Meat companies remain interested in automation but are placing less emphasis on the topic in their public filings, data suggests.

The world’s largest meat processors, already using tech in areas like packing, have been investing in ways to make their production more automated.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The meat sector is one of the more labour-intensive areas of the food industry but, in the last decade, investment has been made in areas like final processing, cutting and packing.

Interest in using more automation in other areas has been fuelled by labour shortages, which were exacerbated by Covid-19, with the pandemic encouraging some businesses to fast-track their own technology investment plans.

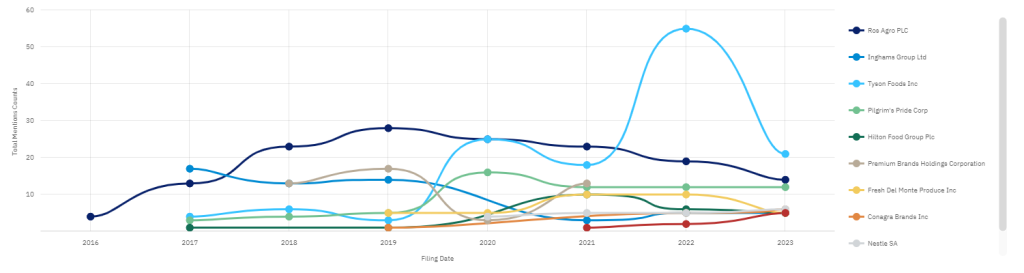

In 2023, the word ‘automation’ appeared 111 times in the public filings of meat companies monitored by GlobalData, Just Food’s parent.

That suggests an easing from 2022 when, during the year as a whole, the topic was cited on 256 occasions. In 2021, the theme was featured 174 times, GlobalData says.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData’s Company Filings Analytics database studies filings released by businesses across multiple sectors. These filings include financial results, investor presentations and annual reports.

Digging into the companies that cited the topic, Tyson Foods topped the list with 21 mentions, followed by Ros Agro, the Russia-based agri-food group with 14 and US poultry and pork major Pilgrim’s Pride with 12.

Earlier this week, European pork giant Danish Crown detailed a cost-savings plan designed to deliver an improvement in operational performance “within” two years.

The Denmark-headquartered meat processor is aiming to boost its “earnings” over the period by “at least” DKr1.5bn ($219.4m) through a multiple-faceted initiative, including improving efficiencies in its facilities through technology to cut production costs.

Danish Crown has already been consolidating its network of abattoirs and deboning operations in Denmark and Germany, complete with the loss of jobs, due to a decline in pigs coming in for slaughter from the cooperative’s farmers. At the same time, the company revealed a plan to invest in automation in December to boost its competitiveness.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.