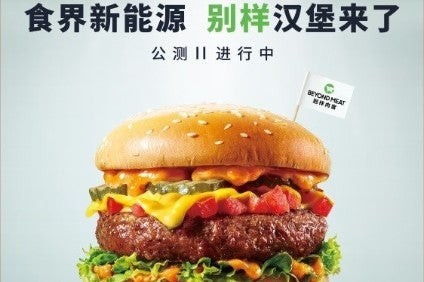

Alternative-protein firm Beyond Meat has launched an online sales channel in China via JD.com, a market where appetite for plant-based meats has yet to take off to the degrees in has in North America and Europe.

Beyond Meat’s first e-commerce portal in China will list the company’s meat-free burgers, beef and pork in the cities of Beijing, Shanghai, Guangzhou and Shenzhen, with plans to increase distribution to a further 300 cities, it said in a statement today (15 July), without providing a timeframe.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The products will be manufactured at the firm’s newly-opened facility in the Jiaxing Economic & Technological Development Zone and “stored in JD.com’s warehouses across China for on-demand ordering and delivery”.

Nasdaq-listed Beyond Meat made its debut in China in 2020 with coffee chain Starbucks, and then inked deals with Yum China-owned fast-food restaurant chains KFC, Pizza Hut and Taco Bell, and in the retail channel with e-commerce giant Alibaba’s Freshippo supermarkets. But the company is still loss-making, despite a three-year deal with McDonald’s announced in February.

In its most-recent financial results for the first quarter ended 3 April, adjusted EBITDA for the group delivered a US$10.8m loss, compared to market expectations for a negative $1.8m print. It posted revenues of $108.2m, up 11.4% year-on-year.

Of the $27.6m in first-quarter revenues generated for Beyond Meat in international markets, both retail and foodservice, the out-of-home channel saw a decline from $18.6m to $10.4m.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSpeaking to Just Food last year, Tao Zhang, the founder and managing director of impact investor Dao Ventures, said there is interest in plant-based foods in China but “mass-market consumer awareness is still not there”.

Candy Chan, Beyond Meat’s general manager for China, said in today’s statement: “Beyond Meat is excited to launch its store on JD.com to expand our local availability and reach consumers throughout China. With increased capabilities thanks to our new manufacturing facility…we are able to offer a growing portfolio of great-tasting, locally-produced plant-based meat products that are nutritious and sustainable.”

Alexia Howard, a senior food analyst at AllianceBernstein, wrote in a research note in May in response to Beyond Meat’s first-quarter numbers that the “continued momentum on distribution and consumer metrics like repeat rates are encouraging for the longer term, and the partnerships with McDonald’s and Yum Brands should start to help in 2022 and beyond”.