Market reaction to JBS’ sale of Northern Ireland-headquartered food group Moy Park to the US’ Pilgrim’s Pride for US$1.3bn has centred squarely on the Brazilian meat giant’s need to pay down debts, Andy Coyne writes.

JBS, one of the world’s largest meat processors, has had a tumultuous 2017, with its controlling shareholder embroiled in corruption scandals – and the company, meanwhile, looking to offload assets to beef up its balance sheet.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Having sold off businesses in Brazil and in Canada this summer, on Monday JBS announced the disposal of its UK-based European unit Moy Park.

The deal means JBS has offloaded the Northern Ireland-headquartered poultry business only two years after acquiring it for US$1.5bn.

However, what also raised eyebrows is the identity of Moy Park’s new owner. The sale to US chicken giant Pilgrim’s Pride sees a JBS asset move to a JBS majority-owned asset. JBS is the largest shareholder in the listed Pilgrim’s Pride, with a 78.5% stake.

Analysts are suggesting the decision has little to do with Moy Park’s performance or, indeed, strategic thinking, above and beyond the necessity for JBS to pay down its debts.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAnnouncing the fine on 5 June, JBS insisted the amount would be “payable solely by J&F preserving minority shareholders and JBS from any financial impact from the agreement, thus assuring the company’s normal course of business, protecting jobs while offering quality products and services”.

Two weeks later, JBS itself announced a “divestment programme”, including its decision to offload Moy Park, to “reduce the company’s net debt and, consequently, its financial leverage, strengthening JBS’ financial structure”.

Announcing the deal with Pilgrim’s on Monday, JBS said: “JBS will use the proceeds from the transaction to reduce short-term debt in Brazil, improving its debt profile and liquidity.”

Pedro Leduc, an analyst at JP Morgan who specialises in the Brazilian market, said: “Ultimately, this deal just internally transfers liquidity from its US vehicle [Pilgrim’s Pride] to JBS S.A..

“It will likely please JBS S.A. creditors as 80% of proceeds will be used to pay down JBS S.A. creditors, as per its recently announced agreement, but won’t have any reduction on absolute consolidated debt for JBSS3, which already consolidated 100% of Pilgrim’s Pride’s balance sheet.

“Leverage will just tilt more towards longer-term US business lines and be less in short-term BRL [Brazil] lines, which should reduce interest expenses and improve short-term liquidity.”

Leduc suggested, though, shareholders might have chosen a different buyer.

“They might have preferred a sale to a third party, which would have brought new cash,” he said.

Andrew Webb of Webb Advisory in the UK is of the opinion that the Moy Park sale was a logical move on JBS’ part.

Quoted in the Belfast Telegraph newspaper, he said: “Moy Park’s parent company needs to reduce its debt pile and selling Moy Park will go some way in doing that. It seems like a logical decision.”

From a Pilgrim’s perspective, the deal is all about global expansion, with the company able to tap into Moy Park’s reputation for innovation as an added bonus.

CEO Bill Lovette said he is expecting a seamless transaction and the Moy Park leadership team, under chief executive Janet McCollum, will stay in place and its headquarters will remain in Northern Ireland, suggesting it will be run as an autonomous unit under the Pilgrim’s umbrella.

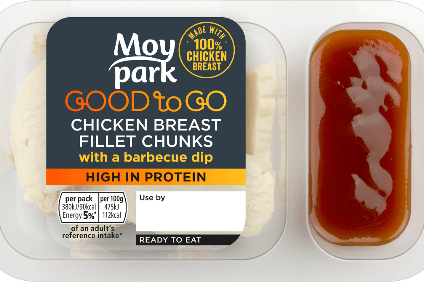

Referring to Moy Park’s strength in Europe, with 13 plants across the UK, Ireland and Continental Europe and 5.7m chickens processed a week, Lovette said: “There are 300m new consumers available to Pilgrim’s. It gives us a huge consumer base we had no access to before. Moy Park is also very innovative. Trends are moving from Europe to the US. Chicken is popular and growing in the UK and Europe. We can capture insight from consumer trends.”

Lovette also indicated the cost benefit he saw from the deal. “There are incredible synergy opportunities having Moy Park part of Pilgrim’s. At Pilgrim’s we have a great track record in capturing synergies.”

Analysts also seem positive about the deal. Chicago-based Zacks Equity Research said: “The Moy Park acquisition will not only broaden Pilgrim’s Pride’s operations across new end markets in the UK and mainland Europe but will also open up a number of business opportunities in the prepared foods and poultry production platform.

“Furthermore, Pilgrim’s Pride anticipates the Moy Park buyout to bolster its annual revenues by nearly US$2bn. It also believes the deal will generate roughly US$50m yearly synergies over the next two years. Notably, these positives are likely to boost the company’s earnings per share in the quarters ahead.”

Moy Park also sees benefits from the deal.

Chief executive McCollum said: “We see great opportunities for Moy Park as part of this successful business. Joining Pilgrim’s Pride gives us the opportunity to accelerate our growth plans, share best practice and leverage Pilgrim’s expertise and operational excellence.”

One area in which it could benefit from Pilgrim’s expertise is in organic chicken production. Pilgrim’s has seen elevated sales of organic and antibiotic-free chicken products in recent times whereas McCollum admits Moy Park’s organic sales are “not significant”.

If there is a dark cloud on the horizon it is Brexit – Britain’s departure from the EU. With its base in Northern Ireland and operations and suppliers in the Republic of Ireland, Moy Park will be caught in the middle when big decisions made on cross-border trade.

Stephen Kelly, chief executive of Manufacturing NI, quoted in The Belfast Telegraph newspaper, said: “A badly delivered Brexit could have a big impact on Moy Park’s supply chain, market access and, particularly, labour availability.

“So we hope this new relationship with Pilgrim’s will help to local management team navigate these challenges and see the business continue to flourish.”