AppHarvest has become the latest casualty in the US indoor-farming sector to seek court protection under Chapter 11 bankruptcy proceedings.

The Kentucky-headquartered business, founded by Jonathan Webb in 2017, joins New Jersey-based peer AeroFarms, which entered the same process in June, citing “capital market headwinds”.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

AppHarvest, which posted a net loss of $176.6m in the year to 31 December, compared to a loss of $166.2m in the prior 12 months, said it is “pursuing a financial and operational transition to enable the company to reduce its outstanding liabilities”.

In pursuit of that transition, AppHarvest “filed voluntary petitions for protection under Chapter 11” in the US Bankruptcy Court for the Southern District of Texas, the company said in a statement today (24 July).

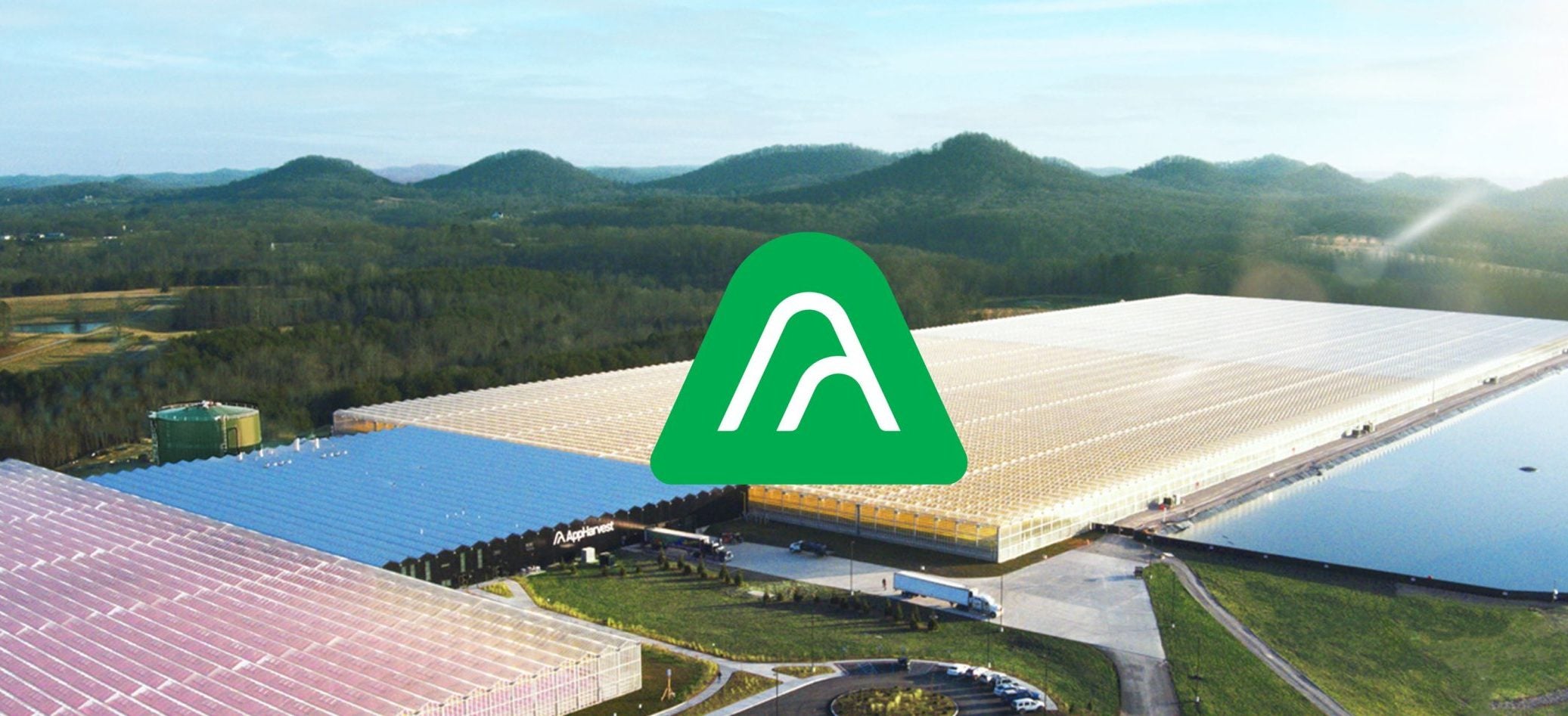

AppHarvest operates four farms around the Appalachia mountain range in Kentucky, growing tomatoes, strawberries, cucumbers and leafy greens in a controlled indoor environment under glass. They are located at Morehead, Berea, Somerset and Richmond.

However, AppHarvest said today it plans to sell the Berea facility to its distribution partner Mastronardi Produce for around $3.75m, along with “additional incremental funding and support for the company’s restructuring plan”.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThat plan is subject to court clearance based on court approval for $30m in so-called debtor-in-possession financing from its creditor Equilibrium Capital, an investor centred on sustainable agriculture headquartered in San Francisco, which supplied AppHarvest with $91m in 2021.

Those funds are intended to provide the “necessary liquidity to support operations” at Morehead, Somerset and Richmond.

Webb stepped down from the role of CEO earlier in July to become chief strategy officer. Tony Martin, an experienced controlled environment agriculture executive, replaced him.

Martin said in the statement: “The AppHarvest board of directors and executive leadership evaluated several strategic alternatives to maximise value for all stakeholders prior to the Chapter 11 filing.

“The Chapter 11 filing provides protection while we work to transition operation of our strategic plan, Project New Leaf, which has shown strong progress toward operational efficiencies resulting in higher sales, cost savings and product quality.”

In the year to 31 December, AppHarvest posted sales of $14.6m, up 60% from the previous 12 months. Nevertheless, adjusted EBITDA remained in the red at $72m, versus a corresponding loss of $69.9m. The company said when the results were announced in March it had cash and cash equivalents of $54.3m.

AppHarvest went public in 2021 via a merger with Nasdaq-listed special purpose acquisition company (SPAC) Novus Capital. In June, AppHarvest revealed it planned to raise $40m through a sale of additional shares, culminating in the successful raise of $46m.

It also secured a $75m credit facility from Rabo AgriFinance, a subsidiary of Dutch investment bank Rabobank, in 2021.

The plight of AppHarvest and AeroFarms is indicative of the challenges in controlled indoor farming, which is capital intensive, requiring significant investment and scale. Players in the industry are yet to turn a profit and some companies have already succumbed by going out of business.

Eider in the UK, Upward Farms in New York, Netherlands-based Future Crops and France’s Agricool have all gone to the wall.

Infarm, meanwhile, an indoor-farming business set up in Germany in 2013, has undergone restructuring by trimming the markets in which it operates and cutting hundreds of jobs. It has also relocated operations to the UK from Berlin.