AppHarvest, a US-based controlled environment farming business, is raising US$40m through a share offer.

Operating four indoor farms out of Kentucky cultivating tomatoes, strawberries, cucumbers and leafy greens under glass, AppHarvest said it will use the funds for “working capital and general corporate purposes”.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The company, founded in 2017 by CEO Jonathan Webb, is selling 40 million of common shares via a public offering priced at $1.00 each, according to a statement provided to Just Food.

Underwriters have been granted an option to purchase an additional six million shares at the same price. A registration document was filed with the US Securities and Exchange Commission last August and the sale of shares is expected to be completed this week.

AppHarvest went public in 2021 via a merger with Nasdaq-listed special purpose acquisition company (SPAC) Novus Capital.

Just Food is confirming with AppHarvest what proportion of the business management owns and its funding to date. It secured $91m in 2021 from Equilibrium Capital, an investor centred on sustainable agriculture headquartered in San Francisco, via so-called loan-to-value financing.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe same year, the company secured a $75m credit facility from Rabo AgriFinance, a subsidiary of Dutch investment bank Rabobank.

Controlled environment farming, including vertical farming, is still a relatively nascent but capital-intensive industry, requiring increased scale and investment for companies to become profitable.

In the year to 31 December 2021, AppHarvest delivered a net loss of $166.2m, wider than a $17.5m loss a year earlier.

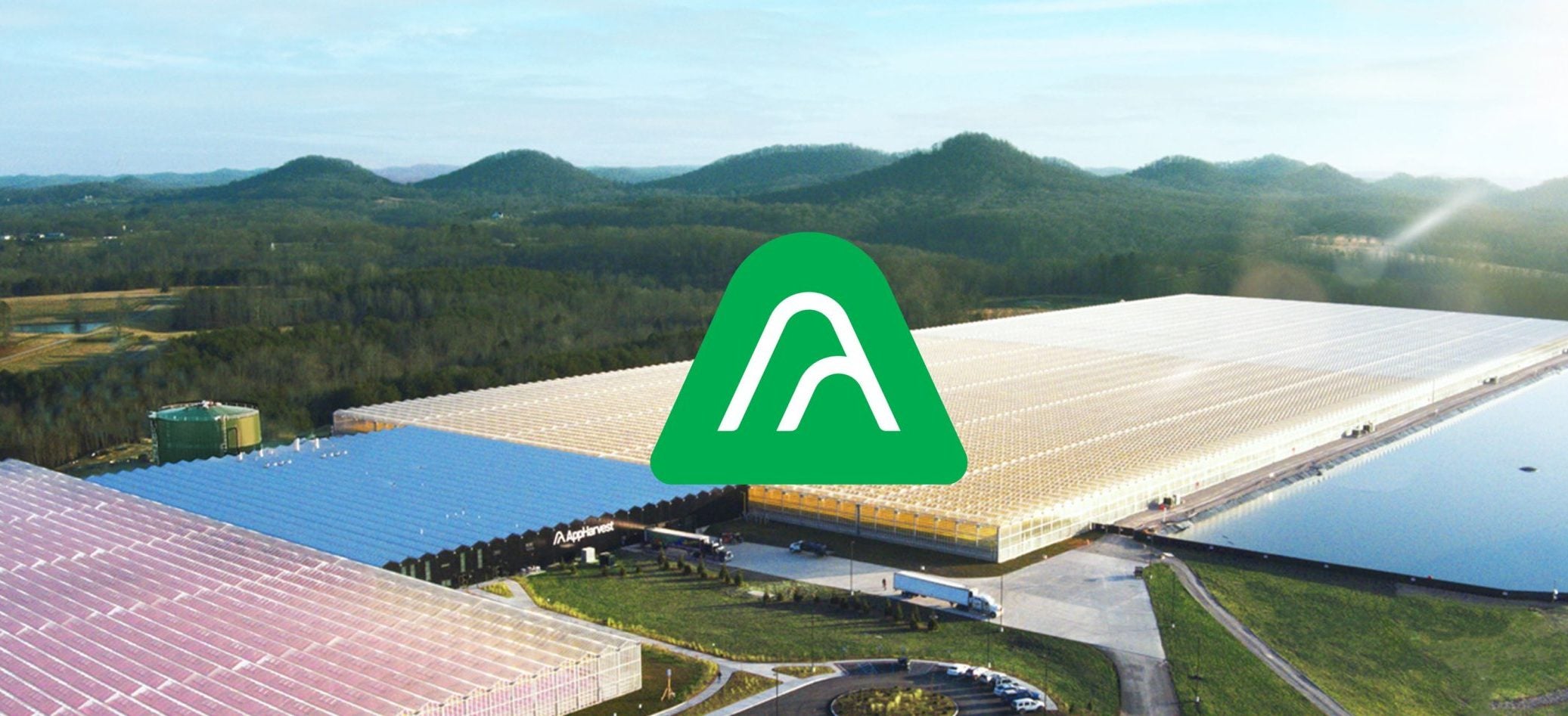

AppHarvest’s farms are located around the Appalachia mountain range. It started with a high-tech farm in Morehead, Kentucky, growing tomatoes in a controlled indoor environment. Berea was added in Kentucky growing salad greens, along with a strawberries and cucumber facility in Somerset and an indoor farm for tomatoes in Richmond, all within the same state.

Its farms use “robotics and artificial intelligence to build a reliable, climate-resilient food system”. They are “designed to grow produce using sunshine, rainwater and up to 90% less water than open-field growing, all while producing yields up to 30 times that of traditional agriculture and preventing pollution from agricultural runoff”, according to AppHarvest.

Representative of the challenges faced by such firms, Germany’s Infarm announced a restructuring exercise involving its facilities last November citing “escalating energy prices” and “challenging market conditions”, replete with the loss of hundreds of jobs.

AppHarvest’s bottom-line loss in 2021 was based on sales of $9.1m. The business posted an adjusted EBITDA loss of $69.9m, versus a $17.1m loss a year earlier. Operating profits were also in the red at $200m, compared to a $16.4m loss.

From the Just Food archive: Indoor farming and the prospects for profitability