There is optimism that the global economic and financial conditions of high inflation and rising food and energy prices, which have impacted consumer confidence and post-pandemic spending, will improve in 2024. However, as dairy prices are still rising, consumers will still be on the hunt for value as they visit the dairy aisle.

It is, though, important to remember that there are opportunities for dairy brands away from price, with health and convenience still playing a role in purchasing decisions.

Shoppers are responding to the increasing prices of dairy products in different ways. Some opt to continue buying dairy products but are switching to cheaper options or private-label products. Others are reducing their spending in other grocery categories to offset the greater amount they are spending on dairy.

Overall, there are three trends set to shape the dairy market in 2024. Foremost among those is affordability but shoppers are also looking for products that offer nutritional benefits, while convenience will also be a factor in buying decisions.

While shoppers will always look for product quality, the pressure on consumer spending has put more emphasis on affordability. The cost inflation faced by dairy processors in recent quarters has led to companies pushing through price increases, which has weighed on demand and manufacturers’ sales volumes.

For example, Lurpak and Castello owner Arla Foods generated revenues of €13.7bn ($14.99bn) in 2023, roughly the same level as its 2022 figure of €13.8bn. Sales were flat in the first half of the year as cash-strapped consumers opted for discounted products.

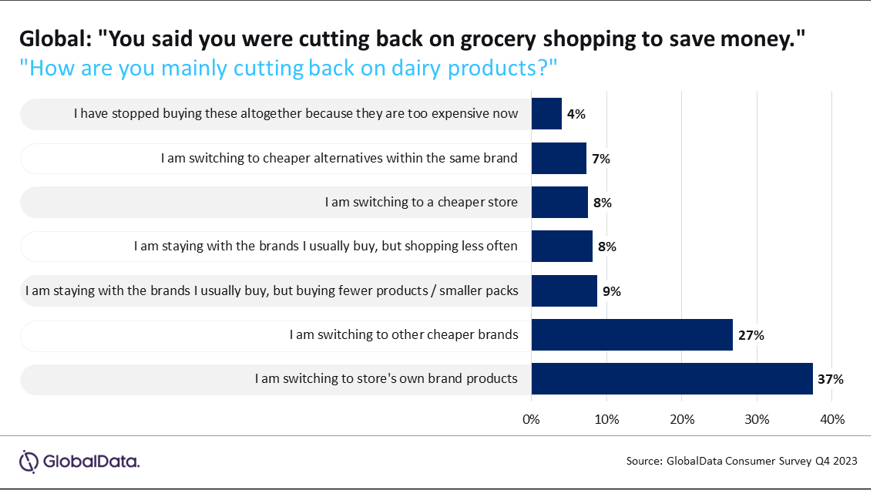

According to a consumer survey GlobalData, Just Food’s parent, conducted in the fourth quarter of 2023, almost two-thirds of consumers (64%) were switching to “own brand products” or “other cheaper brands”, a significant chunk of consumers that underlines the challenge faced by branded dairy businesses.

The survey showed there was some residual brand loyalty among some shoppers but, even among this smaller cohort of consumers, changes in shopper behaviour were clear. Seven per cent said they were looking for “cheaper alternatives” sold under the same brand. Meanwhile, 8% said they were staying with the same brand but shopping less often, with 9% responding that they are sticking to their usual brands “but buying fewer products or smaller packs”.

Private labels have become significant competitors to big brands as they can deliver greater affordability at – in the eyes of price-conscious consumers – a similar level of quality. Moreover, amid the debates over “greedflation” in the mainstream media, a switch to own-label alternatives or cheaper brands is likely among consumers who question a brand’s justification for higher prices.

Nonetheless, in a positive sign for brands, when Arla announced its 2023 results last month, the company said consumers were returning to its brands. Arla reported “strategic branded volume-driven revenue” fell 6% in the first half but grew 4.1%. in the second six months of the year.

Away from price, there are signs of other factors shaping dairy consumption. The growing concerns over lifestyle-related health issues such as obesity, diabetes, and chronic heart disease are encouraging changes in buying behaviour across food.

In dairy, this trend has played out with the demand for products offering specialised and science-led health solutions or those highlighting specific health benefits to the consumer. Within the category, products offering probiotics or benefits to gut health have stood out in recent quarters.

Convenience also features in purchasing decisions and younger consumers have a greater preference for small dairy portion sizes. In 2024, demand for snack-sized dairy products that offer greater nutritional value will increase.

The general “snackification” trend seen throughout the food industry has impacted the dairy sector as consumers seek convenient and portable options to satiate their appetites. Consequently, companies have diversified from conventional snacks and offered healthier alternatives like yogurt cups, cheese snacks, nutritious milkshakes, and protein-rich snacks to meet increasing demand.

In 2023, younger consumers, particularly Gen Z, were more inclined than other cohorts to opt for small packs and bottles when buying dairy. Furthermore, the typically tighter budgets of younger consumers may deter them from committing to higher-priced large packs. There are opportunities for dairy brands to target younger consumers with snacking products that deliver greater health and wellness benefits.

With Gen Z contributing 27% of the global workforce by 2025, their spending power will become increasingly important for dairy brands, as will the need for companies to increase their supply chain transparency as regulatory probes into pricing and upcoming laws on mandatory sustainability reporting come into effect.