on its operations.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

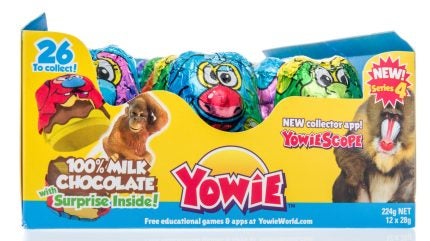

By GlobalDataIts branded products are marketed in Australia and the US, aiming to “promote learning, understanding and engagement with the natural world”.

Yowie relies on external partners for production and distribution.

In May, Keybridge Capital acquired loss-making Yowie, and Nicholas Bolton was appointed as CEO.

At the time, Bolton said: “Following Keybridge’s successful takeover, my initial focus as CEO is to aggressively rationalise the costs structure of the business, whilst promoting innovative products at sustainable margins.”

For the financial year ending 30 June 2024, Yowie reported a loss of $2.64m, compared to a loss of $0.1m the previous year.

The losses were linked to seasonal sales fluctuations in Australia and operational setbacks at the Ernest Hillier facility, which Yowie acquired in 2023.