Tate & Lyle’s launch of its Tasteva Sol sweetener has stevia at its heart, as the ingredients giant seeks to tap into demand for natural options to sugar.

While the issue of sugar reduction has been a hot topic among product developers across food and beverage categories for a number of years, the recent controversy over aspartame may cause NPD teams to look again at how they are using sweeteners in the recipes.

There are a number of different sweeteners at the disposal of food and beverage manufacturers but the tide of clean-label trends washing over the industry may hit the use of artificial ingredients.

Potentially, this presents an opportunity for companies offering naturally occurring sweeteners such as honey, agave and stevia, as well as less familiar ingredients like monk fruit and yacón syrup.

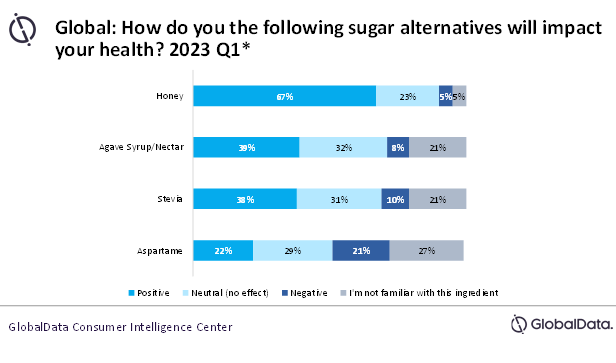

A recent consumer survey conducted by GlobalData, Just Drinks’ parent, shows the majority of consumers see natural sweeteners as harmless to, or even good for, their physical health.

It is interesting to note that, even before the World Health Organization’s recent studies were unveiled, consumers were much more divided over the impact of aspartame earlier this year, reflecting general mistrust of artificial ingredients.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor stevia’s part, most consumers looked at the ingredient favourably, although some consumer education may still be needed. More than one in five said they were unfamiliar with the ingredient.

With the right marketing, stevia has the potential to gain the same popularity as honey, which, of course, is more widely known. Although honey has a high sugar and calorie content, an overwhelming 67% of consumers believe it has a positive impact on health, as in moderation it has been linked to benefits such as improved cardiovascular health and immunity. This demonstrates the nuanced attitudes that consumers have towards sugar reduction, as many of the concerns are around refined and artificial sugars specifically.

Natural sweeteners are resonating with consumers but launching sweet product replacements with these ingredients poses its own set of challenges.

The most obvious of these is the taste of products can be significantly altered when compared to using traditional sugar.

The Coca-Cola Co.’s launch of the mid-calorie Coca-Cola Life in 2013 shied away from a completely stevia-based flavour and was mixed with sugar.

Still containing 55% of the sugar content of Coca-Cola classic/original, Coca-Cola Life was rolled out internationally but, ultimately, failed to compete with the zero-calorie and sugar variants Coke Zero and Diet Coke.

A second issue is stevia often lacks solubility, proving problematic for manufacturers and for end-consumers adding the sweetener to food and beverages at home.

Nevertheless, Tate & Lyle claims its Tasteva Sol is more than 200 times as soluble as other stevia sweeteners while offering a “premium taste”. But remember: taste has been an issue for stevia sweeteners in the past.

Ingredient suppliers, facing demand from customers for support in lower sugar and interest among consumers for ‘clean label’ products, have opportunities to exploit but, undoubtedly, time will tell whether new ingredients like Tate & Lyle’s Tasteva Sol succeed.