The momentum enjoyed by Mondelez International in recent years is showing little signs of slowing.

Mondelez seems to have found a sweet spot with ongoing top- and bottom-line growth, a performance again demonstrated by the US giant’s 2023 financial results, published last week.

Bears might point to the 0.4% decline in “volume/mix” the Cadbury and Oreo maker booked for the fourth quarter of 2023, especially given the seasonal importance of the final three months of the year.

However, overall, 2023 was another year of growth for that closely-watched metric, with Mondelez’s efforts to up prices not, in the main, appearing to hit underlying sales.

In the last couple of years, food manufacturers have seen their sales revenues supported by price increases to offset cost inflation but not all of Mondelez’s peers have had the same success in growing underlying sales.

The household name nature of some of Mondelez’s key brands, plus the relative insulation categories like chocolate enjoy from private label (the growth in volume/mix for chocolate was almost double that for the whole company), have benefited the company, which told investors on Tuesday that elasticities still remain “at or below historical norms”.

Speaking to analysts, Mondelez chairman and CEO Dirk Van de Put said the Lu biscuits maker expects the “solid” volume/mix the company saw in 2023 to “continue into next year”.

Van de Put pointed to the group’s “runway of adding distribution around the world”, a facet of the company’s strategy that some on Wall Street believe could support sales even if there is pressure on demand in more developed markets.

“Mondelez opened 600,000 new stores in 2023 yet still only covers 33-50% of addressable outlets in China and India,” Mizuho Securities’ John Baumgartner wrote in a note to clients. “New distribution can sustain market share gains that temper downside risks to sales from any macro softening.”

Mondelez also plans to up its spending behind its brands in 2024, a wise move to support demand for products now selling at higher prices. CFO Luca Zaramella said the company had prepared “unprecedented” investment in advertising for the first half of the year.

That said, Mondelez’s management is monitoring any signs elasticities could start to be affected by price hikes. “While the consumer is feeling better and more positive, short term we see that elasticity is still at or below historical norms but there is some uptick in consumer elasticity in some spots around the world,” Van De Put said.

Nevertheless, he sought to underline why Mondelez sees that fourth-quarter year-on-year dip in volume/mix as temporary and not a sign of underlying pressure on demand.

A drag on volumes in the final three months of 2023 was the impact the conflicts in the Middle East had on demand.

“There are some tensions in the Middle East and that has some effect on Western brands and we have some of those Western brands. We expect that to continue in Q1 and Q2 but gradually, over the year, that will fade away,” Van de Put said.

Mondelez is forecasting a 3-5% rise in its net revenue in 2024 on an organic basis, guidance on which it did face questions when speaking to analysts last week. Some on Wall Street thought the forecast a little conservative.

Zaramella conceded Mondelez “wanted to be a little bit on the cautious side” as there is the potential for “customer disruption in Europe” where the company is in the middle of negotiating prices with retailers. It has, however, secured more than half of its pricing requests. “The reality is, if we push this through and we are successful, most likely there will be revenue upside,” Zaramella added.

Cocoa costs exerting pressure

The group’s 2024 revenue growth will again be principally driven by price increases. Zaramella said Mondelez expects “volume to be mildly positive” this year.

However, overall, price increases will contribute less to Mondelez’s forecast revenue growth in 2024 than last year, although at a higher rate than “an average year”, Zaramella added. A central reason for Mondelez’s continued efforts to up prices is, the company’s management explained, the ongoing pressure on cocoa prices.

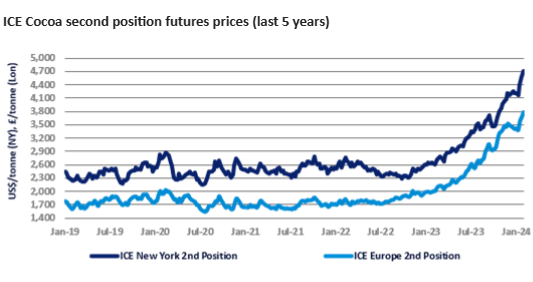

According to agribusiness analysts at GlobalData, Just Food’s parent, over the 12 months to the end of January, cocoa bean prices increased by 79% and 88%, respectively, in the New York and London cocoa bean futures markets. In the period since July 2022, the respective price increases were 97% and 112%. Before then, prices had remained relatively flat over the preceding three and a half years.

And Mondelez was at pains to point out that cocoa is not the only input pressure it is facing.

“For inflation, we expect a high single-digit increase for ‘24. This inflation is driven by significant increases in both cocoa and sugar, as well as another uptick in labour costs,” Zaramella said.

Pressed on Mondelez’s moves to increase prices in Europe particularly, Van De Put said the company had to explain the pressure it was seeing on certain inputs, which, he emphasised, is not just on cocoa.

“Seeing the situation in Europe and the fact that the retailers are seeing probably some deflation in other areas of their business, it is a little bit of an explanation to explain that not only cocoa but also sugar or hazelnut are showing significant inflation, which is not the expectation,” Van De Put said. “I think by now they understand that it has to happen in chocolate, so we have high hopes that we will be able to land that in a good way.”

Morningstar analyst Erin Lash suggests investors will be closely watching how consumers react to another round of price increases but she believes Mondelez’s efforts in areas like innovation will support sales.

“The firm has signalled that additional price hikes are slated to hit shelves at home and abroad over the next several months. This plan runs counter to other consumer product categories, where costs have moderated. Against this backdrop, much apprehension remains as to whether cash-constrained consumers will continue to hunger for Mondelez’s snacking and confectionery mix. However, we suspect its focus on innovation aligned with evolving consumer trends should blunt any lasting demise in demand,” she said in a note to clients.

The company, meanwhile, has had a couple of issues in its North American business, notably the impact of an IT systems change at its Clif Bar business and its decision to stop selling certain lower-margin Give & Go SKUs.

“Overall, despite some near-term snags, Mondelez is still delivering the goods,” AllianceBernstein’s Alexia Howard said last week.

“Headwinds like the Clif bar IT transition and Give and Go gingerbread exit, plus the expected repeat of sales disruptions in Europe due to retailer price negotiations (in Q1 this year versus Q2 last year) are minor headaches but not expected to knock the company off its long-term [growth] algorithm, which could once again prove to be conservative as the year unfolds.”