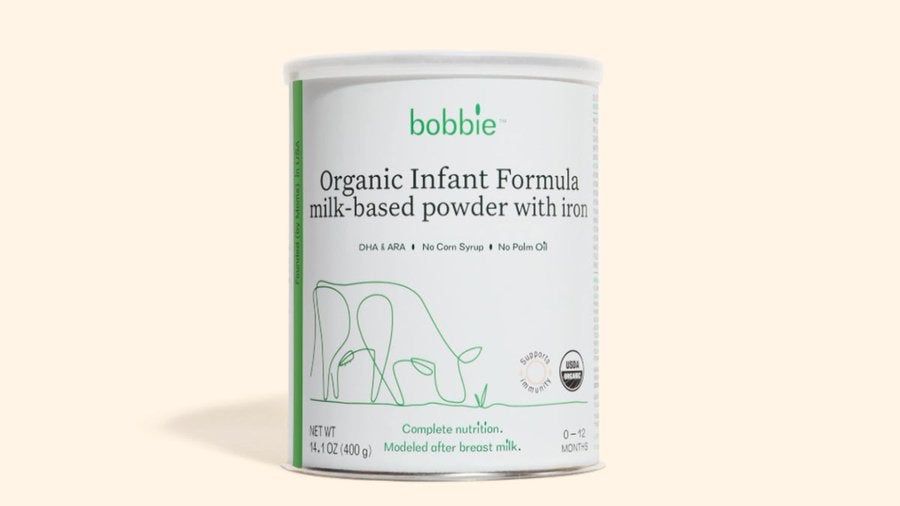

Championed as the “only women-founded and mom-led infant-formula company in the US”, San Francisco challenger brand Bobbie was shaken soon after its launch in 2018 by a Food and Drug Administration (FDA) crackdown and recall. But it has recovered to attract $72m in investment for its organic, “European-style” products in oversubscribed funding rounds and it has mothers across the country, concerned by last year’s annus horribilis which saw the category face facility closures, health scares and empty supermarket shelves, queuing up to join its subscription service.

Supported by a 20-person, women-led “motherboard” and a medical affairs team made up of doctors, lactation consultants, paediatricians and other professionals, the company is promoting its better-for-you credentials to attract parents and is about to launch a new product, Gentle, into the market.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Just Food: You raised another $50m in a Series B funding round around a year ago. Why are investors so keen to give Bobbie infant formula their backing?

Laura Modi: There is a large desire for investment in other product options. The shortage last year [created by the closure of major player Abbott Laboratories’ Michigan facility following a health scare] highlighted there were very few options.

JF: Last year’s problems brought home how a few companies dominated the US infant-formula market and how a problem with one of them could quickly cause food security issues, did it not?

LM: Yes. ‘Formulagate’ revealed that the market was concentrated in so few hands. When a duopoly owns 90% of the market it leads to a crisis at some point. Even before the recall it was going to happen because of the make-up of the industry.

JF: Ironically, the resulting product shortage led to the need for emergency action to be taken to bring in urgent supplies of infant formula from abroad when manufacturing Bobbie in Germany was one of the issues that led to the FDA insisting on a recall of your products back in 2019.

LM: It was very challenging to watch. We got slapped on the wrist for manufacturing abroad and now here they were opening the borders to foreign companies. But I’m in the full belief that the more new options we have the better.

JF: Your desire to manufacture European-style products comes from your own experience when you were no longer able to breastfeed your child, doesn’t it?

LM: Yes, that was the genesis of the company. I didn’t even question how I would feed my child and certainly didn’t think I would be feeding them a product I would not feed myself. I remember reading the ingredients [on the infant-formula pack] and corn syrup was the first ingredient. I was taken by how undisrupted the industry had been, probably the last CPG industry not to be disrupted.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataJF: And yet you had no experience in the sector, having executive positions at Google and Airbnb after moving to the US from Ireland.

LM: We had zero background in the world of food but sometimes an ounce of naivete is the greatest secret to success. I was self-funded for the first ten months and after that I needed to raise outside capital. I raised the first $2.5m in late 2018 when we had that proof of concept and pilot product. I partnered with scientists and medical professionals before realising I needed a colleague from Airbnb [co-founder and COO Sarah Hardy]. Then we found a manufacturer in Germany, a veteran infant-formula maker.

JF: And obviously that fell foul of the FDA. How do you view the experience now of the regulator turning up at your warehouse, telling you your pilot product did not meet US specifications and ordering a recall?

LM: I refer to it as the identity crisis but we say that from that moment, the FDA setback, it accelerated the business forward. We got close to the FDA so that they could see what we were trying to do.

JF: Why is Bobbie convinced the European infant-formula model was the right one to follow?

LM: With Europe and the US, the difference is in nutritional standards. The EC {European Commission] has done a good job of updating regulations on requirements for infant formula every four years or so. The last time this happened in the US was in the early ‘80s. As a mother, I wanted the same quality formula available in Europe for US parents.

JF: From that FDA-led recall until you got the green light from the regulator for your products was only 14 months, not least because you had found a local organic infant-formula manufacturer in the shape of Perrigo Nutritionals, based in Vermont. What followed next?

LM: We got the green light from the FDA at the end of 2020 and launched our formula product through the D2C [direct-to-consumer] channel in 2021, through our website. Our product resonated from an ingredients and recipe standpoint. We did ten months’ worth of inventory in the first two weeks after launch. It was all word of mouth.

JF: I gather you surpassed $1m of sales in your first quarter. And then the Abbott closure and product shortages hit in early 2022. What impact did that have on your business?

LM: From February 25th last year we were depleting inventory faster than we could make it. Our customer count doubled online in the first few weeks after the recall. We had to call a halt [on new business] so we could satisfy our customers. We had to prioritise that Bobbie customer base. We were the only formula company which could reliably serve its customer base.

JF: And what is the situation now?

LM: The industry has started to normalise but what is clear is the demand for safe, high-quality infant formula has never been higher. People are willing to turn to a new company.

JF: Why are you so attracted to the D2C channel?

LM: With D2C, it’s sometimes a struggle to make it a good fit for some products but formula is the most predictable and repetitive product you can find. I’m bullish we can get the product to people on time and so D2C is still 90% of our business and will remain so, although retail is another fluid option that exists.

JF: You have described the US infant-formula category as “stagnant” and in need of a re-set. Have the lessons from ‘Formulagate’, to use your term, been learned do you think?

LM: Consumer demand had evolved but the regulation hadn’t. I think everyone has approached doing their jobs with the utmost intentions but they haven’t caught up with how to fix it. What does it mean and how do we address it? We are living a little bit in the past. The same companies as 40 years ago are heading the industry today. We leaned into education. It was clear to us the difference between education and marketing and the difference between European and US formula. Our job is to be an educator and a thought leader first. Some 40% of the market now is in the tolerance area. That’s the fastest-growing segment of the market. The desire is there for a more sensitive formula.

JF: Are retailers partly to blame? Do they do enough to encourage new entrants?

LM: We launched into [US grocery chain] Target at the height of the shortage. They were saying they wanted to bring in more options from different companies. They welcomed us with open arms and shone a light on our products. The challenge retailers have is deciphering which product is better or worse than the next one.

JF: As mentioned, you have attracted a lot of investment backing from the likes of Park West, VMG, NextView and the Airbnb alumni syndicate, AirAngels. Where will the money be spent?

LM: One thing is that we launched Bobbie Labs a year ago to incubate a small team who could work on innovation.

JF: Might that innovation take you into other product areas?

LM: The Bobbie blend can be used in auxiliary products, such as the supplement category – pre-natal and postpartum care.

JF: What about baby food?

LM: I wouldn’t want to put myself in a corner but infant formula requires rigour and is very different to baby food operationally and in customer mindsets. To do something hard you need to do it really well and we don’t want distractions.

JF: I would imagine some of these large infant-formula companies, wounded by the events of last year and conscious of the desire for better-for-you products which they may not currently manufacture, will be eyeing Bobbie up. How would you respond to an offer from them, whether it be an acquisition or partnership?

LM: The endgame is to have a major impact for any parents who need access to what Bobbie has to offer. If doing that means partnering with someone else then great. But I’m hoping to remain independent.