US activist investment firm Third Point has taken a stake in Colgate-Palmolive Co. and has called for the FMCG giant to divest pet-food business Hill’s Pet Nutrition.

New York-based Third Point, owned by billionaire investor Daniel Loeb, has built a “significant position” in Colgate-Palmolive, the hedge fund said in a letter to investors.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In the letter, Third Point set out why it wants the toothpaste supplier to separate out its pet-food business.

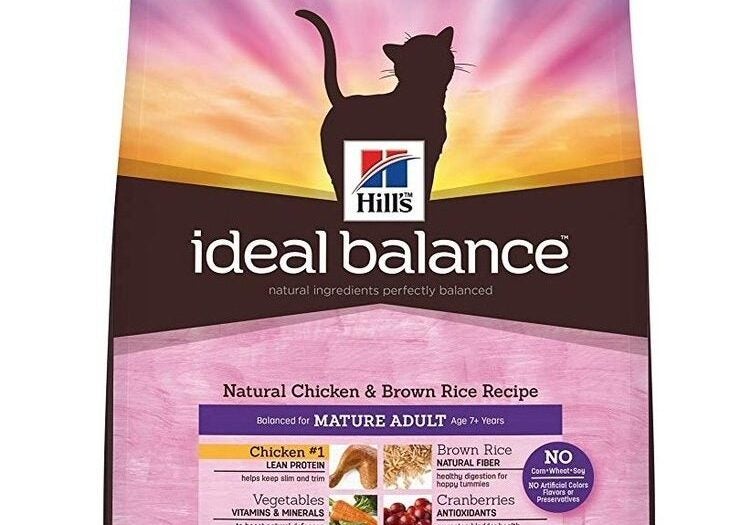

“There is meaningful hidden value in the company’s Hill’s Pet Nutrition business, which we believe would command a premium multiple if separated from Colgate’s consumer assets,” the fund wrote.

“The pet category is one of the most exciting pockets in consumer, and Hill’s is a phenomenal brand with a long runway for growth. We believe that as a stand-alone business, Hill’s could deliver even faster growth and better margins, and would command a premium multiple of 25-30x EPS for an aggregate valuation approaching $20bn on calendar year 2023 numbers. Hill’s is a valuable consumer growth company and hidden gem inside of Colgate’s otherwise defensive product portfolio.”

Bloomberg, citing “people familiar with the matter”, said Third Point has built a position worth roughly $1bn in Colgate-Palmolive and is working in collaboration with Toms Capital Investment Management on the investment.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn 2021, Hill’s Pet Nutrition’s net sales were US$3.31bn, up 15% on a year earlier, or by 13.5% on an organic basis. The pet-food division accounted for 19% of Colgate-Palmolive’s total net sales in 2021. In 2019, that portion stood at 16%.

According to the news agencies, the investor called in the letter for the Colgate-Palmolive board to take action, a tactic Third Point has used before in a number of sectors.

In the food sector, it is perhaps best known for its previous investments in Nestlé and Campbell Soup Co.

In 2017, Third Point bought a stake in Nestlé and called for “a decisive and bold action plan” to address what it said at the time was a “staid culture” and “tendency towards incrementalism” at the world’s largest food company. Nestlé subsequently set out its plans to drive growth but said its management had already reassessed its priorities. A year on, Third Point continued its criticism, prompting Nestlé to defend its strategy.

At Campbell, in 2018, Third Point was publicly critical of the way the soup and meatballs giant had been run and its campaign led to electing two executives chosen by Third Point to its board and disposing of a number of assets.

Colgate-Palmolive announced European expansion plans for Hill’s Pet Nutrition earlier this year.

Neither it nor Third Point had responded to requests from Just Food for comment on the news agency reports at the time of writing.